S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

15 Feb, 2022

By Matt Smith and Rehan Ahmad

| Israeli soldiers use new high-tech weapons at the army's warfare training base. |

Israel's technology M&A boom may weather potential interest rate rises due to cash-rich buyers taking advantage of lower valuations and startups shunning IPOs amid market volatility.

Companies that listed before this year's tech stock slump are sitting on cash piles that could let them pick up bargains during a global tech sector sell-off caused by concerns about the value of future earnings. Investor unease may also encourage smaller companies to accept takeover offers rather than risk potentially rocky share listings.

"Lower multiples make it a good time to buy if you're a large enterprise or private equity firm with cash to invest," said Omry Ben David, general partner at Viola Ventures, the early-stage fund of Israeli venture capital firm Viola Group. More Israeli companies are likely to make acquisitions at home and abroad to expand, he said.

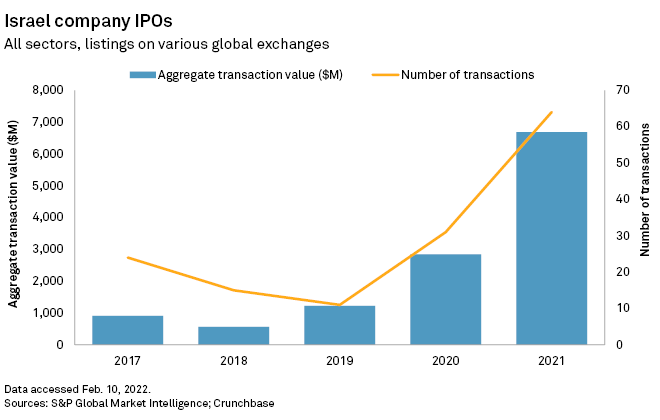

The chance to grab a bargain will help M&A volume hold near the $10 billion average of recent years, excluding mega deals, said Ben David, formerly an investment banker at The Goldman Sachs Group Inc. Israeli companies have money to spend, having raised at least $6.69 billion through IPOs in 2021 and several billion more in the preceding few years, according to data from S&P Global Market Intelligence and Crunchbase.

"Many Israeli companies went public at considerable valuations and that provided them with serious capital," said Yair Ephrati, head of investment banking at Israeli investment bank Value Base, which provides M&A advisory services. Slumps in their own shares may also spur businesses "to make acquisitions to grow quickly and help their stock rebound," Ephrati said.

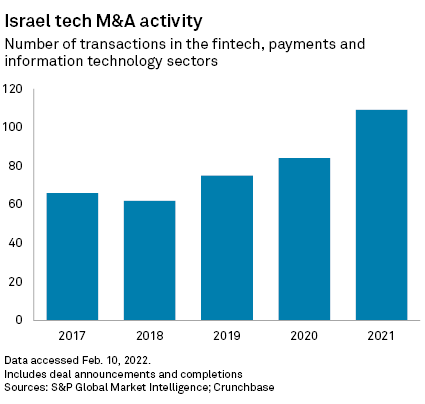

Israeli tech companies were involved in at least 109 mergers and acquisitions last year, up from 84 in 2020 and 75 in 2019. The largest 2021 deal for which Market Intelligence has figures was the acquisition of cybersecurity company XM Cyber Ltd. by German company Schwarz Unternehmenskommunikation for $700 million.

Investment banks can generate about $250 million to $500 million in fees from $10 billion of M&A, Ben David said. Israeli tech IPOs pay fees of about 5% to 7% of the money raised, he said.

Support for tech innovation

Israel has a vibrant tech sector, aided by strong state backing for research and military spending on developing sophisticated technology. The country trails only Singapore in terms of startup funding per capita, Crunchbase data shows.

This support helped fuel 64 IPOs last year, led by software company monday.com Ltd.'s listing on the Nasdaq exchange in the U.S. at a value of $630.9 million. The largest 2020 deal was mobile games developer Playtika Holding Corp.'s Nasdaq sale with a $2.16 billion transaction value.

Still, the IPO boom will ebb this year, as market risks will cause some companies to instead opt for late-stage investments, according to Andy Kaye, president of OurCrowd, an Israel-based venture investing platform that has invested in about 280 companies and 30 funds.

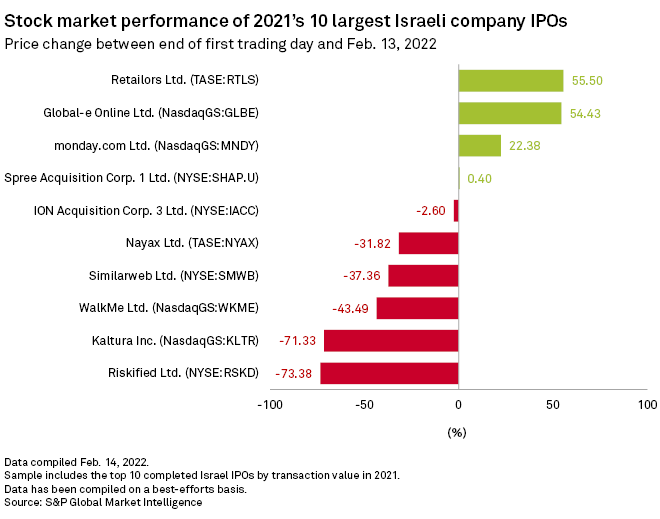

This likely slowdown is partly because concerns about inflation, increasingly tight monetary policy and slowing U.S. growth have hurt recent deals. Six of last year's 10 largest Israeli IPOs by transaction value have fallen since their first trading day. Nasdaq-traded software-as-a-service company Kaltura Inc. and NYSE-listed e-commerce risk management platform Riskified Ltd. have both suffered share slumps of more than 70% as of Feb. 13.

Companies will still seek to issue debt this year, and secondary equity issues may also be common, Value Base's Ephrati said.

"Debt issuance will continue to be very active well into 2022, with interest rates still very low," he said. "We expect some rate increases [in Israel] this year, but these will be more moderate than in the U.S." The U.S. is tapering quantitative easing and many market watchers expect the Federal Reserve to hike rates in March.

Investment banks expand

The broader growth in the Israeli tech sector is encouraging investment banks to expand in the country. Value Base doubled its banking staff in 2021, Ephrati said. Deutsche Bank has similarly grown its Israeli investment banking team, Reuters reported. Goldman Sachs is planning to double its local team, a senior executive told Bloomberg in January.

Major international banks have long been active in Israel, as they want to be close to technological innovation, Kaye said. Having a presence helps them find investments for international clients as well as work with local companies on exits and capital raising, he said.

U.S. banks, in particular, are looking to add to the list of Israeli companies trading on the Nasdaq and NYSE. IPOs in the U.S. require an American registered underwriter, and U.S. banks can also provide local execution capabilities as well as sales networks. These lenders are also seeking to help companies make acquisitions.

"These banks, and their European counterparts, are all active in Israel looking for deals," Ben David said. "The same is true for M&A."