S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Jun, 2021

Cerberus Capital Management LP played a major role in relieving European banks of bad debt portfolios and underperforming assets in the years following the global financial crisis, and the private equity group's reported interest in HSBC Holdings PLC's French retail banking arm could be a precursor to more deals involving buyout firms in the near future, industry experts said.

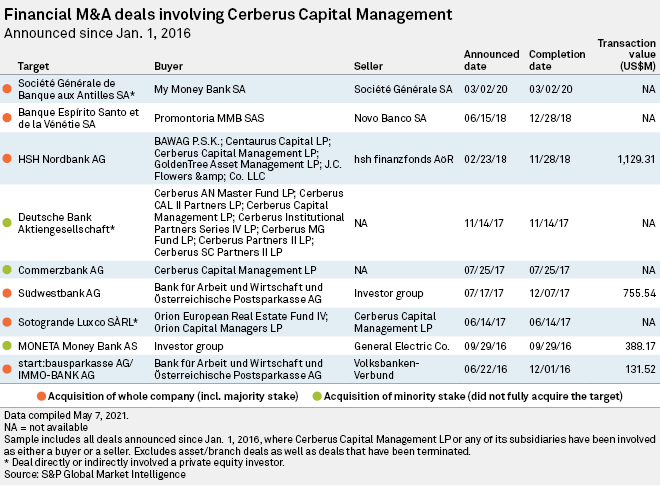

Promontoria MMB SAS, a Cerberus subsidiary, bought an 87.5% stake in France-based Banque Espírito Santo et de la Vénétie from Portugal's Novo Banco SA, the "good" bank that was carved out of the failed Banco Espirito Santo, in a deal that closed in December 2018, while My Money Bank SA, an independent French bank created by Cerberus in 2017, bought up Société Générale SA's Antilles-focused unit in 2020, to name just two whole-company transactions. The firm also holds equity stakes in Deutsche Bank AG, Commerzbank AG and Czech Republic-based Moneta Money Bank a.s.

Cerberus has acquired sizeable debt portfolios from lenders such as AIB Group PLC, UniCredit SpA and CaixaBank SA, all of whom racked up large volumes of bad debts post-2008. Portfolio deals have included both performing and defaulted loans on shipping, real estate and unsecured debt, and ticket sizes have been large — for example, the purchase of a $1 billion bundle of NPLs, many of them relating to buy-to-let mortgages, from AIB agreed in 2019.

Profit over scale

HSBC entered the French market in 2010 with the purchase of Crédit Commercial de France for €11.1 billion, which it renamed HSBC Continental Europe S.A. While the business had looked like it might provide the global banking giant with a convenient foothold in the EU in the aftermath of Brexit, returns have deteriorated in recent years, with the French operations contributing a $1.17 billion pretax loss in 2020 compared to group-wide profit of $8.78 billion.

It is likely that other large European banks will be mulling sales of underperforming businesses, according to Tom McAleese, managing director and head of Alvarez & Marsal's financial services restructuring practice.

Following the global financial crisis, the main motivation for banks to off-load assets was pressure from regulators to clean up their balance sheets and capital, McAleese said. But today, the impetus to trim down comes less from a need to satisfy regulators and more banks' own concerns about their chronically low profitability.

"We will see less externally driven restructuring of banks by regulators, and more internal restructuring where banks will continue to review their own business models. Noncore geographies, product lines and customer propositions will be either sold, wound down, or a combination of both. Already, we have seen this with foreign bank exits in Ireland, France and Spain driving ongoing M&A in the banking market," McAleese said.

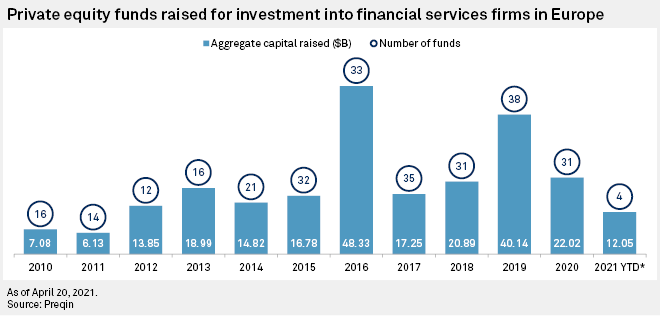

As and when they do put assets on the block, private equity firms will be natural buyers, he said.

Banks increasingly do not see themselves as "full service" companies, according to Christian Kent, managing director in the financial institutions group at investment bank Houlihan Lokey. Lenders are slimming down their businesses and focusing on cost-cutting and automation, which act as drivers for sales of operations in niche markets or require a large amount of manual underwriting, he said.

"These can be attractive to private equity as they operate in niche markets, and can often generate good margins if well managed. Post-COVID, with greater certainty around the performance of existing loan books of these businesses/loan portfolios, we can see private equity being more front footed," said Kent.

J.C. Flowers & Co. LLC is one private equity firm that would consider further purchases of European banking assets, according to Tim Hanford, managing director in the investor's Europe team.

A specialist in financial services deals, J.C. Flowers' recent activity includes the acquisition of Piraeus Financial Holdings SA's Romanian unit in 2018 and a stake in The Co-operative Bank PLC earlier this year.

Hanford believes that private equity firms are well placed to absorb underperforming bank assets. "Private equity firms ... bring strong management, strategic focus and an investment into technology that allow these businesses to return to independent growth," he said.

A perfect marriage?

In some respects, further acquisitions of bank assets by private equity firms would be a positive for the European banking industry, according to Alexander Lehmann, lecturer at the Frankfurt School of Finance and Management and visiting fellow at Bruegel, a Brussels-based think tank specializing in European economics.

"[Private equity firms] bring not only fresh equity, but are known to reduce inefficiencies — one of the long-running issues among banks in the Euro area. They will probably take an approach which is a bit more innovative and on-the-ball about cutting costs, branch closures and potential mergers," he said.

However, the business model of debt-fueled purchases by private equity firms of companies that are themselves already highly leveraged is "problematic," Lehmann said. Not only that, but previous private equity-banking deals have not always ended happily.

For example, the sale of Germany's HSH Nordbank, now renamed Hamburg Commercial Bank AG, to J.C. Flowers, GoldenTree Asset Management and Cerberus, resulted in a long-running legal dispute, Lehmann said.

HSH Nordbank was sold in 2018 in order to comply with EU rules that demanded its privatization, having been bailed out in 2008 by the German states of Schleswig-Holstein and Hamburg. However, bondholders sued the bank in 2019, saying that it had unfairly depressed the value of their holdings to make itself look more attractive to its private equity buyers. Hamburg Commercial Bank did not respond to a request for comment on the status of the lawsuit.