S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

26 Feb, 2023

By Katherine Dela Cruz and Jason Woleben

Natural catastrophe-related losses will continue to be the largest risk to Japanese nonlife insurers' earnings in fiscal year 2023, though the effects of inflation are catching up.

"Inflation [in Japan] has been very low compared to overseas. However, the prices are going up, so we are watching whether the nonlife insurers can adjust premiums to absorb the impact," S&P Global Ratings director Toshiko Sekine said during a recent webinar.

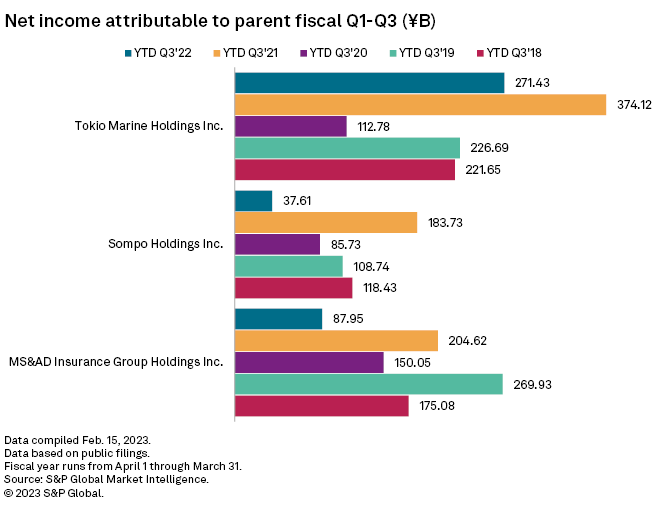

The three major domestic nonlife insurance groups in Japan — Tokio Marine Holdings Inc., MS&AD Insurance Group Holdings Inc. and Sompo Holdings Inc. — are forecast to record lower year-over-year earnings for fiscal 2022 following a weak performance through the fiscal year's first nine months.

While the pandemic's effect is expected to wane in fiscal 2023, the virus will drag on nonlife insurers' fiscal 2022 results, Sekine added.

Catastrophes, COVID-19 weigh on performance

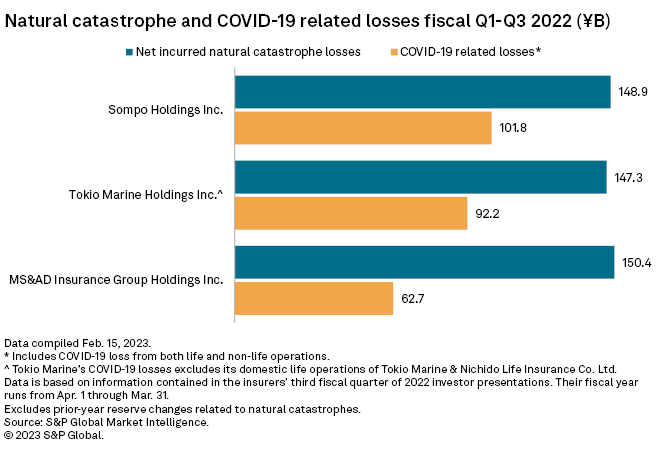

Tokio Marine, MS&AD and Sompo posted lower earnings for the nine months ended Dec. 31, 2022, as their local and overseas businesses struggled to deal with the twin effects of COVID-19 and natural disasters.

Tokio Marine's adjusted net income shrank by ¥145.1 billion year over year, while net incurred losses, before taxes, related to natural catastrophes climbed to ¥147.3 billion in the nine months ended Dec. 31, 2022, from ¥73.8 billion in the prior-year period.

Major catastrophes that affected Tokio Marine's domestic operations included typhoons Nanmadol and Talas, both of which brought torrential rain that led to flooding and mudslides in Japan. Gross incurred losses from those storm systems were about ¥53.4 billion. The insurer's international operations also felt the impact of Hurricane Ian in the U.S., bearing net incurred losses of ¥32.8 billion.

Tokio Marine's domestic non-life, domestic life and international segments all recorded COVID-19 losses so far in fiscal 2022.

MS&AD's adjusted profit fell by ¥194.8 billion to ¥81.2 billion year over year in the first three quarters of fiscal 2022. The insurer attributed the significant decline to natural catastrophes in Japan and abroad, as well as to pandemic-related losses at its domestic nonlife insurance companies.

Incurred losses from domestic natural catastrophes such as a June 2022 hailstorm and Nanmadol were ¥92.3 billion. Overseas natural catastrophes, including Ian, generated incurred losses of ¥58.1 billion for MS&AD.

Sompo also recorded a massive year-over-year decline in adjusted consolidated profit to ¥83.4 billion from ¥205.1 billion, partly due to the effect of natural catastrophes in Japan and COVID-19.

Projections unchanged

Tokio Marine did not change its latest projection of ¥400 billion adjusted net income for fiscal 2022. The insurer expects an upturn in profits from its overseas businesses and greater-than-expected gains on the sale of business-related equities to counter adverse development of COVID-19 losses in Taiwan and an increase in losses related to overseas natural catastrophes.

|

* Use Capital IQ Pro's screener to access financial data of various companies, including Japanese insurers. * Use this template for a quick review of select insurance metrics around the globe. |

Sompo's recent adjusted consolidated profit forecast for fiscal 2022 also remained at ¥160.0 billion on projected increases in profits from its overseas units, as well as group investment income.

MS&AD made no changes to its projection of ¥170 billion for fiscal 2022. The insurer disclosed in an earnings presentation that it expects an increase in natural catastrophe losses and COVID-19-related claims to affect the fiscal-year results of its domestic nonlife insurance business. For the overseas insurance subsidiaries, investment losses could also weigh on results.