S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

5 Nov, 2021

| A large coal-carrying ship is loaded at a port. Canadian officials recently announced the country would phase out exports of coal to other countries by 2030. Source: dan_prat/E+ via Getty Images |

Canada's decision to phase out thermal coal exports by no later than 2030 received immediate pushback from Canadian coal miners and could close a key export path for U.S. producers.

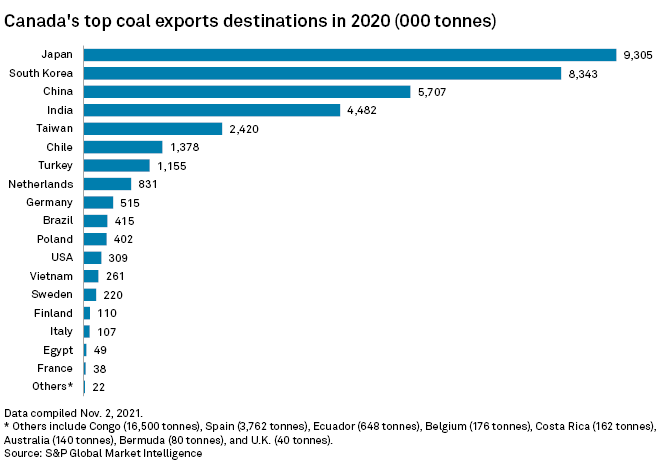

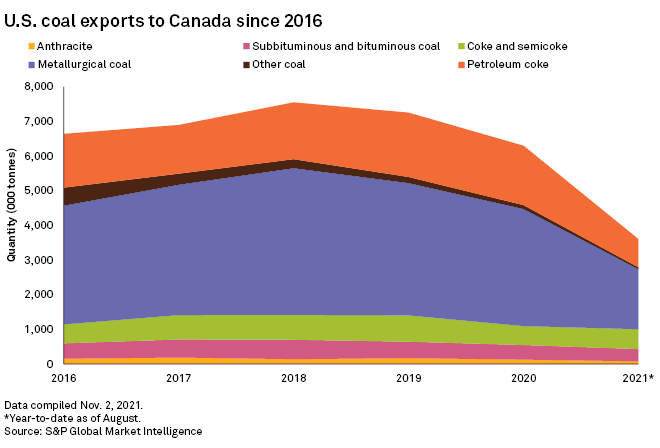

Prime Minister Justin Trudeau announced Nov. 1 the plan to ban exports of the coal used to generate electricity as global climate talks proceed in Glasgow, Scotland, saying that ending coal power emissions is one of the most important steps to fighting climate change. According to the International Energy Agency, Canada is the seventh-largest exporter of coal. Some U.S. coal producers, like those in Montana, have shipped coal into the country for export elsewhere.

"If this prime minister thinks that by reducing coal exports in Canada, you're going to reduce coal use around the world, he's sadly mistaken," Robin Campbell, president of the Coal Association of Canada, told S&P Global Market Intelligence. "Our producers that are in production right now can't keep up with the demand requests from different buyers around the world."

Canada, which has already committed to phasing out domestic coal plants by 2030, also announced $1 billion for the Climate Investment Funds Accelerated Coal Transition Investment Program. That program aims to help developing countries transition away from coal-fired electricity quickly.

"Climate action can't wait," Trudeau said in a statement.

Trade troubles

Campbell said that the government announced the ban without consulting industry or provinces that may have a stake in the policy, and that the announcement could also raise thorny issues around international trade. For example, western U.S. coal producers have few options for exporting coal, primarily due to environmental opposition to coal ports along the West Coast.

"This sets off a very sensitive political conversation in addition to the legal issues that arise from it," noted Clifford Sosnow, a lawyer and co-chair of the international trade and investment group with Fasken Martineau DuMoulin LLP. Sosnow said he is watching as to whether the ban will properly use international trading rules but had not yet seen analysis on how that might work.

"The truth is, this announcement is flying under the radar," Sosnow said. "For those that are interested in it, it's extremely important. It's going to have a significant local impact."

Few countries are likely to push back on Canada's policy announcement, Sosnow said. However, the attorney said he does not anticipate other large coal exporters will follow Canada in an outright ban on thermal coal exports. He noted that many countries are increasingly talking about carbon border adjustments that could impact the flow of coal, other fossil fuels and emissions-intensive products.

"I just see that it's part of that larger conversation about controlling borders, using taxes to ensure globally that countries adhere to their own climate change commitments," Sosnow said. "I just don't see that conversation going away now."

Canada's move may limit Montana coal

Whether or not the U.S. will challenge the policy may be largely dependent on whether Montana drives any action, Sosnow said. In recent years, companies have struggled to complete coal export facilities off the western coast of the U.S. Under the Biden administration, the U.S. government asked the U.S. Supreme Court to decline taking up a case filed by Montana and Wyoming involving the blocking of a permit for the Millennium Bulk Terminals-Longview LLC coal export facility in Washington.

Already, western U.S. coal producers have few options for exporting coal, largely due to local and environmental opposition to coal ports along the West Coast.

"The export opportunity? I would say the door is closed for us," said Travis Deti, executive director of the Wyoming Mining Association. "It's closed, but it's not locked."

Deti noted that while the economics for much of the Powder River Basin, including mines in Wyoming, do not pencil out for exports through Canada, there are coal operations in Montana that ship coal internationally through Canada.

Signal Peak Energy LLC exports over 95% of the thermal coal mined at its Montana mine abroad, according to the website of a company that markets its coal. The company uses the Westshore Terminals LP export facility located in Vancouver. Signal Peak's Bull Mountains Mine No. 1 produced 6.0 million tons of coal in 2020, according to U.S. Mine Safety and Health Administration data.

Signal Peak recently admitted to criminal charges of illegally disposing of mine waste and covering up employee injuries in a federal court. The company did not immediately respond to a request for comment on the Canadian policy.

The Navajo Transitional Energy Co. LLC, or NTEC, bought three Powder River Basin thermal coal mines from Cloud Peak Energy Inc.'s bankruptcy reorganization sale in 2019. Part of NTEC's marketing materials tout access to the international coal market through the Westshore Terminals. NTEC did not immediately respond to a request for comment.

Colorado-based Westmoreland Mining LLC also operates coal mines in Alberta and Saskatchewan. While many of its operations produce coal for use in Canada, its Coal Valley mine touts a nominal capacity of 3.0 million tons of annual production for thermal coal exports. Westmoreland also did not immediately return a request for comment.

Broader impact

The Institute for Energy Economics and Financial Analysis, or IEEFA, estimated that a coal export ban could lead to roughly 13 million tons of thermal coal being taken off the Pacific Rim export market, with much of that total coming from Montana mines. That organization estimated the decision was roughly the climate equivalent of taking between one million and three million cars off the road.

Many questions remain about how the policy will play out, including whether Canada will force companies to cancel existing contracts or only block new deals, said Clark Williams-Derry, an energy finance analyst with IEEFA. But, while the announcement has largely flown under the radar, taking that coal off the international market does move the needle on global emissions.

"You can make the case that it's actually from an environmental perspective, for a relatively minor policy, it has a pretty big impact," Derry said. "Especially interesting is that it could be precedent-setting."

Binnu Jeyakumar, director of clean energy at the Canadian nonprofit think tank Pembina Institute, said the announcement was a "major step forward for Canada" and an excellent example for other countries to follow. The policy, Jeyakumar said, sends a "clear signal to the coal mining industry with regards to their future investments and standards."

"I think we can have greater ambition and that [2030 target] can be accelerated," Jeyakumar said. "It's great for communities to have an advanced signal on how the industry is changing, and it allows them to come to the table to discuss transition plans and support them."

This story was amended on Nov. 8 to clarify that Travis Deti leads the Wyoming Mining Association.