S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 Oct, 2021

By Jiayue Huang and Rehan Ahmad

China's slowing bank loan growth will likely cool further after the slowest gain in more than 15 years amid attempts to rein in the property market.

Concerns about borrowers' ability to make repayments, particularly in the real estate sector, following debt crises at China Huarong Asset Management Co. Ltd. and China Evergrande Group, could force banks to tighten credit. Power shortages and rising inflationary pressure could dampen investment, while policymakers have been more focused on debt risks rather than economic growth.

Lending growth may drop from the 11.4% year-over-year increase reported for September, which was the weakest pace since March 2006, analysts say.

"The key difference this time is more tightening on developers' funding and higher tolerance of slower growth," said Michelle Lam, Hong Kong-based Greater China economist at Société Générale. "The latter is of particular importance because policymakers are seen as always giving in when there is more economic slowdown pressure."

China's year-over-year GDP growth slowed to 4.9% in the September quarter from 7.9% in the previous three months, according to an Oct. 18 statement. Real estate output fell 1.6% from a year earlier and construction dropped 1.8%. The two sectors made up 13.7% of quarterly GDP. Growth in industrial production slipped to 3.1% from 5.3%. The sector remained the biggest part of the economy at 32% of output.

Corporate debt accounted for around 160% of China's GDP as of Sept. 30.

"This credit boom has been going on for a number of years, and a lot of Chinese companies have struggled before," said Chris Leahy, founder of strategic advisory firm Blackpeak in Singapore. "I think Evergrande is just a poster child because the number is staggering."

Risk in real estate

Chinese lenders will likely be more cautious in financing real estate developers due to concerns on "the general weaker profitability and potential of credit risk," Natixis senior economist Gary Ng said.

As part of the effort to deleverage and curb rising housing prices, the Chinese government in August 2020 launched the "three red line policy," which puts thresholds on advance receipts, leverage and liquidity ratios for developers. Regulators would place limits on the extent to which developers can grow debt if they fail to meet at least one of the three ratios.

Loans to developers accounted for 7% of total lending of the nation's banking system as of Sept. 30, according to Société Générale's Lam.

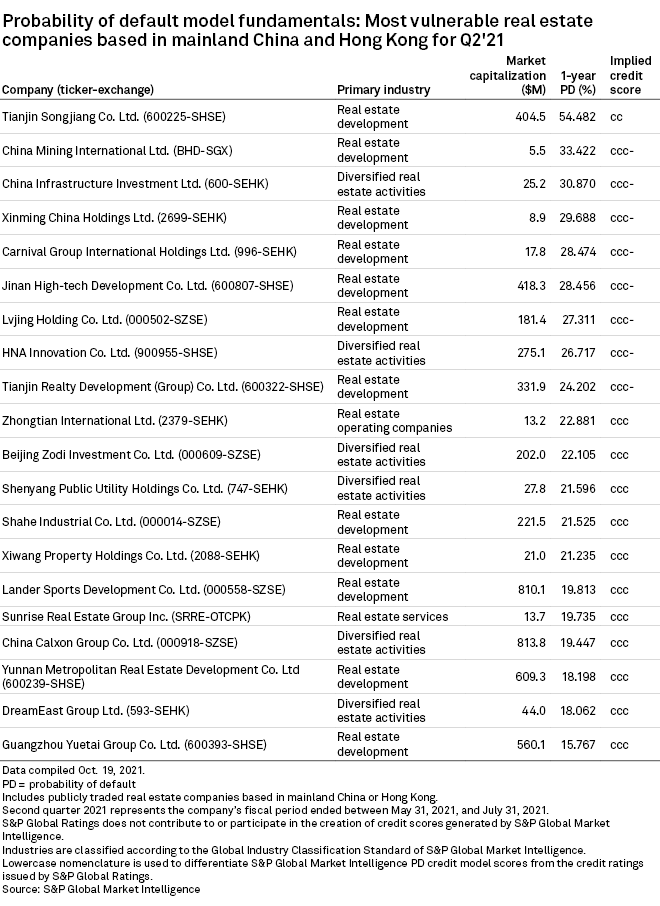

At least 14 listed real estate companies in mainland China and Hong Kong had a one-year probability of default above 20% as of end-June, much higher than the sector median of 0.8%. The figures by S&P Global Market Intelligence represent the odds that a company will default on its debt within the next year based on fluctuations in the company's share price and other country- and industry-related risks.

"This is highly concerning for policy makers as it implies greater economic fragility to unexpected shocks," said Chang Weiliang, Singapore-based fixed income and credit strategist at DBS.

System still resilient

Vibrant lending activity has buoyed the interest income of Chinese banks, some of which have grown to be the world's largest lenders by assets with increasing global systemic importance in recent years. Interest income accounts for around 70% to 80% of revenue at the four largest Chinese state-backed banks, according to their latest earnings reports.

A slowdown in loan growth and property prices is a "fundamentally positive development" for the Chinese banking system, according to an Oct. 20 report by S&P Global Ratings.

"GDP levels and GDP per capita continue to expand at solid rates, adding to buffers against credit risks in the economy. These factors could eventually lead us to assess economic risk more favorably for the China banking sector, should the policy direction remain clear and be consistently executed," the report said.

The sentiment score of China's financial sector has been improving over the past several months amid the loan slowdown, while the score of the real estate sector has tumbled during the same period. The scores, devised by Market Intelligence, extract sentiment signals from company filings and earnings call transcripts.

"China's new political objective of 'common prosperity' has changed policy attitudes towards speculative investment in real estate, and there are now more severe clampdowns than in the past," DBS' Chang said.

As of Oct. 20, US$1 was equivalent to 6.39 Chinese yuan.

Aries Poon and Mohammed Hadi contributed to this article.