S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

3 Nov, 2021

By Tom Jacobs

Private passenger auto insurance rates have idled in California since the early stages of the COVID-19 outbreak, a sharp contrast to the rest of the U.S.

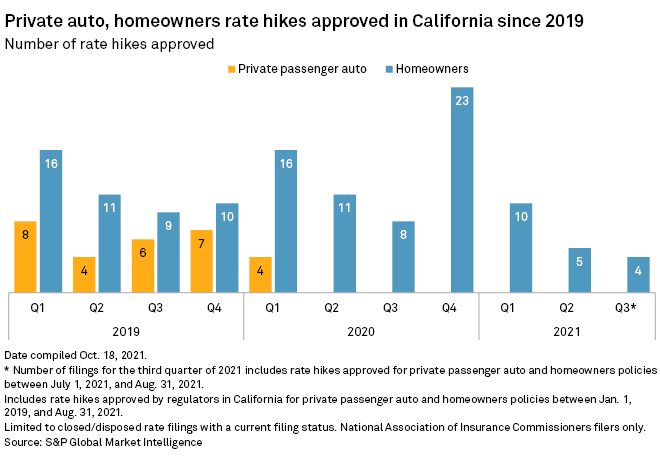

California approved 29 filings for private auto rate increases between January 2019 and March 2020, but none since April 2020, according to an S&P Global Market Intelligence analysis. Insurers submitted four requests for rate increases between April and August 2020, but none since. The reason for that pause, according to an emailed statement from the California Department of Insurance, is reduced driving activity due to the pandemic.

"We have not approved any pending [private passenger auto] overall rate increase requests as we are still not yet completely out of the woods with respect to COVID and the reduced driving impact it is having on [private passenger auto] insurance," the department said in a statement.

Considering his order directing insurers to refund personal auto premiums, Insurance Commissioner Ricardo Lara deemed it "inappropriate and unsupportable" to approve personal auto rate increases when consumers were driving much less, the regulator added. That differs from the state's approach to homeowners insurance rate requests, as well as to the actions of other states on auto rate.

Rate increases resume elsewhere

While California has stopped all private passenger auto rate hikes, regulators across the rest of the U.S. have given green lights to increases.

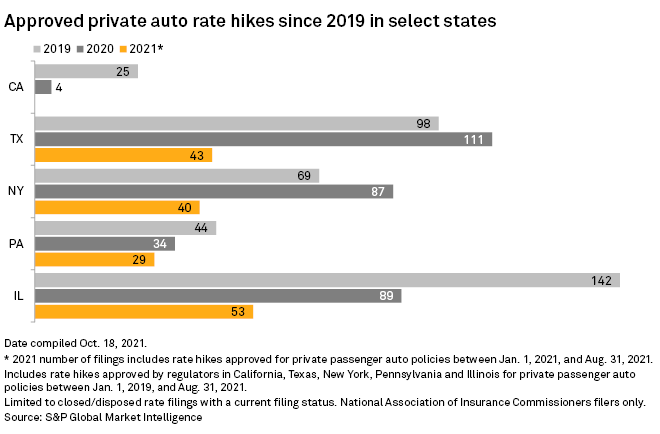

Texas has approved 108 rate hikes since April 2020, the most among the five states in the S&P Global Market Intelligence analysis. Illinois has approved 104 rate increase requests, followed by New York at 102 and Pennsylvania at 47.

California's insurance department in its email said rate systems in these other four states are not similar to that of the Golden State and stressed that no other state in the U.S. has the level of consumer protection built into its laws and regulations that California has under Proposition 103.

The American Property Casualty Insurance Association in an email statement noted that California, Texas and Pennsylvania all follow a "prior approval" regulatory scheme, meaning that rates must be approved by a regulator before they are used. Texas and Pennsylvania both have "deemer" provisions that automatically consider a filing to be approved after so many days. California, however, has an intervenor process in which there is consumer participation in the administrative process for setting insurance rates if they are deemed excessive or inadequate.

The emphasis on consumers has been evident throughout the pandemic. In April 2020, Lara told insurers to provide premium rebates to consumers and businesses because of reduced driving and "misclassifications" of personal auto risks stemming from COVID-19.

More pressure for rebates was brought to bear on Mercury General Corp., CSAA Insurance Exchange and Allstate Northbrook Indemnity Co. when Lara on Oct. 6 ordered the companies to provide additional reimbursements to drivers it says were charged excessive premiums at the pandemic's onset.

Homeowners hikes being approved in California

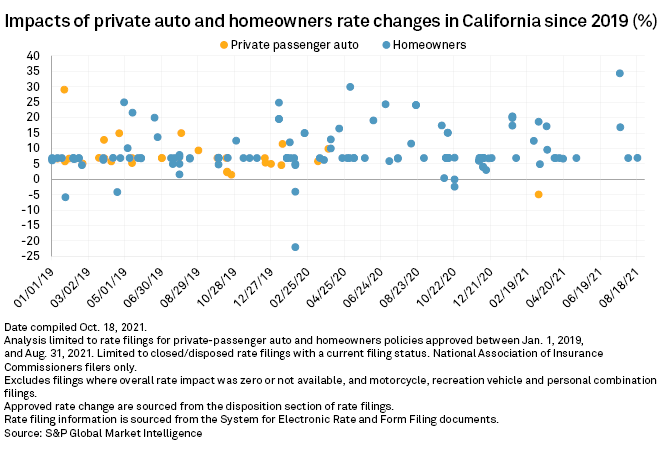

Even with auto rate hikes halted, insurers looking to raise homeowners rates have been able to do in California, as wildfire damage continues to be a major factor in the market. The state approved 58 homeowners rate increases in 2020, including 42 after mandatory stay-at-home orders were issued. There were 19 approvals in the first three quarters of 2021.

Though carriers have been able to boost homeowners rates, they remained concerned about the length of the process and the size of the increases, according to an industry observer who spoke on condition of anonymity.

There have been a large number of homeowners rate requests, and those requests are taken in the order they are received; what used to be a process that lasted five or six months in the past can now turn into a year-long wait, the observer said. The bigger problem, the observer said, is that companies have a huge rate need, but they only take 6.9% at a time. Requests that go over the 6.9% threshold can trigger the hearing process under Proposition 103, which can be lengthy.

Keefe Bruyette & Woods analyst Meyer Shields understands the state's concern about consumers not having insurance, especially in the face of recurring wildfires. But insurers see themselves as being saddled with undue exposure to catastrophes if they cannot charge an adequate rate, he said.

"Theoretically, [the regulator] could resolve all these problems by letting insurance companies charge what they want to, but then you'd have public backlash in terms of affordability," Shields said. "So, they really do look at this reality in two different ways."

That dilemma took center stage during Chubb Ltd.'s third-quarter earnings call when CEO Evan Greenberg said the company was reducing its homeowners insurance exposure in wildfire-prone areas of the Golden State because it cannot get sufficient rate increases to counter the risk.

"We cannot charge an adequate price for the risk and not by a small amount" because of decisions made by the state, Greenberg said.

Despite the difficulties that come with doing business in California, Shields said most insurers are content to play the game by the state's regulatory rules.

"The decision-making processes take forever, but we are talking about a huge state in terms of premium," Shields said. "So I think the industry will probably put up with a fair amount of pressure before completely walking away from the state."