Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Apr, 2022

By John Wu and Cheska Lozano

Major Chinese lenders will likely report slower net profit growth in 2022 as an uncertain economic outlook weighs on loan growth and net interest margins.

The aggregate net profit of China's commercial banks will likely grow by around 10% in 2022, compared with 12.6% in 2021, according to estimates by Bank of China Research Institute.

Despite lower rates and lackluster capital markets dragging down net interest margins and fee growth, respectively, and rising credit risk for the real estate sector, J.P. Morgan said the outlook for Chinese banks is "net positive, as management are guiding for stable profit growth and asset quality trend in 2022."

The key drivers of profits will be the optimization of deposit mix, decline of long-dated deposit rate, lower operating expense growth and declining credit costs as banks may release provisions, J.P. Morgan said in an April 6 research note.

Macro headwinds

The outlook of China’s banking sector in 2022 is clouded by macro headwinds, as the world’s second largest economy slowed in the second half of 2021 following the debt problems of major property developers. A recent flare-up of COVID-19 infections, contraction of onshore manufacturing activity and softening export demand while major economies are hit by high inflation are set to weigh on China’s onshore economic activity this year.

Beijing is expected to announce more easing measures to support its economy, which will renew pressure on banks' interest margins. Lenders are trying to keep up the growth in loans to mitigate margin compression.

Nomura's economists see a "reasonably high likelihood" that the country's loan prime rate, both 1-year and 5-year, will be cut by 10 basis points on April 20, followed by a 50-basis-point cut in reserve requirement ratio over the next couple of months.

Both Agricultural Bank of China and Bank of China have set their loan growth targets at above 10% for 2022, while China Construction Bank's management said it expects to be "reasonable" about its loan growth expectations. All four banks achieved low-double-digit growth last year.

Slowing loans

The aggregate outstanding loan balance of China's banking system rose 11.1% in February from a year earlier, the weakest growth in more than 15 years, according to data from the People's Bank of China.

Loan demand in the first quarter recovered from the previous quarter, but was still weaker than a year ago, according to a survey of about 3,200 Chinese lenders by the central bank released March 30. The recovery of credit demand mainly came from infrastructure investment and manufacturing, while demand from the wholesale and retail sectors was largely flat. Loans for property development also recovered but remain weak, as the sector is still reeling from debt problems and falling home prices.

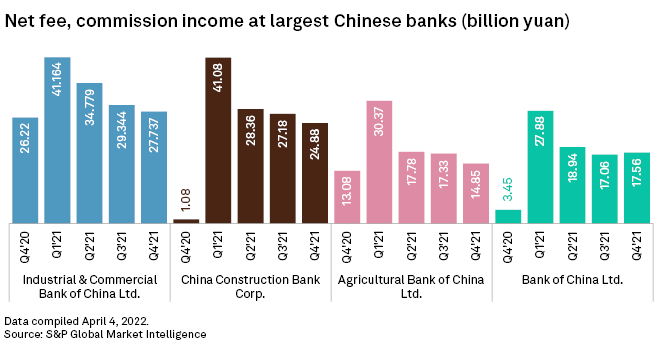

Stable fee income from intermediate business, together with gains in investment book, contributed to banks' earnings growth in 2021, said Beijing-based Huaxi Securities Co. Ltd., but the contribution will likely decline in the coming quarters due to high base effect and volatility in the equity market.

Despite rounds of interest rate cuts and Beijing’s call for banks to step up lending, sector-wide loan growth will likely be around 8.5% during the first half of 2022, largely unchanged from a year ago, the research firm predicted.

As of April 8, US$1 was equivalent to 6.36 Chinese yuan.