S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

1 Nov, 2021

By Camille Erickson

|

|

Concerns over future lithium supplies are spurring China's aggressive push to buy assets globally. A lithium plant located in Susques, Argentina, is pictured above. |

Chinese companies are snatching up lithium projects worldwide, ensuring access to supplies of the metal amid worsening global shortages and surging prices.

The nation's mining and battery companies acquired 6.4 million tonnes of lithium in reserves and resources in 2021, as of Oct. 18, nearly matching the 6.8 Mt of lithium acquired by all companies in 2020. China-based mining and battery giants have placed winning bids on five development-stage lithium projects valued at $1.58 billion, not including off-take and royalty deals,

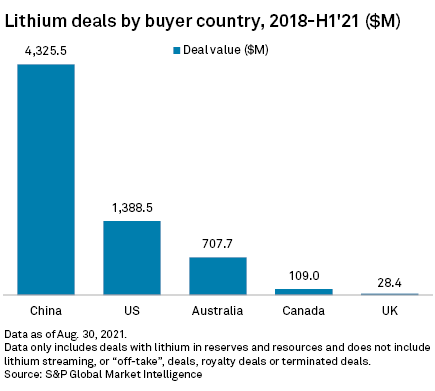

Although China leads in global lithium processing and refining, it still sources the bulk of raw lithium products beyond its borders, including from Australia, Chile and Argentina. China's buying spree, which stretches from Africa to South America, will safeguard access to lithium resources as COVID-19 disruptions and geopolitical tensions test the fragility of international supply chains. Global deficits in lithium supplies may also surge more than 60-fold to 950,000 tonnes in 2030, according to Benchmark Mineral Intelligence, as rising sales of electric vehicles spur demand for the battery-making metal.

"Chinese companies have done the math and realized how much lithium they're going to need to meet either battery or EV growth plans and have decided to try to secure that by going after some of the most promising junior projects in development," said Seth Goldstein, a senior equity analyst at Morningstar.

In a deal that topped metals and mining transactions for the week ended Oct. 8, Chinese mining company Zijin Mining Group Co. Ltd. announced its entrance

Contemporary Amperex Technology Co. Ltd., which supplies batteries to electric automaker Tesla Inc., in September agreed to acquire Canada-based Millennial Lithium Corp., topping the C$353 million bid offered by the world's fourth-largest lithium producer Ganfeng Lithium Co. Ltd. Millennial Lithium's Pastos Grandes lithium project is in Argentina's Salta province.

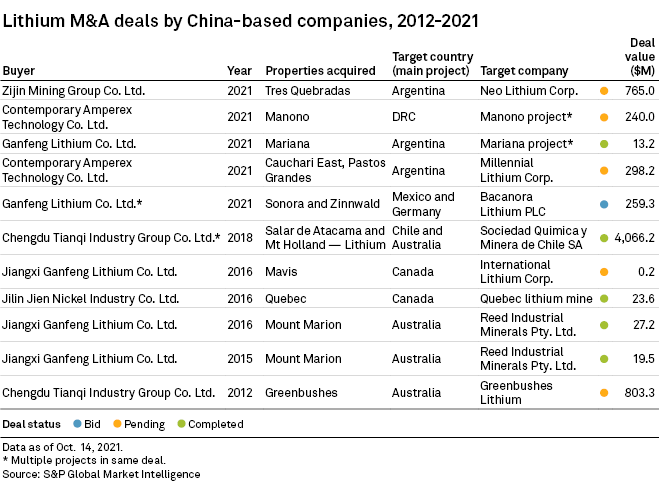

Ganfeng Lithium withdrew its bid for Millennial but still managed to ink two other acquisition deals worth $272.5 million, not including off-take and royalty deals, so far in 2021, according to Market Intelligence. And companies headquartered in China have made lithium M&A to the tune of $6.52 billion since 2012, according to Market Intelligence.

"It seems to me to be a really good strategy: Try to secure some of the best resources right now, even if you have to pay a premium," Goldstein said. "It ultimately results in having that security of supply in the future."

Ganfeng typifies the strategy by Chinese companies of plucking up economic lithium assets wherever they can be found.

"We're looking across the world to see where there [are] good opportunities for the recent resources," Xiaoshen Wang, Ganfeng's chairperson of sustainable development, said at an Oct. 5 conference hosted by Reuters.

Ganfeng, Zijin Mining Group and CATL did not respond to requests for comment.

Betting on the future

According to Market Intelligence analysts, China held just 50,500 tonnes of lithium carbonate equivalent, or 12.2% of the world's lithium raw material supply, in 2020.

"The ... thing they're doing with lithium is the same thing they've been doing with uranium or copper. Once they see they need it, they go and get it in countries and regions they feel they can operate in, like Argentina or Africa," Exploration Insights analyst Joe Mazumdar said.

The recent spate of lithium acquisitions comprises relatively early- and development-stage assets and technically difficult brine projects. These projects are on the cusp of becoming major producers, and they require significant investment to reach the next stage. Junior mining companies, including those with advanced predevelopment brine projects, may be ready to hand off to deep-pocketed companies.

"They're saying, 'We've done as much as we can do, so let's sell it'," Mazumdar said.

Chinese companies may also be finding willing sellers, particularly those with brine projects, where extraction can require deep expertise in separating lithium from other minerals.

"We see that the demand is coming [and] if we have more money, we would likely invest in the upstream resources and also downstream chemicals and ... even in the battery and the recycling," Ganfeng's Wang added at the conference. "We want to do everything."

Chinese companies are also likely focused on in-development assets because major miners are unwilling to shed mature projects amid skyrocketing lithium prices.

"Because they know there's profitability for the next two to three years, and really solid profitability at that, they're unlikely to sell," Miller said.

|

| Visitors walk past a display by Chinese battery-maker Contemporary Amperex Technology Co. Ltd. at the 2019 IAA Frankfurt Auto Show in Germany. Source: Sean Gallup/Getty Images News via Getty News |

Bullish markets

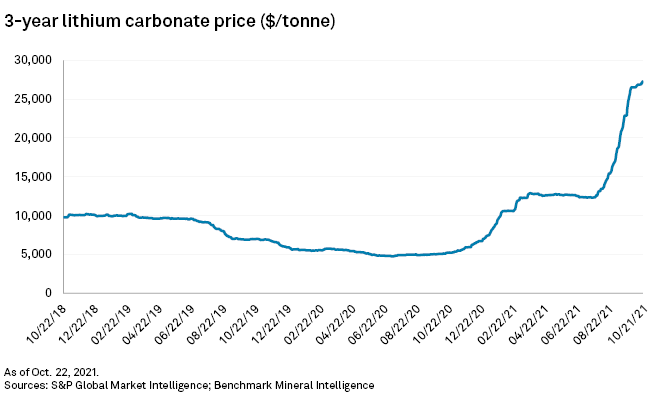

Tight supply coupled with intense demand has pushed lithium prices to near-historic levels.

Benchmark Mineral Intelligence's price assessment for EXW China battery-grade lithium carbonate reached an average $28,675 per tonne in the first two weeks of October — about a 322.5% increase year over year.

"This year, the run-up in pricing was a real indication there isn't enough supply to feed the end market demand that we're seeing from both electric vehicles ... and also energy systems storage," said Benchmark Mineral Intelligence analyst George Miller.

This was especially true in China, where domestic lithium prices surged ahead of the rest of the world, said Kwasi Ampofo, head of metals and mining at BloombergNEF. Underpinned by broader issues such as the impact of COVID-19 on supply chains, rising geopolitical tensions over raw materials and projected supply deficits, the pricing signal motivated Chinese companies to chase deals.

"They have seen what happens when you don't do M&A; when you don't expand capacity and you wait while market demand grows," Ampofo said. "And when it catches up with you, it becomes a mess."

Everyone else playing catch-up

China's drive to snatch up lithium assets also puts pressure on North and South American producers to follow suit or risk missing out on opportunities.

"We see the Chinese companies taking the lead on this, whereas some majors from South America are really going to need to pick up the pace on their investment strategy," Benchmark Mineral Intelligence's Miller said.

Miller expects bigger mining names outside the relatively small lithium industry to pursue lithium acquisitions or developments. Indeed, Rio Tinto Group's $2.4 billion decision to build the Jadar lithium-borates project earlier this year heralded lithium's move into the big leagues.

It's not the first time China has placed its bets on the lithium industry. During the last high price cycle, roughly between 2016 and 2018, Chengdu Tianqi Industry Group Co. Ltd. purchased a stake in Chilean lithium developer Sociedad Química y Minera de Chile SA for $4.07 billion.

"China walks the talk and knows where its money is welcome," Howard Klein, founder of RK Equity, a capital market advisory firm, said during an Oct. 20 conference hosted by Adamas Intelligence.