Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Mar, 2021

|

A large-scale wind and solar farm in Jiangsu, China. |

The absence of an emissions cap and more aggressive peak-carbon policies in China's energy transition roadmap for 2021-2025 is likely to cool enthusiasm for the nation's green financing in the near term, experts say.

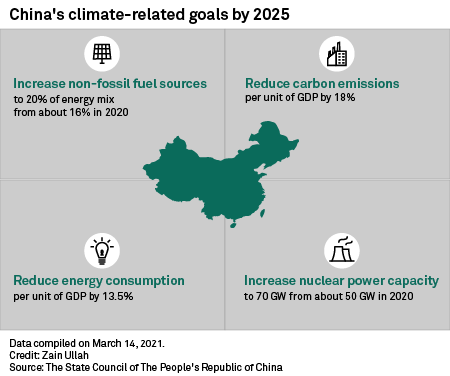

The goals in the roadmap, such as increasing non-fossil fuel in the nation's energy mix by 4 percentage points and nuclear power capacity by 40% over the next five years, are "underwhelming" and unlikely sufficient to reach its goal of reducing carbon emissions by 18% by 2025, experts say. Analysts said ahead of China's 14th five-year plan announced recently, which was the first national strategy since President Xi Jinping pledged to achieve net-zero emissions by 2060 late last year, that policy details could unleash a wave of green financing to fund new projects.

"There was nothing impressive out of [the five-year plan]," Mana Nakazora, ESG strategist at BNP Paribas in Japan, said. "I'm not expecting green bonds to gain strong momentum to be issued."

China's green bond issuance declined for the first time last year due to the pandemic, with some issuers also reportedly putting their plans on hold ahead of Beijing's top-level policy blueprint. In 2020, Asia's largest green bond issuing country issued $37.6 billion worth of green debt, down from a record amount of $55.58 billion in 2019, according to Climate Bonds Initiative.

Delayed impact on green debt

Yoshihiro Fujii, an executive of the Research Institute for Environmental Finance, expects the "scanty" five-year plan "casts a shadow over the outlook for [China's] green bond issuance" after 2022. The volume of green bond issuance in 2021 will still manage to bounce back to the pre-pandemic levels largely due to pent-up demand from the previous year, Fujii added.

He said China could flesh out the five-year plan with more details later, such as how it will shift to clean energy to achieve the zero-emissions target. "China may pull out a wild card" later, he said, possibly after Xi meets with U.S. President Joe Biden at a summit in late April.

Under the five-year plan, China will reduce its emissions intensity – the amount of greenhouse gas produced per unit of gross domestic product – by 18% over the period of 2021-2025, same as in 2016. Non-fossil fuel sources are targeted to make up 20% of China's energy mix by 2025, up from about 16% in 2020.

"While it's positive that this plan does reiterate its commitment to carbon neutrality by 2060, and peaking emissions before 2030, there is little sign of the change needed to reach that goal," Swithin Lui, the Climate Action Tracker's China lead, of NewClimate Institute, said in a statement released March 5.

"In terms of the climate, initial indications from the five-year plan are underwhelming and shows little sign of a concerted switch away from a future coal lock-in," Lui wrote.