S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 Nov, 2021

By Camille Erickson

|

|

An aerial view of a coal-fired power plant on Oct. 13, 2021, in Hanchuan, China. |

China's energy shortage is curbing lithium and battery production, adding to inflationary pressures and supply tightness throughout the supply chain.

China sits at the center of the battery supply chain, refining the majority of the world's lithium, cobalt and rare earth elements, while also producing the bulk of the battery anodes, cathodes and electrolytes needed for electric vehicles. However, in a rush to preserve dwindling coal supplies and to ease heightened pollution levels, China has asked several industries to hit the brakes and lower their electricity use. The disruption is hitting battery suppliers and lithium suppliers, and it could drive up prices amid already tight supply conditions.

"We are rapidly seeing material price increases percolating down the value chain with some Chinese [battery] cell suppliers," Alla Kolesnikova, head of data and analytics at Adamas Intelligence, told S&P Global Market Intelligence.

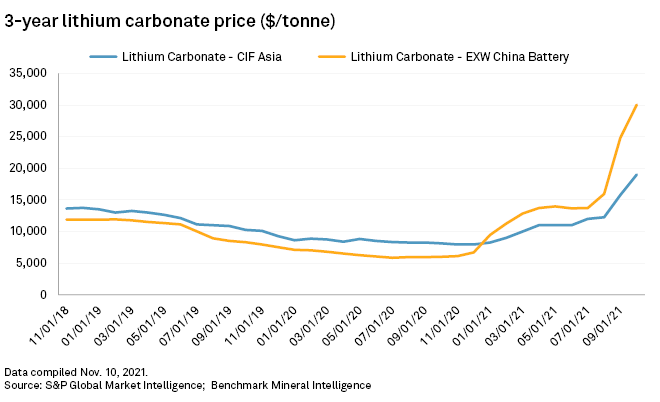

Raw materials represent the bulk of the total cost of a battery. The cost of certain lithium-ion batteries declined by nearly two-thirds between 2014 and 2020, from $290/kWh to $110/kWh, according to Benchmark Mineral Intelligence data. But that trend could reverse in the coming months, as prices for lithium and other battery materials have surged recently.

The pain is already being felt

Widespread power cuts in China have hit battery markets before, but never when the battery market was so hot. Global passenger plug-in EV sales in 2021 are forecast to more than double last year's sales,

"Obviously, this is a booming market," said Andrew Leyland, head of strategic advisory at Benchmark Mineral Intelligence. "So, any reduction in energy is directly impacting production, which is slowing down supply chains. And that's happening across the Chinese economy as the government struggles to source more energy."

In a letter to clients, major Chinese battery-producer BYD Co. Ltd. announced plans to increase its cell prices by 20% starting in November, citing rising raw material costs, according to reporting by Chinese media company Caixin. BYD did not respond to a request for comment.

Chinese production of anodes and cathodes, two of the main components in rechargeable batteries, showed signs of slowing late in the third quarter for some suppliers, potentially due to the energy shortage and the semiconductor chip shortage.

South Korean battery-maker LG Chem Ltd. said energy restrictions and rising coal prices were slowing parts of its petrochemical business, while the semiconductor shortage has been the primary cause of decreased battery production.

"Due to the impact of the supply issue in China from the recent government's power usage restriction measures and rising coal prices as well as the over demand improving from the living with COVID trend, supply is expected to remain tight," Hyun-suk Yoon, LG Chem's head of investor relations, said of the company's chemical business during an Oct. 25 earnings call.

U.S. lithium producer Livent Corp. reported spending more on operating costs and producing less lithium hydroxide than expected due to less stable production in China caused by "unscheduled power cuts imposed by government authorities," Gilberto Antoniazzi, Livent's vice president and CFO, said on a Nov. 4 earnings call.

"We have three lines and in some cases, the whole park has been shut down, so all three lines shut down," Livent CEO Paul Graves said of the company's lithium hydroxide operation in China. "In other cases, they've asked us to take a line or two down and only run one line to save energy."

Others, including company executives for South Korea-based battery-maker SK Innovation Co. Ltd., downplayed the effect of the energy caps on production activities.

"Our Chinese entities, they have received requests to look into ways to try to cut electricity use," Yoon Hyung-jo, a SK Innovation executive, said during an Oct. 29 earnings call. "However, based upon very detailed discussions in cooperation with the local autonomies in China where our sites sit, we have embarked upon various electricity-saving measures to an extent in which it would not hinder the overall production that we have."

Materials crunch coming for EVs

Batteries typically make up over 30% of EVs' overall cost, and increased material prices for the battery could mean higher EV prices. However, in an Oct. 29 report, Market Intelligence senior analyst Alice Yu remained "cautiously optimistic" about EV sales in China in the December quarter, often the strongest period of the year for sales.

"This is a supply chain that's going to struggle to keep up with itself," Benchmark Mineral Intelligence's Leyland said. "That's already leading to higher prices and inflation in the supply chain, not just in raw materials such as lithium, cobalt and nickel, but in all of the other components in a battery: in shipping costs, labor costs and equipment costs. We're seeing cost inflation of 20%, 30%, 40% for some pieces of equipment and that's all going to flow through eventually into higher prices."