S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

24 Mar, 2021

By Nephele Kirong

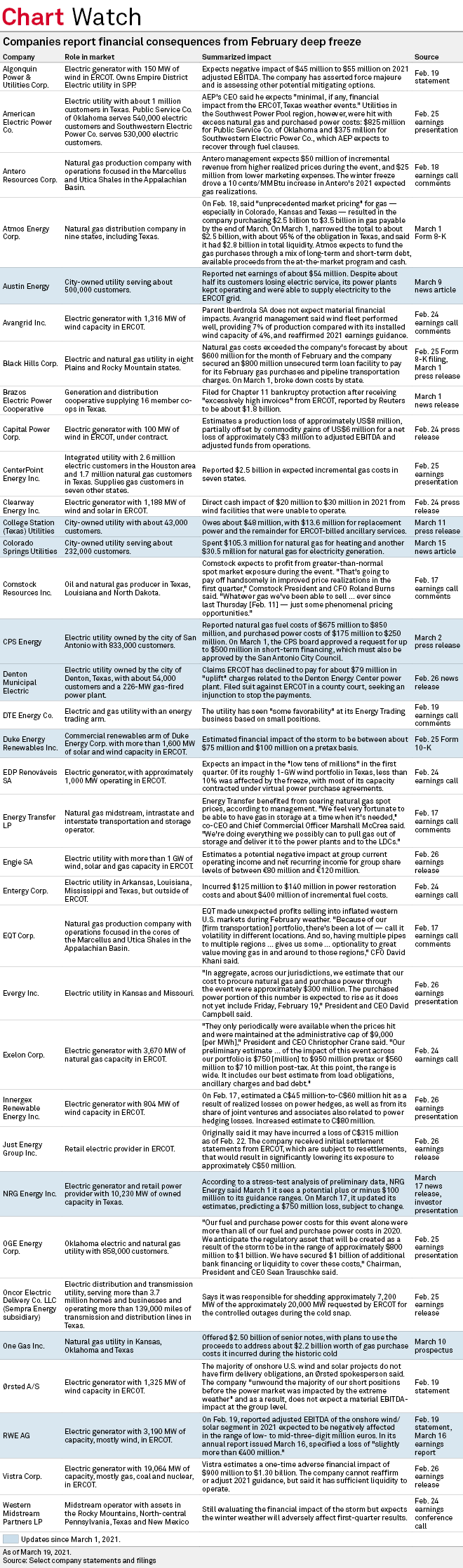

As energy companies continue to disclose financial impacts from the historic mid-February freeze in Texas, some have begun taking more decisive steps to address the fallout.

ONE Gas Inc. has tapped the debt market to address about $2.2 billion of gas purchase costs during the weather event, recently closing an offering of $2.50 billion of senior notes.

The CPS Energy board recently received approval from the San Antonio City Council to seek a line of credit of up to $500 million for additional liquidity. If used to maintain operations, the debt will have no negative financial impact on the city or customers' bills, the utility said.

Aside from the capital raise, the Texas municipal utility legally known as City Public Service of San Antonio filed lawsuits against its natural gas suppliers over alleged exorbitant charges during the winter storm.

Suppliers allegedly charged the utility up to 15,000% more for natural gas, according to the utility.

"Imagine going to the gasoline pump during a natural disaster and seeing the price of a gallon of gas at about $348 or about $7,000 for a full tank. That is essentially what happened with natural gas prices during the storm," CPS Energy President and CEO Paula Gold-Williams said in a March 23 statement.

The utility reported natural gas costs of $675 million to $850 million and purchased power costs of $175 million to $250 million.

Denton Municipal Electric is also hoping the court will decide in its favor to stop the Electric Reliability Council Of Texas Inc. from collecting "uplift" charges.

The uplift mechanism allows ERCOT to spread costs of other market participants' failure to pay power purchases. The city of Denton-owned utility, however, views the payment as an "unconstitutional gifting of public funds and unconstitutional lending of its credit."

The District Court of Texas has already granted Denton Municipal Electric a temporary restraining order over the imposition of the charges and the company has indicated that it will explore all legal options to protect its financial assets and its ratepayers.

NRG Energy Inc.

Following the announcement, S&P Global Ratings placed the power provider's ratings on CreditWatch and Moody's revised its outlook to stable from positive.

The uncertainty prompted NRG to withdraw its full-year 2021 financial guidance. Despite this impact, NRG executives voiced opposition on ERCOT repricing $16 billion in transactions.

"I think that it is in the best interest of our business and the best interest of consumers and shareholders to have as minimum government intervention as possible in these markets," NRG President and CEO Mauricio Gutierrez said in a recent conference call.

Other companies reporting impacts include Duke Energy Corp.'s commercial renewables arm and RWE AG.

Duke Energy Renewables Inc. estimated a financial impact of between $75 million and $100 million on a pretax basis. The company has more than 1,600 MW of solar and wind capacity in ERCOT.

RWE indicated in its annual report a loss of "slightly more than $400 million" and announced an expected decline in 2021 results due to the extreme cold snap. RWE has 3,190 MW of capacity in ERCOT, mostly wind.

This S&P Global Market Intelligence news article may contain information about credit ratings issued by S&P Global Ratings. Descriptions in this news article were not prepared by S&P Global Ratings.