Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Jan, 2021

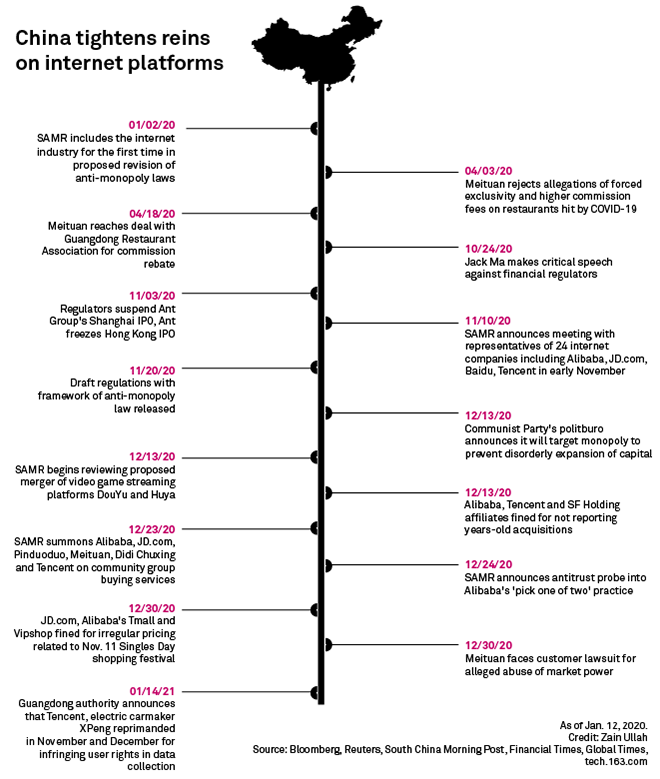

China's antitrust probe into Alibaba Group Holding Ltd., the country's largest and most high-profile internet company, is more about sending a message to the tech industry than targeting the group and its founder Jack Ma, industry observers said.

Beijing's series of actions relating to Alibaba, which include an investigation into alleged forced exclusive deals with merchants and the blocking of its affiliate Ant Group Co. Ltd.'s IPO, is intended to show the country's thriving internet sector that no one is above state rules and that any violation will be dealt with swiftly and severely. Influential internet companies such as Tencent Holdings Ltd., Meituan and Pinduoduo Inc. may find themselves subject to similar levels of scrutiny in 2021, they said.

Their views echoed that of state-backed newspaper China Daily, which in a Dec. 24, 2020, editorial hinted that the Xi Jinping government is looking to put the brakes on the unchecked expansion of internet companies into different sectors. The editorial, however, added that the aim is not to strangle these companies. The country's top leadership emphasized several times in December 2020 the importance of antitrust enforcement.

"The honeymoon period for Chinese tech companies is over," said Wong Kok Hoi, founder and Chief Investment Officer at APS Asset Management. "For many years, the e-commerce companies were allowed to do what they like with almost no regulation [or] very light regulation. Therefore, the light regulation has led to anti-competitive behaviors, [such as] choose one from two and 'wash sales' [fake online orders]," Wong said.

China vs. Jack Ma

So far, regulators have chiefly focused on Alibaba and its affiliates, with its founder Jack Ma's Oct. 24, 2020, speech criticizing regulators and banks seen as the inflection point. Within two months of the speech, Chinese regulators halted fintech company Ant Group's IPO, released new draft rules targeting monopolistic practices by online platforms, fined an Alibaba group affiliate, along with those of Tencent and logistics company S.F. Holding Co. Ltd., 500,000 yuan for failures to disclose past mergers, and launched an antitrust probe against the e-commerce company.

Alibaba's U.S.-listed shares plunged a record 13.4% on the announcement of the antitrust probe, wiping $100 billion off its market cap.

Alibaba did not respond to S&P Global Market Intelligence's requests for comment. The State Administration for Market Regulation, or SAMR, said Alibaba "actively cooperated" during its investigation, according to South China Morning Post.

If found guilty, Alibaba could face a fine of up to 10% of its revenue in the preceding year, which could amount to nearly $7.2 billion, and be forced to take remedial actions.

"High fines put the antitrust agencies in the media spotlight, increasing their profile and visibility, as well as helping them achieve greater political merits," said Angela Zhang, director at the Center for Chinese Law at the University of Hong Kong and author of the book Chinese Antitrust Exceptionalism.

The state's propaganda arm issued a directive in December prohibiting local news outlets from publishing anything beyond the official line on the investigation, Bloomberg News reported, citing people who asked not to be identified as the order has not been made public. The restrictions also apply to Ma, who has not been seen in public since he made the speech, the people told the publication.

Beyond Alibaba

Industry observers reasoned that the focus of the enforcement is much larger than the Alibaba founder and, regardless of what prompted the crackdown, the Chinese Politburo, the decision-making body of the Chinese Communist Party, is unlikely to limit the action to Alibaba or even the e-commerce sector.

"We believe platform economy will be merely one of the enforcement focuses," said Michael Gu, partner at Beijing-based Anjie Law Firm. The SAMR has indicated that the so-called livelihood industries, including healthcare, finance, automobile and consumer products, will also be subject to strict antitrust scrutiny, he said.

"I don't subscribe to the views [of Ma being targeted]," said Wong. "For exclusive deals with merchants, if Alibaba is prohibited from adopting such anti-competitive behaviors, then I am sure Pinduoduo or JD.com Inc. also can't do it," he said.

The situation is not unique to China nor Alibaba, as regulators in the U.S. have also tried to rein in their domestic technology leaders such as Amazon.com Inc., Facebook Inc. and Alphabet Inc., they said.

"What you are seeing is the Chinese authorities moving quicker than the U.S. authorities in this case and Alibaba is clearly one of the targets," said Chris Leahy, co-founder and managing director of risk advisory firm Blackpeak.

However, it is unlikely that brands will jump ship and abandon bigger platforms like Alibaba once they are free to sell on other platform, analysts said. User traffic, marketing returns and quality of service are factors that ensure loyalty, and bigger companies have their track record to fall back on in their relationship with the merchants.

"If you are free to work with the big and small players under the same conditions, it will be likely that you will lean towards the bigger platforms," said Danny Law, an analyst at Guotai Junan Securities. "It just means that merchants will have more options."

Such action would put Pinduoduo at a disadvantage, which has grown rapidly thanks to heavy discounting. It would also likely keep customers at Alibaba and JD.com, which offer better services, said Guotai Junan's Law.

Furthermore, Pinduoduo has its own share of regulatory issues, the most recent being an investigation launched Jan. 4 into working conditions at the company following the death of a worker.

"It will need to act fast to create a better environment for brands. This will necessitate a crackdown on counterfeits and unauthorized distributors selling branded products on the platform," said Michael Norris, research and strategy manager at e-commerce consultancy AgencyChina.