S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

18 May, 2021

By Jiayue Huang, Yuzo Yamaguchi, and Rehan Ahmad

China's green bond issuance in the January-to-March period rose to the highest level in six quarters, leading some analysts to predict this year's volume may beat the 2019 record as the nation pushes ahead with its emission reduction plans.

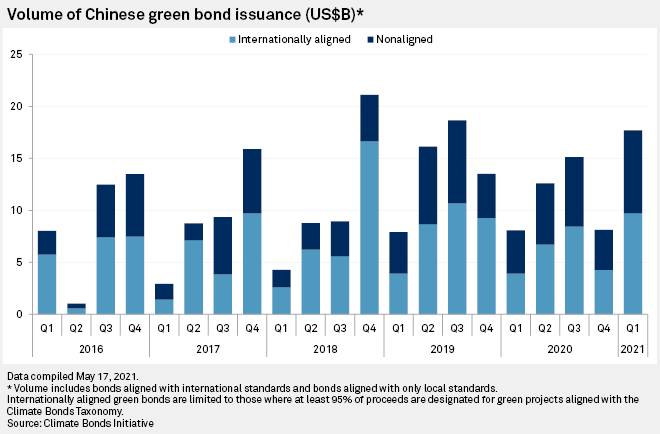

In the three months ended March 31, the country sold $17.7 billion of green bonds, the most since the third quarter of 2019 when the volume totaled $18.7 billion, according to Climate Bonds Initiative, or CBI, a U.K.-based global green bond tracker. In 2019, China issued a record $32.9 billion of green bonds.

However, almost half of the volume in the first quarter was of bonds that only met local definitions, such as allocating up to 50% of proceeds to general corporate purposes instead of designated green assets. Excluding these so-called nonaligned bonds, China was the world's third largest issuer of green bonds in the first quarter after the U.S. and France, according to CBI.

In a bid to further reduce emissions and attract more interest from international investors, Beijing proposed last year to stop recognizing clean coal, which ranges from coal washing to carbon capture, as projects that qualify for green bonds. It did not say when its new green bond catalog will be implemented. Clean coal projects have always been excluded in green bonds certified by international standards.

The issuance rebound in the first quarter suggests that the absence of an emissions cap and more aggressive peak-carbon policies in China's energy transition roadmap for 2021-2025, announced early March, might not have cooled enthusiasm for green financing as much as some experts had expected. The country's leadership, however, remains committed to its long-term climate goals.

"China's green bond issuance could double in 2021 as many corporates are showing interest to issue green bonds amid China's policy drive," said Xie Wenhong, Beijing-based China program manager at CBI.

Push by stakeholders

President Xi Jinping reaffirmed at the climate summit in April that China aims to reduce greenhouse gas emissions to net-zero by 2060 and that it is on track to reach its current goal of peak carbon emissions by 2030 under the Paris Agreement. President Joe Biden, who brought the U.S. back to the global accord in February, called for other major economies at the summit to pursue a zero-emissions society.

"The Chinese government announced the strategic goal of carbon peaking and carbon neutrality, encouraging the issuance of green bonds from the regulatory level. Meanwhile, the U.S. returns to the climate agreement. We expect international cooperation on climate change will increase, and the issuance of green bonds is expected to be in the ascendant," Guotai Junan International said in an email to S&P Global Market Intelligence.

Chinese banks will also remain "a major component of the supply market" of green bonds, BNP Paribas' Ou Yong said, as lenders will need to raise fresh funds to finance their increased lending to green projects, which is now one of the many assessment criteria pushed by the People's Bank of China.

"The strong momentum built on the green bonds could continue for the rest of the year as China will move on with the 2060 no-carbon pledge," Tamami Ota, a researcher at Daiwa Institute of Research, said. Ota expects the country's green bond issuance for this year to return to pre-pandemic levels.

Alignment remains an issue

Since the beginning of 2020, the proportion of Chinese green bonds that were only aligned with domestic standards have been on the rise. In the first quarter, these nonaligned bonds totaled $8.0 billion, jumping from $3.8 billion in the previous quarter and $4.2 billion a year earlier, according to CBI.

The gap between the standards acceptable in China and elsewhere has made global investors hesitant to snap up the country's green debt. But Mimi Zhao, rating advisor for debt capital markets at Haitong International Securities, said the push by some exchanges in Asia may change that.

"Both the Hong Kong Monetary Authority and the Monetary Authority of Singapore can reimburse 100% of external reviewers' expense if the issuance meets certain criteria such as listing in the stock exchange. This encourages issuers to issue more internationally aligned green bonds," Zhao said.

Haitong Securities sold 16 offshore green bonds that were compliant with international green definitions this year, compared with 30 issuances in 2019 and 2020 combined, according to the broker.

"It is difficult to speculate whether China will further narrow the gap on the standards of green bond issuance with the global market," CBI's Xie said. "Regulators are definitely aware of the gap in terms of the use of proceeds but we can't speculate if they will take measures to narrow it given the need to balance continued market growth with robustness."