S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Jul, 2022

By Nathan Stovall and Syed Muhammad Ghaznavi

The rates that banks offer on their certificates of deposits have only increased modestly through late-June despite sizable rate hikes by the Federal Reserve in recent months.

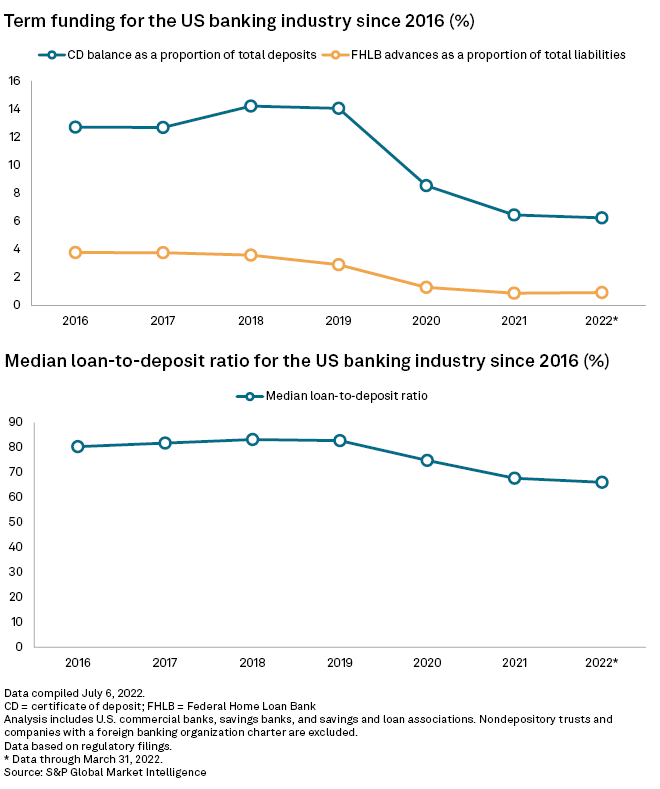

CD rates historically have closely mirrored long-term benchmark rates such as the 5-year and 10-year Treasury yields, and those long-term rates have risen more than 100 basis points since the end of the first quarter as the Fed took action to combat elevated inflation through a series of rate hikes. Still, rates banks offer on one-year CDs, one of the most popular term funding products, have lagged the increase in benchmark rates because institutions remain flush with deposits and continued to report historically low loan-to-deposit ratios.

CD rates lag Fed rate increases

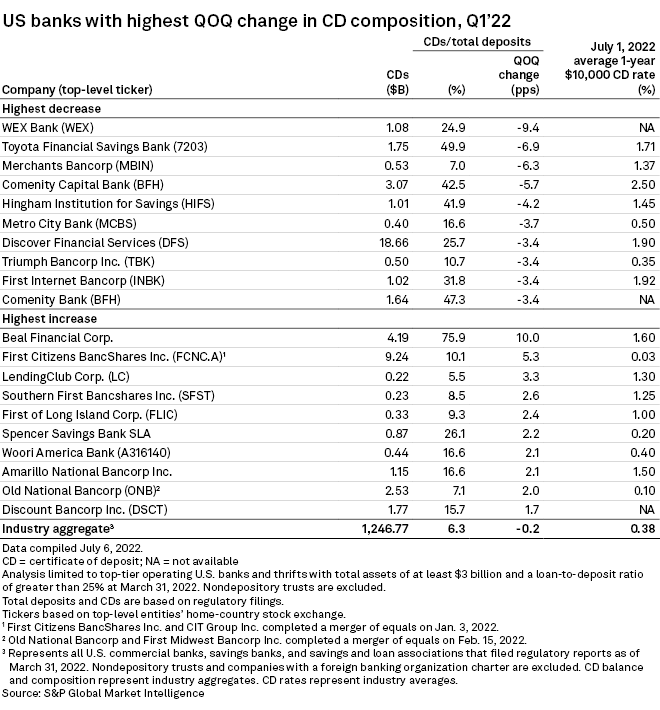

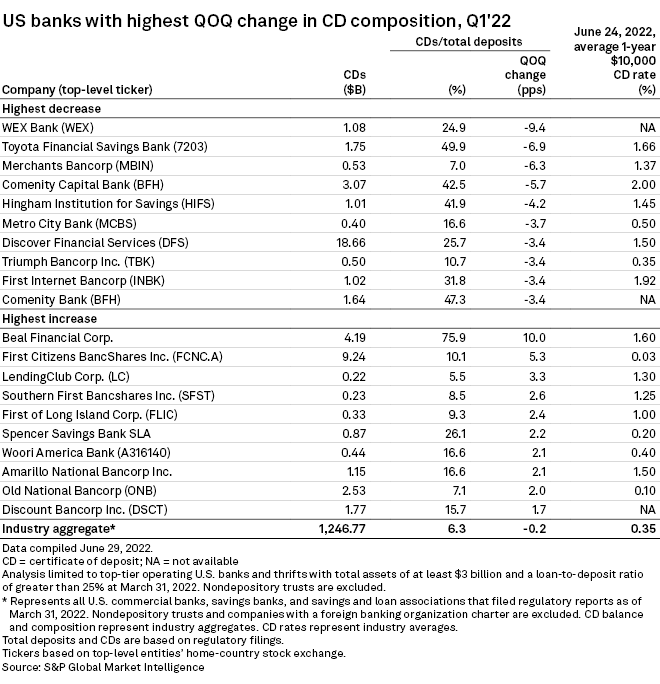

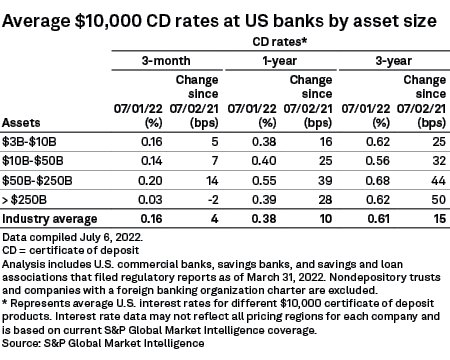

Across the industry, the average rate on one-year CDs has risen 10 basis points to 0.38% between June 25, 2021, and July 1, 2022. Large regional banks, institutions with assets between $50 billion and $250 billion, have increased their offers on one-year CDs the most, lifting those rates by 39 basis points since last June. Banks with more than $250 billion in assets increased those rates by 28 basis points since last June.

With the fed funds rate rising 150 basis points during that time frame, that still equates to a beta, or what percentage of change in rates banks pass on to customers, of 26.1%. Banks with assets over $250 billion recorded the second-highest beta on one-year CDs, equating to 18.9% during the period.

Some banks starting to grow CDs

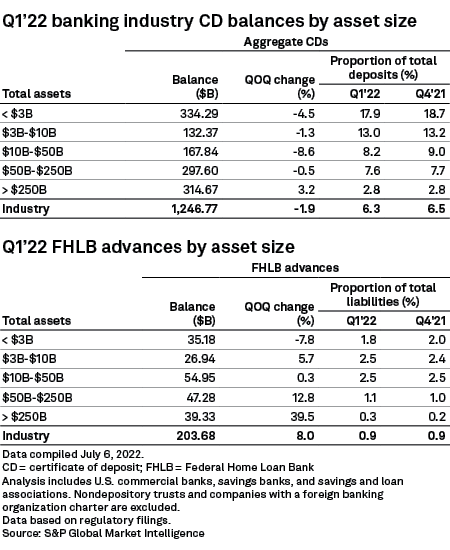

Those larger institutions have started growing at least their large-time deposits once again after shrinking CDs steadily since the pandemic began. Banks large and small have taken advantage of the flood of liquidity into the system to shrink their CD balances by nearly 39% since the end of 2019, reducing the concentration to 6.26% of total deposits.

Most banks continued to shrink CDs through the end of the first quarter but institutions with more than $250 billion in assets grew the balances 3.2% from the prior quarter.

The Federal Reserve's H.8, which tracks commercial bank balance sheets on a weekly basis, shows that the 25 largest, domestically chartered banks in the U.S. reported a 9.1% in large time deposits through the week ended June 22 when compared to March 30, the day before the first quarter ended.

Growing CD balances today could be seen as attractive because institutions could lock in funding before deposit costs rise much more materially. With the Fed now raising rates this year at a quicker pace than many economists expected in the first quarter, deposit costs should also rise at a faster pace. While banks should still be able to report higher interest margins even as deposit costs rise more quickly, CDs might be seen as a more attractive funding vehicle for some institutions to lock in rates at current prices, particularly if they are fearful that the Fed's reduction of its balance sheet and lack of government stimulus could lead to broad pressures on liquidity.