Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Sep, 2021

By Vanya Damyanova and Rehan Ahmad

London is making an effort to pry away listings of special purpose acquisition companies from other financial hubs by easing rules that had hamstrung competition.

The U.K. capital missed out on opportunities earlier this year to list SPACs, which raise capital via an IPO and subsequently purchase a previously unidentified business, because of its tighter regulations, legal experts said. Changes brought in by the financial services regulator on Aug. 10 will bring long-term benefits for London, they said.

The new regime has removed a key legal barrier, namely the presumed suspension of trading in a SPAC's shares after it announces a potential acquisition. The revised rules "should make London much more credible and competitive as a listing venue for sponsors looking to launch a SPAC," said Patrick Sarch, co-head of the U.K.-based M&A team at global law firm Hogan Lovells.

U.K. regulators aim to reinforce the London market's position by luring companies in technology and financial technology — two prime areas for SPAC activity. Another is sustainability. The latest SPAC listing on the London Stock Exchange was that of Spinnaker Acquisitions PLC on July 28, which raised £2.08 million and will be looking for acquisition targets in the areas of sustainability and energy transition.

Timing

The U.K. listing rules changes are "very welcome," but unfortunately they have come too late for London to take advantage of the wave of capital raising seen over the past couple of years, Sarch said.

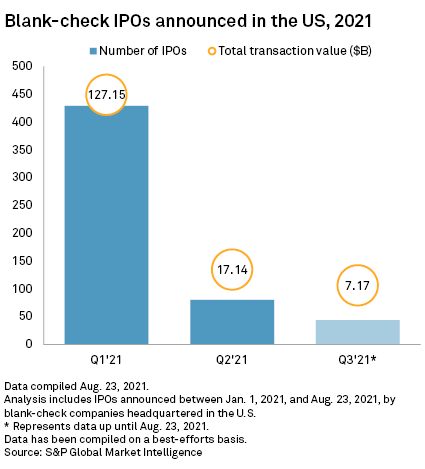

Since the first quarter of 2021, when U.S. SPAC IPO numbers and fundraising amounts surpassed the 2020 annual total, there has been a marked decline in activity. Part of the slowdown was attributed to regulatory action. The global SPAC market has slumped since the U.S. SEC set out to tighten rules following a $127.15-billion deluge of listings in America in the first quarter.

The levels of activity that took place in the U.S. from mid-2020 through to April and May 2021 were unsustainable, Jon Parry, a London-based partner at the capital markets group of international law firm White & Case, said in an interview.

"However, as both a capital markets tool and an M&A tool, SPACs are here to stay. They perform a very valid function," Parry said.

Timing is certainly relevant and, indeed, some people in the market have questioned the U.K. change coming months after the U.S. listings peak, Daniel Mathias, counsel at the London-based office of international law firm Cohen & Gresser, said in an interview.

However, the new rules have merit from a long-term perspective, given that SPACs will remain a capital-raising option and that, prior to the amendments, the U.K. was "out of step" with other jurisdictions, he said. The presumption of suspension and the lack of redemption option, which allows SPAC investors to exit their shareholding before an acquisition is completed, were key deterrents before the change, according to Mathias.

Other jurisdictions, such as Singapore, are also making a late attempt to draw listings of SPACs, also known as blank-check companies, by making their rules more accommodating.

Competitive position

The presumption of suspension was the main reason London did not become a major center of SPAC activity when the number of European listings started to grow in early 2021, White & Case's Parry said. After the rule's removal, the U.K. capital is much better placed going forward, he said.

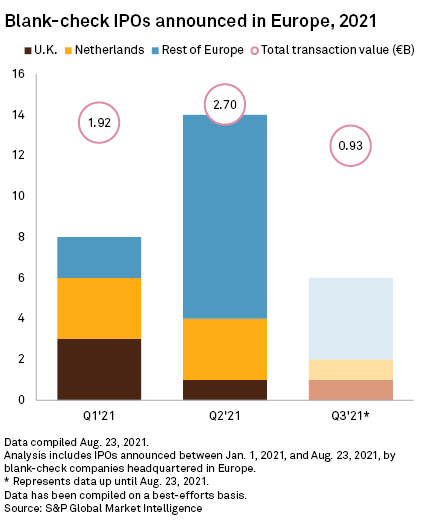

Amsterdam emerged as the preferred SPAC listings destination in early 2021, which some have attributed to the fact that the Netherlands had no rules specifically targeted at blank-check companies. SPAC listings volumes in Amsterdam stayed stable in the second quarter compared with the first, while U.K.-based listings dropped and listings elsewhere in Europe surged, S&P Global Market Intelligence data shows. Volumes so far in the seasonally weaker third quarter have been lower across the regions.

Parry and his White & Case colleague Inigo Esteve, who focuses primarily on IPOs on the London Stock Exchange and other exchanges across Europe, the Middle East and Africa, see a "healthy pipeline" of IPOs and potential SPAC listings in both the U.K. and the EMEA region in the second half of 2021.

How much U.K. listings will grow as a result of the rule changes is yet to be seen, but there is continued interest from potential sponsors, according to Esteve.

The Financial Conduct Authority, or FCA, said it expects SPACs to remain a modest feature of U.K. markets overall, but the vehicles offer an alternative funding route for private companies against traditional IPOs and may drive competition in that area. "[A]ny increase in appropriate opportunities for investors and issuers to access U.K. capital markets is positive," the FCA said.

As the U.S. is a huge market with a lot of knowledge around SPACs, there will be a need to create a compelling story about why these vehicles should be listed in London, Cohen & Gresser's

London rules

In some areas, the new U.K. regime goes beyond the investor protections offered in other European markets; notably, neither the sponsor nor anybody who is invested in the "sponsor promote" — the sponsor's share in the SPAC's post-IPO equity — is able to vote for a proposed acquisition, Esteve said. This is a "key difference" and differentiator for the U.K., he said.

Although some other jurisdictions do not require a shareholder vote, the FCA considers its approach "to be proportionate in seeking to balance flexibility for issuers with protection for investors," the regulator said.

It remains to be seen how the market views these differences and whether they will have an impact on London's position as a SPAC listings venue compared with competing financial centers such as New York and Amsterdam, White & Case said in its note on the U.K. rules change.