Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Jan, 2023

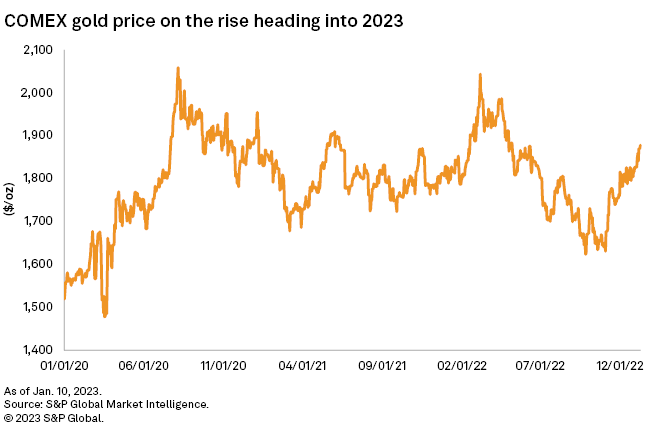

Record-high central bank buying combined with investor sentiment around global monetary policy has driven a gold price surge of about 15% since early November 2022.

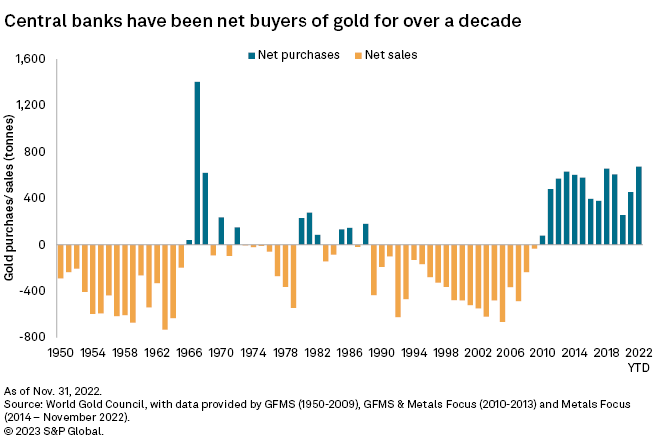

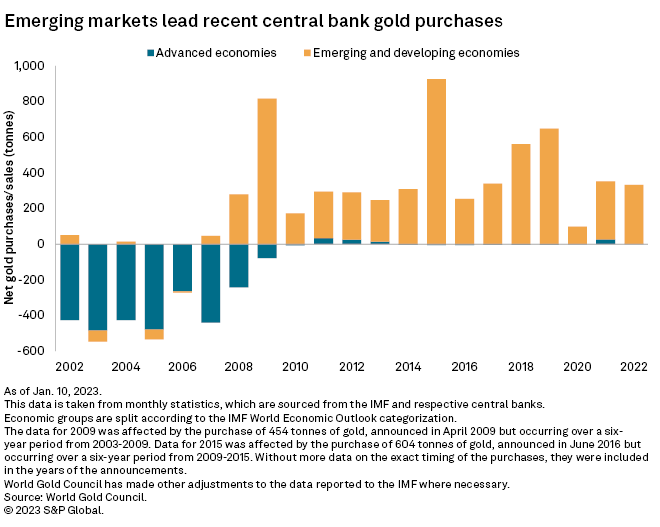

Central banks bought 673 tonnes of gold, a record high, through the first three quarters of 2022 and then continued to accumulate gold in October and November at a slower pace, according to the World Gold Council. Central banks have been net purchasers of gold since 2010, the industry organization's data shows. In recent years, emerging and developing economies' banks have dominated net gold purchases.

The U.S. dollar has retreated from recent highs even as interest rates rise, pushing banks and investors toward gold as a hedge against optimistic inflation targets and geopolitical uncertainty.

"It predates COVID. It predates sanctions," said Joe Cavatoni, chief market strategist for North America with the World Gold Council. "It's actually been consistent across the board because that safe haven asset — that diversification benefit — has been looked at by the central banks, and they see the value of it."

The heavy buying by central banks, along with a weakening dollar and the prospects of recession, presages what may be a big year for the yellow metal.

"It's potentially setting up the foundation for a push toward fresh record highs this year," said Bart Malek, global head of commodity strategy at Canadian investment bank TD Securities.

High interest rates often suppress the price of gold, as other investments become more attractive. However, central bank buying, particularly from developing countries turning away the dollar, has propped up the gold price.

"Extremely aggressive buying on the central bank front," in particular, has elevated gold prices, said Ole Hansen, head of commodity strategy at investment bank Saxo Group.

"In my opinion, the prospects for gold look fairly favorable," Hansen said. "That is something that I think markets are realizing. It certainly looks like the U.S. dollar is moving off its highs, and that is a pretty good indicator for commodities broadly."

The gold recovery that started late last year continues in 2023, James Steel, the chief precious metals analyst for HSBC Global Research, wrote in a Jan. 11 report. The falling value of the dollar and a perception that the U.S. Federal Reserve will end its tightening cycle in the first quarter will support gold in the coming year, the analyst added.

Steel predicts an average price of $1,843/oz for gold in the year, with a trading range of $1,675/oz to $2,005/oz. In its most recent Commodity Briefing Service report released in December 2022, S&P Global Commodity Insights projected that the 2023 gold price would average $1,794/oz over the year.

The COMEX gold price hit its highest close of the year at $2,043/oz on March 8, 2022, as investors sought a safe haven investment after Russia invaded Ukraine. The geopolitical uncertainty drove gold price dynamics early in the first quarter of the year. However, global monetary policy addressing inflation, particularly the Federal Reserve's actions, created a headwind for the market.

"As things start to settle, and we start to see the outcome of these rate rises, not only in the U.S. but globally ... we're going to start to see how gold will fit back into people's portfolio," Cavatoni said.

Throughout 2022, gold prices increased slightly — about a tenth of 1% — despite the rise in interest rates and a strengthening U.S. dollar, factors that typically pull gold prices downward. The strong finish was enabled by a sharp 14.8% increase starting late in the year, from $1,635/oz on Nov. 3, 2022, to $1,877/oz by Jan. 10.

"By some accounts, that was a very disappointing year, considering we had inflation surging to the highest level in 40 years," Malek said. "I would say it was actually a fantastic performance considering not only what happened in bonds and stocks, but also the jump we had in the dollar ... and we had a massive jump in real yields, which historically tends to be negative for gold."

While early performance has been strong for gold, Malek warns that January is when a lot of capital rushes back into the market, and that can present false market signals about the rest of the year.

"I think anyone investing in gold at these levels best considers that this is going to be a marathon, not a sprint," Malek said. "Be prepared for setbacks as we go along because the real drivers have not really yet played out."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.