S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

19 Jan, 2022

By Rebecca Isjwara and Rehan Ahmad

More Chinese issuers are expected to flock to the green bond market in 2022 on the back of the government’s initiatives to widen the investor base and encourage bank lending to energy transition projects.

The issuance of Chinese green debt, including instruments that only meet local standards, could grow by at least 80% this year after raising $94.77 billion in 2021, said Anish Ailawadi, senior director and head of investment banking at research and analytics firm Acuity Knowledge Partners.

The world's largest carbon dioxide emitter is expected to align its definition of green projects with the global taxonomy to draw more international investors, after excluding fossil fuel-related projects when they revised the list of projects eligible for issuing green debt in April 2021, analysts said. China's easing monetary efforts, which are in stark contrast to tightening in most other economies, will also bode well for the onshore green bond market in 2022.

Major Chinese banks are also expected to be more active buyers in the market, after the People's Bank of China, or PBOC, included their green bond holdings in its assessment of their overall performance in green finance in July 2021, analysts said. Banks could also step up their lending to green projects after the central bank has been offered cheap funding to banks to subsidize their green loans in November 2021.

"The rise in green issuances will accelerate as a trend," said Ailawadi. "This will continue in the years to come until the end goals are met."

China has been pushing corporates and all levels of the government to speed up energy transition since President Xi Jinping announced in September 2020 the nation’s commitment to reach carbon neutrality by 2060.

Local governments are now able to set sustainable targets, said Iris Pang, chief China economist at Dutch bank ING Groep NV, adding they may also encourage issuers to disclose their own targets in their respective annual and interim reports, which may be a driver for more green bonds.

In addition to efforts to widen funding access for green projects, President Xi said in September 2021 China would no longer build new coal-fired plants overseas. It followed the country’s pledge in April to cap coal consumption to less than 56% of the energy mix in 2021, down from 56.8% in the previous year. China did not disclose its stance on new domestic coal-fired plants and the nation’s coal production reached a new high in 2021 amid the winter gas crisis.

Use of proceeds

About two-thirds of Chinese green bonds issued in 2021 were classified as nonaligned with international standards, according to data from Climate Bonds Initiative, or CBI, a U.K.-based green debt tracker. Issuers are allowed to allocate up to 50% of the proceeds to working capital, which includes the funding of day-to-day operations or repayment of existing borrowings, while international standards allow only up to 5%.

“It is expected that at least $22 billion, or half of the nonaligned bonds, goes towards state-owned eligible green projects, and the other half could be funding non-green projects," said Christina Ng, a researcher at the Institute for Energy Economics and Financial Analysis.

The revision of China’s green bond catalog last year has kept the 50% threshold. The authorities said earlier the harmonization of taxonomy is a long-term project of high priority.

The portion of nonaligned green bonds may grow further if the regulation governing the use of proceeds is not amended to match international standards, said Ng.

"The PBOC should be concerned, however, as foreign [environmental, social and governance] investors may need more evidence that market discipline for China's [state-owned enterprise] green bond issuers has improved in order for them to invest in onshore [state-owned enterprise] green bonds,” Ng said.

The so-called nonaligned green bonds are often off-limits to international investors who are bound by their investment protocols.

Detailed, verified and transparent post-issuance reporting is necessary, Ng said. "Otherwise, the PBOC could face a concentration risk with its domestic banks, insurers and asset managers being the main holders of onshore bonds."

Issuer mix

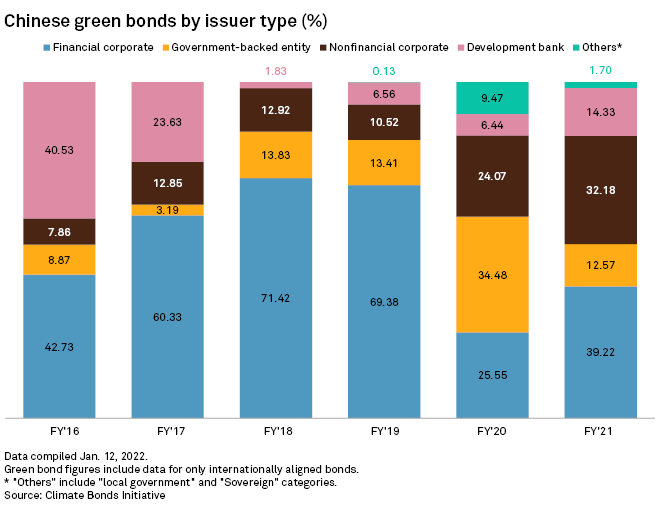

State-owned enterprises have been active issuers for green notes in recent years. In 2021, 12.57% of green bond issuances came from government-backed entities, according to CBI data.

Meanwhile, the dominant share issuers in 2021 were corporates at 71.4%, while the development bank comprised 14.3% of issuers.

China's journey towards net-zero will need active participation of all its stakeholders, including the government, corporates and banks, Acuity's Ailawadi said.

"The transition to low-carbon emission, or technology with zero-carbon footprint will need innovation and investments from corporates in this decade," Ailawadi said.