Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Jan, 2022

China is likely to cut borrowing costs further as its measured pace of easing has yet to revive bank lending and economic growth, analysts say.

The People's Bank of China is expected to lower the benchmark interest rates by another 15 basis points before midyear after cutting Jan. 20 the one-year and five-year loan prime rates, or LPRs, by 10 bps and 5 bps, respectively, UOB analysts wrote in a same-day note. Another 50-basis-point cut of the required reserve ratio, or RRR, for banks is likely on the table too, following the 50-basis-point RRR cut in December 2021, the note said.

"The size of the rate cut is simply too small to have a material impact," Nomura analysts wrote in a Jan. 20 note. The brokerage also expects the central bank to cut LPRs again before mid-2022.

Loan demand in China has been hit by a wave of defaults among property developers and business disruptions related to the pandemic. Banks have also been reluctant to lend more aggressively due to concerns over bad loans.

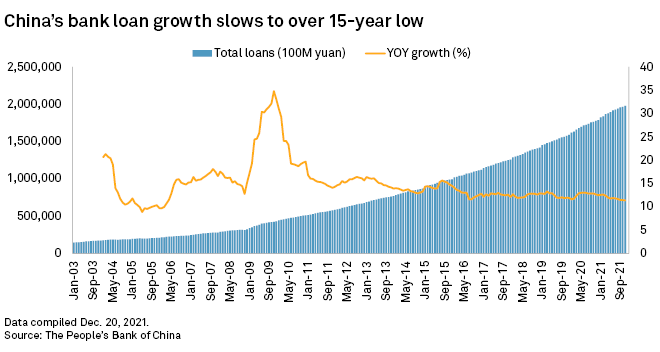

Bank loan growth continued slowing after Beijing rolled out measures to free up more liquidity late 2021. New yuan loans in December 2021 contracted 9.7% from a year earlier, and down 20.5% from the previous month, according to the the People's Bank of China, or PBOC.

The outstanding loan balance of Chinese financial institutions rose 11.37% in November 2021 from a year earlier, according to the China Banking and Insurance Regulatory Commission. The growth rate was the lowest since March 2006.

Treading carefully

As the growth of the world's second-largest economy has been softening since the third quarter of 2021, Beijing stepped up easing efforts. In addition to the two LPR cuts and a reduction of the RRR, the central bank slashed the medium-term lending facility loans and reverse repos by 10 bps Jan. 17.

"They are tweaking [rates] quite carefully, just to make sure that the policy easing its targeted at those that need it than to areas that may lead to speculation," said Song Seng Wun, economist at CIMB Private Banking. "They don't want the fire [of the property boom] to come back again as it would undo everything."

The Chinese central bank has further room to cut rates as inflation expectations remain well anchored, said Song.

China's CPI rose by 1.5% in December 2021, down from 2.3% in the previous month due to lower food prices.

Property pressure

China's property sector has been under close scrutiny following debt problems from prominent developer China Evergrande Group. Although the impact on banks has been limited, market sentiment may have impacted liquidity within the industry and homebuyers, analysts said.

"Refinancing is the biggest concern now facing developers as reports about heightened liquidity issues and building and delivery delays are sapping homebuyers' confidence. A lot will be hinged on regulatory development," said Nathan Chow, a senior economist at DBS Hong Kong.

The central bank last cut the one-year LPR by 5 bps a month ago, which was the first cut since April 2020, but kept the five-year rate, on which most mortgages are based, unchanged.

"The cut to five-year LPR suggests some softening of the official stance towards the real estate market but the smaller cut still indicates that the PBOC wants to target support for the businesses rather than fueling a rebound in the real estate market," the UOB note said.