S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

11 Feb, 2021

By Polo Rocha

For years, only a small number of banks and credit unions have been willing to offer their services to the cannabis industry, giving its cash-laden businesses a place to safely deposit their money without fear of a robbery.

But the number of institutions willing to do so appears to be growing. And now, those early adopters are moving beyond deposit services and slowly starting to offer loans to the cannabis industry — which has struggled to get access to credit even as more states legalize the drug.

Those efforts could get a boost from President Joe Biden's administration and the Democratic majority in Congress. Even if policymakers opt against legalizing the drug at the federal level, analysts say the banking industry may get the green light to offer services to cannabis companies in states where the drug is legal.

"Bankers are seeing clearly that there's a road map to providing services to these customers — and that we're not going backwards," said Tony Repanich, a former banker who is now president of Shield Compliance, a firm that helps institutions comply with the regulatory framework around cannabis banking.

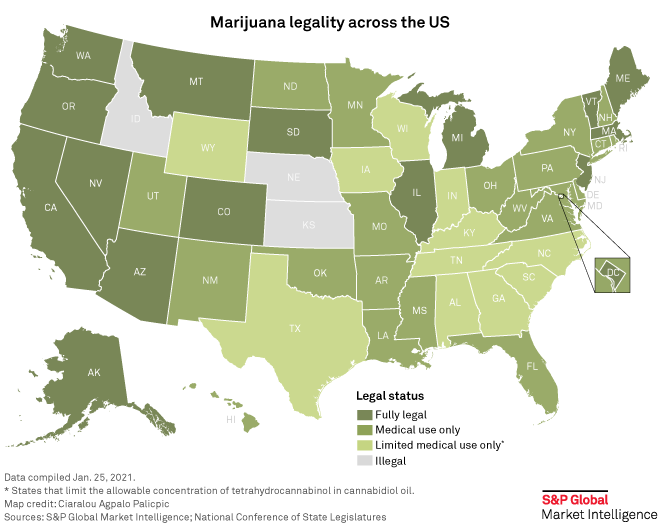

The interest is spreading beyond just smaller financial institutions. Wayne, N.J.-based Valley National Bancorp, a regional bank with more than $40 billion in assets, has launched a pilot program to accept deposits from a few larger corporate customers. It sees an opportunity to help multi-state operators manage their operations in compliance with different states' regulations by using software that verifies the legality of each transaction ahead of time. In New Jersey, for example, voters have approved the legalization of marijuana, but neighboring states have only legalized the drug for medical purposes.

Valley National decided to get into the space after a "pretty exhaustive due diligence process," said Chief Financial Services Officer Rick Kraemer. Its early efforts to understand how to work with the industry could also give it an advantage over banks that wait until federal regulations have been loosened to set up programs, he added.

"Having these rails around it right now and building this process now will only benefit us more when and if it becomes federally legal," Kraemer said.

'Stars are aligned' for cannabis banking clarity

Whether full legalization will happen under the new Biden administration is uncertain, but analysts and lawyers see a growing chance for at least some more legal clarity for banks. Lawmakers are pushing forward again with the SAFE Banking Act, a bipartisan bill that would prohibit federal bank regulators from penalizing institutions that offer services to legitimate marijuana businesses. The bill passed the House in 2019 on a 321-103 vote, but it did not get a vote in the Senate last session.

The "stars are aligned" for some type of clarity on cannabis banking, said John Geiringer, a partner at the law firm Barack Ferrazzano, who says he has talked to "banks of all sizes throughout the country" on the issue.

The number of institutions that provide services to marijuana-related businesses has mostly ticked up since 2014, according to the Financial Crimes Enforcement Network, or FinCEN. Regulatory filings from banks and credit unions indicated that 677 of them were banking marijuana-related businesses as of September 2020, FinCEN data show. While that is down from the start of the year, FinCEN says the dip could be due to the disruptions from the COVID-19 pandemic and institutions getting guidance from regulators on how to treat hemp-related activities.

But even if legal uncertainties with marijuana banking get resolved, it is unlikely that banks will rush to start offering their services. Banks will likely take their time to study any new rules and develop compliance regimes for what will continue to be a high-risk business, given the amount of cash involved, observers said.

Some banks may decide the additional compliance tied to marijuana is not worth the effort, said Laura Lee Stewart, president and CEO of Seattle-based community bank Sound Financial Bancorp Inc.

"You pick your markets and your strategies and look at how it works for you," said Stewart, whose bank is focusing on ancillary companies like equipment-makers or payroll companies that specialize in serving marijuana companies.

For now, the bank is limiting its services to accepting deposits from marijuana-related businesses. But it could eventually offer loans to those companies once it has more experience with the industry under its belt.

"They would be totally bankable businesses for us to lend to, and that's an important part of the business we're in," Stewart said. "We're in the business to make loans."

Early inroads into lending

A handful of institutions have started to offer loans to the industry, whose limited credit options often consist of high-interest-rate loans from nonbank lenders or investor cash infusions that dilute owners' equity in the business.

That explains why the "demand is huge" for any bank or credit union that looks to lend at more attractive interest rates, said Tina Sbrega, president and CEO of Gardner, Mass.-based GFA FCU. Sbrega's credit union launched a pilot program to offer loans to cannabis businesses — all secured by non-cannabis collateral like commercial real estate or equipment — but it has had to pass on some lending opportunities to keep the program small.

"The demand was much greater than what we even anticipated. It's been hard to … turn away people that you wish you could help," Sbrega said.

The credit union has structured its compliance program to mirror that of Arvada, Co.-based Partner Colorado CU, a cannabis banking pioneer that advises financial institutions on the issue through a division called Safe Harbor Private Banking.

Partner Colorado, whose cannabis-related deposits grew to $3 billion in 2020, has itself begun to make a few loans to the industry. Its loan program is starting with real estate but could later expand into equipment financing and lines of credit, said Partner Colorado CEO Sundie Seefried, who wrote a 2016 book on cannabis banking.

As with any loan, offering credit to a business carries the risk that it will not pay back the loan. But credit risks are heightened for marijuana companies, which face the prospect of a seizure of their property and assets if they run afoul of the law.

To compensate for that added risk, Partner Colorado is charging a somewhat higher interest rate on its loans to cannabis companies even as the industry continues to mature.

It also is limiting its loans only to cannabis businesses that it has worked with for years, given that their longstanding deposit relationship has given Partner Colorado the ability to track each transaction that brings cash in and out of the business.

"We know the business, we know the owners and we know the money," Seefried said. "That gives us a great deal of comfort because you have to think about forfeiture and seizure of property. If you don't have enough confidence and trust in the cannabis business, that they're not going to break the rules, you can find yourself with a bigger risk."