S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

23 Aug, 2022

By John Wu

The recent mortgage boycott in China is unlikely to pose serious systemic risks to the banking sector from the residential mortgage-backed securities market as it represents only a tiny portion of lenders' assets.

China's market for residential mortgage-backed securities, or RMBS, is valued at 1.2 trillion yuan, according to financial services company Morningstar, and is the world's second largest after the U.S. in terms of outstanding balance. Despite some homebuyers openly protesting and suspending payments on unfinished homes since July, analysts said the excess capital buffers of the country's banking system, relative to the size of the securitized market, indicate that the likelihood of the current mortgage boycott to cause systemwide distress is low.

"It is still too early to jump to such conclusions given the limited scale of the potential mortgage defaults relative to Chinese banks' 38 trillion yuan [residential] mortgage loan book," said Iris Tan, senior equity analyst at Morningstar. About 3% of mortgages in China are securitized, compared to over 60% in the U.S., Tan said.

Rare protests

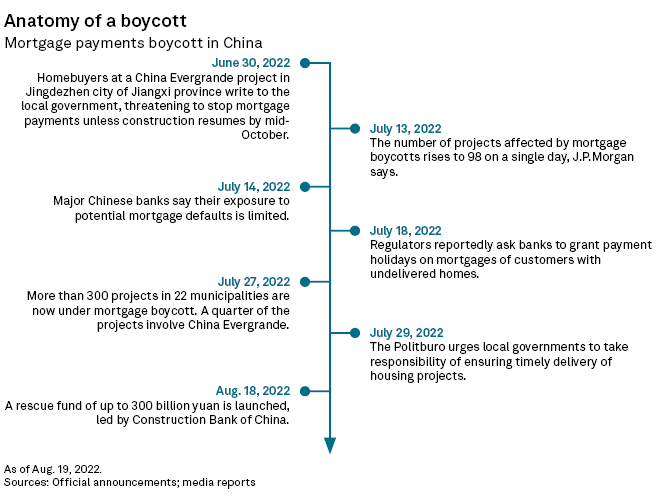

Customers in more than 300 unfinished residential projects across China reportedly stopped servicing their mortgages since June as developers delayed construction amid a liquidity crunch. There were fears that unpaid mortgages may eventually go into default, hitting the RMBS markets. The protests have since abated, but they highlight the troubles that Chinese developers face.

Owning a home was once considered a ticket to becoming wealthy and a safe investment in China. The country now faces a crunch with property prices falling and higher raw material costs. Home prices fell for the 11th consecutive month in July, as measured by a 70-city index compiled by the National Bureau of Statistics.

RMBSs, akin to bonds backed by a pool of individual residential mortgage loans, gained popularity in China in recent years as a tool to free up banks' balance sheets to increase lending to homebuyers amid a vibrant property market. The value of annual new issuance increased by more than four times in two years before peaking in 2018, according to S&P Global Ratings. New issuance of RMBSs totaled 499.3 billion yuan in 2021, compared with 584.3 billion yuan in 2018.

Mortgages on forward-delivery homes in China is estimated to account for about 16% of all mortgages, or about 3% of all bank loans in the country, as of the end of the first quarter, according to a July 14 Nomura research note.

Delayed residential projects in China currently account for up to 8% of all homes under construction, according to an Aug. 8 research by Pimco. In a downside scenario where delayed projects rise to 10% and all related mortgages go into default, that would add around 50 basis points to the nonperforming loan ratio of the nation’s banking system, the investment manager said.

There are no signs of systemic risk pressures in China despite rising stresses within the property sector, according to a July 23 Goldman Sachs research note. The banking system, with 10 trillion yuan in risk buffers, has significant capacity to absorb property credit losses even in a bear-case scenario in which defaults on mortgages rise to about 4% of the mortgage book and losses reach close to 1 trillion yuan if property prices decline by 40%, Goldman Sachs said.

As of June 30, the average nonperforming loans ratio of China's largest commercial banks stood at 1.35% and their provision coverage ratio was 245%, according to the China Banking and Insurance Regulatory Commission.

While a rescue fund would largely be in the right direction and could boost mortgage payers’ confidence, Ricky Tsang, director of corporate ratings at S&P Global Ratings, said "centralized coordination" on how these funds will actually be utilized is needed to avoid policy risks.

More a protest

The mortgage boycott is more of a "homebuyers' protest" that pushes for home deliveries rather than an inability to service mortgages in most cases, said Tang Shengbo, Hong Kong-based banking analyst at Nomura.

The legal consequences of default on mortgages can lead to social cost for homebuyers. "Individuals who fail to pay mortgage would turn up on credit list which could result series of problems from daily activities to even employment," said Daisy Li, fund manager at EFG Asset Management (HK) Ltd., adding that it is "more of wrestling among homebuyers, developers and local governments which can't afford to see social unrest."

China's RMBS market, which already saw zero issuances since the middle of February, will inevitably take a hit and continue to suffer for the rest of 2022, according to S&P Global Ratings.

The 91% year-over-year decline in the value of RMBS issuance the first half reflects the weak mortgage origination volume and less imminent needs for banks to manage their mortgage loan books, Ratings said in August report. "It is unclear when RMBS issuance will resume, but it is likely to depend on mortgage origination momentum and the regulatory stance in the second half," Ratings added.

Chinese RMBSs with securitized collateral, including mortgages over unfinished properties, may be exposed to incompletion risk and face higher delinquencies over the next few months, Fitch Ratings said Aug. 3. "We expect any future RMBS deals to include fewer forward-delivery properties as investors will try to avoid exposure to pre-sold projects or require a premium in pricing," the rating agency added.

The average default rate of Chinese RMBSs increased 5 basis points to 0.39% in 2021 from the prior-year period, as banks tend to package better-quality mortgages into their RMBSs, according to Morningstar.

As of Aug. 23, US$1 was equivalent to 6.83 Chinese yuan.