Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Dec, 2022

The Consumer Financial Protection Bureau will continue vigorous efforts to oversee the banking industry — with a focus on the largest banks — in 2023 despite challenges in Congress and in the courts.

The agency's full-steam-ahead approach to guidance and compliance work is unlikely to be deterred in the face of multiple headwinds, including an expected strong push by U.S. House Republicans to lessen the CFPB's power and the agency's pending appeal to the U.S. Supreme Court regarding a lower court's decision that the agency's funding structure is unconstitutional.

Industry experts expect big banks to remain under the microscope. For example, just on Dec. 20,

As the agency moves full throttle with guidance and enforcement, the financial industry needs to stay focused on compliance even in the face of looming headwinds for the agency, attorneys said.

"The bureau has emphasized the bully pulpit and supervisory authority to influence market behavior," said John Coleman, a partner at Buckley LLP who previously was CFPB's deputy general counsel for litigation and oversight.

Among major areas of focus for the agency in 2023 will be overdraft fees, credit card late fees, seeking illegal discrimination in audits and the ability of consumers to get their financial data from banks.

Focus on large banks

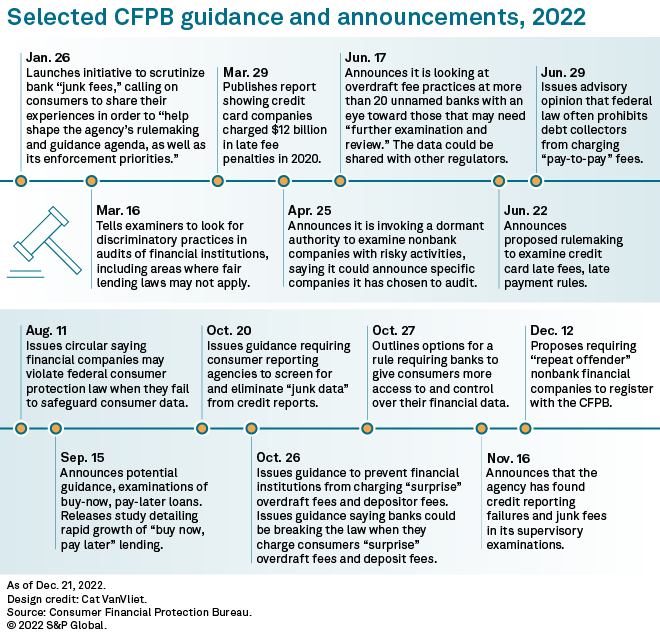

In targeting a broad range of practices that it believes will harm consumers, including junk fees and discrimination, the agency has used numerous avenues to pursue what Chopra believes is wrongdoing, including lawsuits, announcements, reviews, advisory opinions, rules and enforcement initiatives.

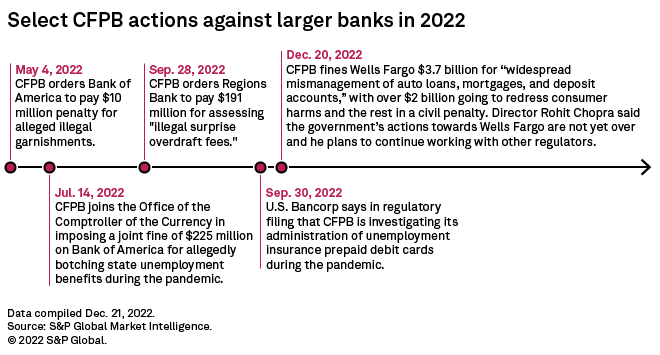

Chopra told the Senate Banking Committee in April that the CFPB "is shifting enforcement resources away from investigating small firms and instead focusing on repeat offenders and large players." Chopra was as good as his word through the rest of 2022. In addition to the recent Wells Fargo action, the agency has imposed a string of recent fines on, and investigations of, some of the nation's largest banks, including Bank of America Corp., Regions Financial Corp. and U.S. Bancorp.

"The bureau caused financial institutions to snap to attention with its focus on 'repeat offenders' and naming individual defendants in enforcement actions," Jonathan Engel, a partner at Davis Wright Tremaine, told S&P Global Market Intelligence.

Chopra is expected to keep up the pressure on the nation's biggest financial institutions in 2023, industry experts said.

"For the almost 14 months he's been in charge, he has taken an aggressive approach to consumer protection," said Eamonn Moran, a senior counsel at Norton Rose Fulbright who has served as a regulations counsel at the CFPB. "Compliance should be front of mind for institutions."

CFPB targeting fees

As the agency looks at big banks, fees have been — and will continue to be — a major focus, stemming from efforts first announced in January.

The agency has been aggressively asserting its authority in this area, and "in some instances in areas where it looks to be expanding that authority beyond what it had been given by Congress," said Chris Willis, who co-leads the Consumer Financial Services Regulatory Practice Group at Troutman Pepper.

In a controversial action that analysts and trade groups have said could draw litigation in the year ahead, the CFPB issued guidance in October cracking down on "surprise" overdraft fees and depositor fees.

In another significant fee issue, the CFPB is reviewing the Federal Reserve's credit card late fee rules. The agency is expected to issue a formal notice of proposed rulemaking in early 2023, and any proposed rules could have a big impact on small institutions, experts told Market Intelligence in October.

Crackdown on discrimination

The agency's focus on discrimination also caused waves in the financial community that are expected to spill over into 2023.

In March, the agency updated its examination manual so that CFPB auditors will now be looking for illegal discrimination on a broad scale, which attorneys said may go beyond what Congress has authorized. That manual is used in audits to determine whether banks are using "Unfair, Deceptive and Abusive Practices."

The U.S. Chamber of Commerce and several trade groups, including major banking associations, sued the CFPB in September to overturn the guidance. At the end of November, the groups sought a summary judgment in the case based in part on the 5th Circuit's ruling that the CFPB's funding structure was unconstitutional, but the agency is fighting back.

Despite the pushback, "I just don't think Chopra will be shy," Anthony DiResta, co-chair of the Holland & Knight's Consumer Protection Defense and Compliance Team, said in an interview. "I think that will be an issue that he feels is within the jurisdiction of the CFPB. So I think we need to anticipate that that will be an agenda item."

The agency is already fighting back, filing a motion Dec. 20 for the judge to either dismiss the original case or rule in favor of the agency, according to Ballard Spahr LLP's Consumer Finance Monitor.

Data access 'key priority'

In another key — and sometimes controversial — issue, Chopra said in December at recent Congressional hearings that data reporting and protection will be a major theme of the agency's activity in the year ahead.

Testifying in mid-December before the House and Senate banking committees, Chopra said data access is a "key priority" for the agency, and it seeks to use its long-dormant authority to give consumers more access to their data. The law authorizes the CFPB to write regulations under which consumers may access information about themselves from their financial service providers.

Supreme Court appeal underway

|

As the CFPB moves ahead with its jam-packed agenda, the agency is also facing an uncertain outlook with its appeal to the U.S. Supreme Court.

The CFPB took its case to the nation's highest court after the 5th Circuit Court of Appeals ruled that the agency's funding structure, with its money coming from the Federal Reserve rather than directly from Congress, is unconstitutional. All of the agency's guidance and enforcement initiatives since its inception hang in the balance of the Supreme Court's decision. If upheld, the decision could invalidate all of the agency's prior actions and guidance.

The CFPB hopes that the court will take up the case this term due to a growing number of companies involved in CFPB lawsuits already seeking dismissal of their cases based on the 5th Circuit decision.

"The pending action is unlikely to slow down supervisory activity but will gum up enforcement matters as the targets of some investigations will invariably raise questions about the CFPB's legitimacy as a basis for refusing to comply," Davis Wright's Engel said.

Congressional Republicans take aim

While the financial industry monitors the ongoing case, another area of sharp focus will be the GOP's vigorous opposition to the CFPB in 2023.

During separate hearings with the House Financial Services Committee on Dec. 14 and the Senate Banking Committee on Dec. 15, Republicans reiterated their concerns about the CFPB's funding and leadership structure and accused Chopra of overreaching his authority. They cautioned Chopra that he will face rigorous oversight.

"The political pendulum does not stop swinging," Ranking Member Patrick McHenry, R-N.C., said in introductory remarks. "Next month, there'll be a new majority in the House of Representatives. We look forward to more oversight, and I hope you'll wish you'd tried harder — well, I know you'll wish you'd tried harder — to play by the rules, and we hope you'll change your behavior going forward."

Senate Republicans took their concerns one step further by introducing a bill that would subject the CFPB to appropriations and shake up its leadership structure by replacing its single director with a five-member bipartisan board.

Despite the distractions from the Hill, the CFPB may not feel too much impact, said Ori Lev, a partner in Mayer Brown's Washington, D.C., office.

"It will be a drain on resources directed to responding to various oversight inquiries, but I don't actually think it's likely to have a substantive impact," said Lev, a member of the Financial Services Regulatory & Enforcement practice and the Consumer Financial Services group. "I don't think it's going to derail the bureau from being able to do whatever it would otherwise do."