Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Jun, 2022

By Marta Lillo

| Two workers taking lithium brine samples from salt pools in Chile's Salar de Atacama region. Source: Oliver Llaneza Hesse/Construction Photography/Avalon/Getty Images |

Chile may miss out on the lithium price boom if it cannot set policy to allow development of its vast reserves.

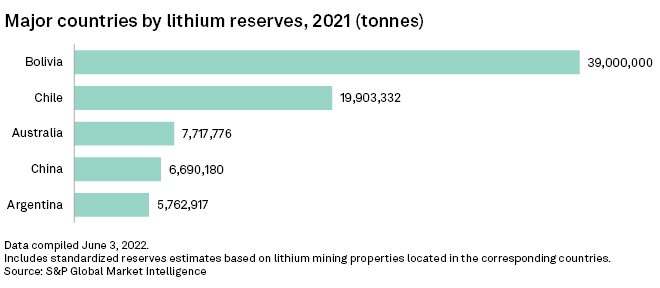

With lithium prices soaring through most of 2021 and 2022, major miners have been eyeing Chile as a potential new source of the white metal. But Chile has been flailing for half a decade to create a legal framework to sell concessions to developers to extract its 19.9 million tonnes of lithium reserves, according to S&P Global Market Intelligence data, and the country has only issued a handful of permits.

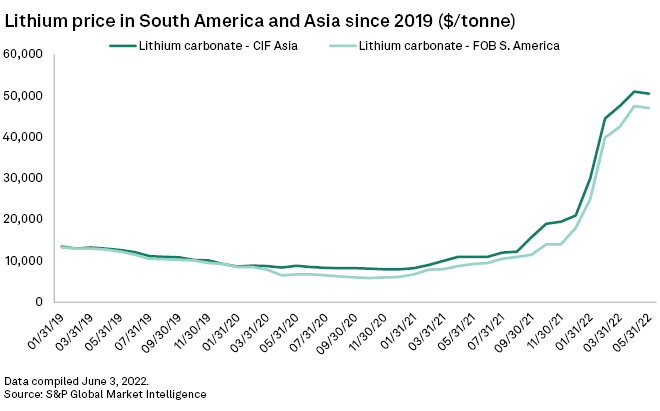

Chile is mired in a constitutional rewrite that must be finished before new policy can be created. The country is expected to vote on a final draft in September, after which the government can begin to write policy. By the time the necessary framework is in place, the country may have missed the lithium boom. The CIF North Asia price for lithium carbonate peaked in April and has since leveled off, according to S&P Global Commodity Insights data.

"If Chile wants to maintain its market share and leverage the creation of added value, it must focus on production but also make the leap in research and cutting-edge technology developments," Sergio Bitar told Commodity Insights. "The question is how to do it." Bitar was a minister in the administrations of former Chilean presidents Salvador Allende and Michelle Bachelet. He serves as president of the Chilean Council for Strategy and Foresight, a think tank.

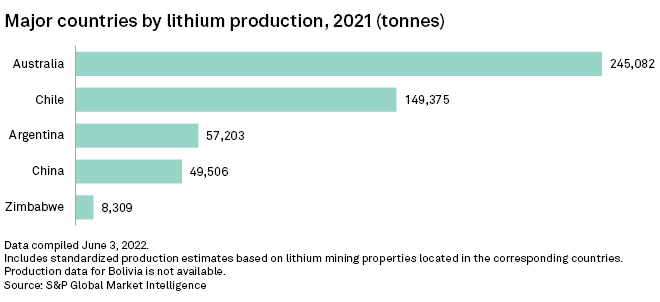

Talk of Chile becoming a leading player in the lithium market dates back to the last price supercycle in 2017. However, the country's inability to capitalize on its reserves allowed Australia to surpass it in 2017 and become the top global lithium supplier, according to United States Geological Survey data.

The barely open door

Chile has handed out few concessions to develop its reserves. Albemarle Corp. and Sociedad Química y Minera de Chile SA operate large lithium mines in the country, and both have shown interest in adding to their operations. In October 2021, then-President Sebastián Piñera tried to add new permits in the waning days of his administration by awarding concessions to BYD Chile SpA, a subsidiary of China-based BYD Company Ltd., and Chile-based Servicios y Operaciones Mineras del Norte SA. The permits were stayed in January, and voided in June by the Chilean Supreme Court.

The administration of President Gabriel Boric, which has not offered a clear vision for distributing mining rights since it took office in March, has told investors it is aware of the uncertainty surrounding mining investment in the country. While the administration did not respond to multiple requests for comment, government officials have publicly voiced their opinions.

Mining Minister Marcela Hernando told reporters June 1 that the government will focus on building an institutional framework for lithium to improve private sector confidence.

"We are not closed to any possibility of a public-private alliance because we understand that our country does not have the competence in technology and, therefore, one way is to look for those partners," Hernando said.

Lithium companies say they may be willing to wait.

"In mining, especially in lithium, [the Boric administration sees] an opportunity to generate a sustainable development model with social value," Ignacio Mehech, Albemarle's vice president of external affairs and country manager for Chile, told Commodity Insights in an emailed statement.

Waiting for a constitution

The constitutional overhaul underway is not inspiring confidence in the mining sector. While early calls for nationalization of mining resources were averted, Congress is considering adding new taxes and royalties to mining operations.

"In Chile, we have regressed in these matters, which directly affects the competitiveness of the projects," Ignacia López, a spokesperson for Sociedad Química y Minera de Chile, told S&P Global Commodity Insights. "Decades of experience have shown us that prices are cyclical."

Companies hope for clear direction from the government soon.

"The impact [the new charter] will have is that mining investments will remain in limbo," Sociedad Nacional de Mineria de Chile President Diego Hernández said May 16 in a radio interview on Radio Pauta. "No one will dare to make significant investments, just enough to keep current operations running."

Albemarle added in a statement that it, too, would "wait and see" before deciding on new investments.

But some companies are worried about timing.

The closing window

Lithium prices leveled off in May and June, with the lithium carbonate CIF North Asia price slipping to $73,700/tonne on June 15,

By early 2022, Argentina had attracted some of the largest lithium deals in the market, including the Cauchari-Olaroz brine project, a joint venture between Ganfeng Lithium Co. Ltd. and Lithium Americas Corp., scheduled to start commissioning in December 2022. Lithium Americas also recently bought out Millennial Lithium, the company responsible for the Pastos Grandes project, expected to start production in two years, and Rio Tinto Group acquired the Salar del Rincon mine for $825 million in late 2021.

Unlike Chile, Argentina does not consider lithium to be a strategic mineral exclusively controlled by the government. Its legal system permits corporations and individuals to explore and produce lithium through concessions they can own in perpetuity if they meet certain investment criteria. While the country alarmed investors with a June decision to set a lithium exports reference price of $53 per kilogram for lithium carbonate, the country remains hospitable to investment.

"We have found Argentina an attractive jurisdiction to do business, as there is strong support at the federal, state, and local governments levels for investment in resource development," Virginia Morgan, Lithium Americas' senior director of investor relations and environmental, social and governance criteria, told Commodity Insights in an emailed statement.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.