Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Oct, 2022

By Avery Chen

|

Chinese President Xi Jinping said the country can achieve its carbon neutrality goal without sacrificing energy security. |

China's coal production and consumption are likely to rise in the near term, as the country's top leaders underscored energy security during the twice-a-decade National Congress of the Chinese Communist Party.

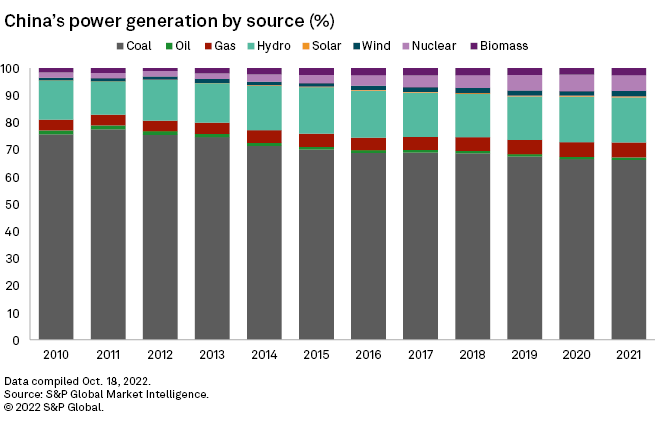

Despite the government's unchanged commitment to cut carbon emissions, coal will continue to play a vital role in China's energy mix until the country's rapidly expanding renewable power supplies can meet energy needs, officials and experts said. China has ramped up coal production, approved more projects, supported financing and shortened the safety inspection period to prevent a repeat of the coal shortage that triggered a power crunch in 2021.

"Based on China's energy and resource endowment, we will advance initiatives to reach peak carbon emissions in a well-planned and phased way in line with the principle of building the new before discarding the old," President Xi Jinping said Oct. 16 in his opening speech at the 20th National Congress of the Chinese Communist Party.

S&P Global Commodity Insights forecasts that China's coal-fired generation will continue to grow by 2025 and then flatten out

With the Chinese government emphasizing energy security, "coal needs to [play] a very important role for a long way to come," Xie Chunping, senior policy fellow at the Grantham Research Institute on Climate Change and the Environment at the London School of Economics and Political Science, said in an interview. "We can't just phase it out entirely, because we don't have that much renewable [output] to build that energy system we need."

Rising reliance on domestic supply

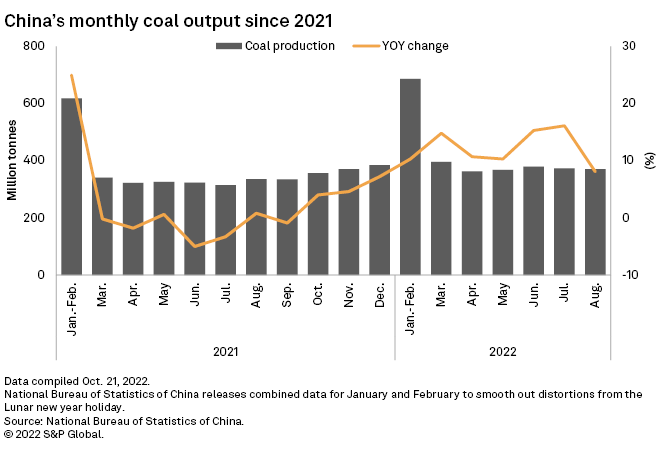

The Chinese government has increased the use of domestic coal for electricity generation while energy imports have fallen sharply since Russia's invasion of Ukraine. The war has exacerbated tightening energy supplies in Europe, pushing up global oil, gas and thermal coal prices.

In the first eight months of 2022, China's coal imports fell 14.9%, crude oil imports fell 4.7% and natural gas imports fell 10.2% compared with the same period a year earlier, according to the National Bureau of Statistics of China.

As China's energy endowments are "rich in coal, poor in oil and low in gas," as Xi has previously said, coal is the obvious option for substitution fuels, Xie said.

"China will give full play to coal as the ballast stone in the energy mix," Ren Jingdong, deputy director of the country's National Energy Administration, said at a news conference on the sidelines of the party congress on Oct. 17.

China aims to ensure domestic coal supplies could meet its needs — especially after Indonesia, its major thermal coal supplier, banned exports in January — Yang Jie, a thermal coal analyst with information provider YiMei Net, said in an interview. Yang expects that China will continue to increase coal production and capacity by 2025, even after adding 300 million tonnes of capacity in 2022.

Recent heatwaves and droughts that have driven up energy demand and cut hydropower supplies have also increased China's reliance on coal-fired plants to complement intermittent renewables.

The uncertainty of renewable power in China will increase the need for coal to provide a stable power supply in the short term, Guosen Securities analyst Fan Jinlu wrote in an Oct. 19 note. The decline in hydropower and wind generation could raise coal consumption by 25.7 Mt this year.

Despite China's wind and solar installed capacity accounting for more than 30% of the world's total, renewables generation is lagging far behind the capacity, Xie said. The main challenge for China is the large-scale integration of renewables into the grid system, which requires further improvements in energy storage and flexible grid management technologies.

Given higher overall energy demand, lower energy imports and lower renewable power output, China is expected to increase coal output by 290 Mt in 2022 from a record high of 4.126 billion tonnes in 2021, according to Fan.

Risks to global climate action

China's delay in curtailing coal use in favor of energy security poses risks to global climate action. Yet the Chinese government remained committed to its target of reaching peak emissions by 2030 and carbon neutrality by 2060 as it continues to expand renewable capacity.

China plans to increase its share of nonfossil fuel energy to 20% and 25% of its energy mix by 2025 and 2030, respectively, Ren said.

Yan Qin, lead analyst at Refinitiv, said it was "quite clear" that China will continue to ramp up renewables.

"So in the power mix, coal plants' running hours will decline year on year," Yan said. "This means the revenues outlook for coal plants will deteriorate anyway, so I am not sure the current rush to build new coal plants will happen in the 15th five-year plan period [in 2026-2030]."

Analysts noted a change in phrase from the earlier promise of a "modern energy system" to Xi's promise to speed up the development of a "new energy system."

"I think it will definitely mean an energy system with a high share of renewables, but the transition from current coal-dominant energy mix will be rather gradual and cautious," Yan said.

Central and local governments have announced targets to add 870 GW of wind and solar capacity during the 14th five-year plan period from 2021 to 2025, or more than double the progress over the previous five-year period, said Lauri Myllyvirta, lead analyst at the Centre for Research on Energy and Clean Air. This would help China meet the Paris Agreement on climate change.

"These investments into new clean energy have already reached a very significant scale," Myllyvirta said. "I'm not sure if that actually means that it needs to be accelerated from that 870 GW."

Cleaning up coal

China's plan also likely relies on deployment of carbon capture, utilization and storage technology, or CCUS, as Xi promised to strengthen the "clean and efficient use of coal."

Ren expects China to "upgrade coal-fired power plants to conserve resources, reduce carbon emissions, make operations more flexible and upgrade heating facilities."

The country plans to upgrade a total of about 600 GW of coal-fired plants between 2021 and 2025, potentially using CCUS technology.

Xie took "clean and efficient use of coal" to mean building new and more advanced coal power plants that use less coal to generate more electricity.

"I don't think that should be called 'clean coal,' because that makes people confused whether it generates less CO2 emissions," Xie said. "We do reduce other air pollution, but not the CO2 emissions."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.