S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

5 Feb, 2021

By Allison Good

Chevron Corp. will probably need to increase its $12.47 per unit bid to buy out Noble Midstream Partners LP in order for the pipeline master limited partnership to agree to the deal, midstream industry experts said.

The oil and gas supermajor, which closed its $13 billion acquisition of parent company Noble Energy Inc. in 2020, already owns 62.6% of Noble Midstream. Chevron said its more-than-$1 billion offer to purchase outstanding Noble Midstream shares based on the closing price of common units as of Feb. 4 would "align long-term interests," but the price may not be high enough for the MLP.

"The no-premium price for the bid is not too surprising given the strong performance of [Noble Midstream] over the last three months," CBRE Clarion Securities portfolio manager and MLP expert Hinds Howard said in an email. "The market will expect a negotiation with the conflict committee to lead to a small sweetener."

With Noble Midstream units up just over 5% in early-morning trading, analysts at energy investment bank Tudor Pickering Holt & Co. agreed that the "market is focused on recent precedent of [limited partners] necessitating premium offers to get transactions across the finish line." They pointed to TC Energy Corp.'s $3.68 billion roll-up of subsidiary TC PipeLines LP that was agreed to in 2020 after the Canadian midstream giant raised its initial $1.48 billion offer.

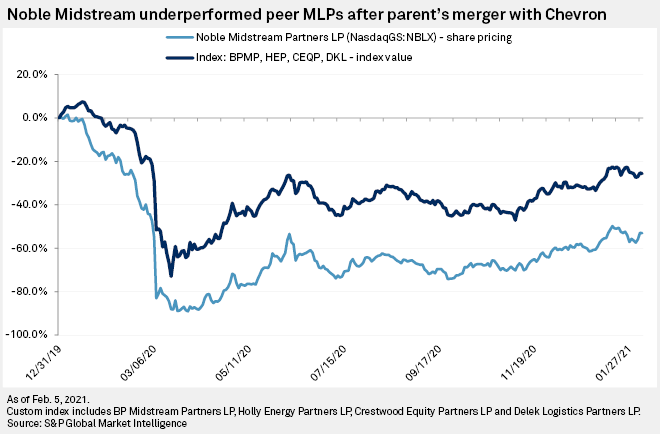

Noble Midstream, which Noble Energy spun off in a 2016 initial public offering, has seen its stock price spike almost 22% in 2021 so far. Chevron's offer, analysts at Credit Suisse noted, "implies <7x our '22 EBITDA, one of [the] lowest among peers." Since crude oil prices crashed in early 2020, Noble Midstream's stock performance has lagged behind that of similarly-sized midstream MLPs, even after the Chevron merger announcement and completion.

When the supermajor agreed to buy Noble Energy, analysts were split on whether Chevron would keep or sell the company's pipeline unit. Rolling up Noble Midstream became the obvious choice as the pipeline M&A market "cooled," according to CBRE's Howard.

"With the ongoing lack of interest in MLPs in the equity markets, MLP sponsors see that the original concept of a drop-down or sponsored MLP is no longer viable," Howard said. "This transaction is a further signal of the lack of interest in midstream M&A from third parties and private players."

Appalachian shale gas driller CNX Resources Corp. also bought out its midstream MLP in 2020.

The only sale on the horizon so far for 2021 is CenterPoint Energy Inc.'s potential divestment from Enable Midstream Partners. President and CEO David Lesar said on Dec. 7, 2020, that CenterPoint has retained a financial adviser to support its evaluation of the pipeline partnership and will provide an update in the next 60 days. CenterPoint holds 53.7% of common units representing limited partner interests in Enable Midstream and 50% of the management interests in its general partner. OGE Energy Corp. — which holds 25.49% of the partnership's common units and the other 50% of the general partner — is reportedly also considering unloading its stake.