S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

5 Jul, 2022

By Deza Mones and Cheska Lozano

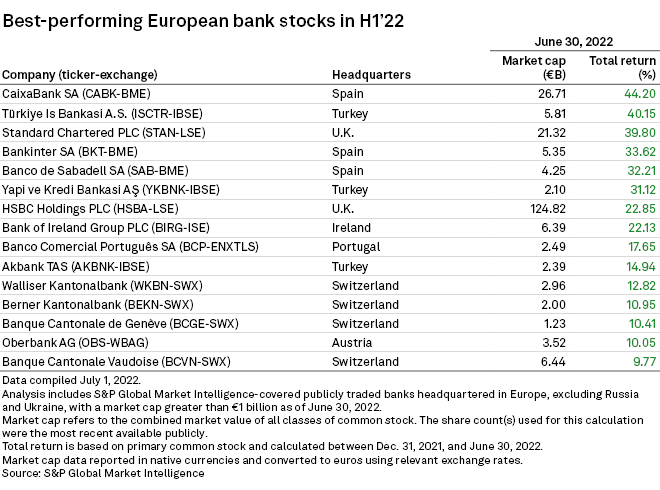

CaixaBank SA had the best-performing bank stock among large European banks in the first half of 2022 amid a turbulent backdrop of market volatility and macroeconomic pressures.

Spain's biggest domestic lender registered a share price return of 44.2% for the six months to June 30, S&P Global Market Intelligence data shows. CaixaBank and its Spanish peers have been among the hardest hit by ultra-low interest rates because of their reliance on net interest income, or NII. They are now poised for a boost in revenues due to the European Central Bank's impending return to positive rates.

CaixaBank recently outlined a three-year strategic plan anchored on rising rates and post-pandemic economic recovery. It aims to generate an extra €2 billion in NII and raise its return on tangible equity to 12% by 2024. The bank also plans to distribute around €9 billion to shareholders between 2022 and 2024.

Fellow Spanish lenders Bankinter SA and Banco de Sabadell SA were also among the top five performing bank stocks over the period, rising 33.6% and 32.2%, respectively.

War leaves its mark

Many of the worst-performing stocks in the half belonged to banks with exposure to Russia. Kaspi Bank JSC, which operates the largest payments system in Kazakhstan and is backed by Moscow-based private equity firm Baring Vostok Capital Partners Ltd., suffered the steepest share price decline, at 60.8%. Escalating sanctions on Russia due to the war in Ukraine have reverberated through neighboring Kazakhstan's economy and roiled its banking sector. Sberbank of Russia's Kazakh subsidiary was until recently the second-biggest bank by assets in the country.

Raiffeisen Bank International AG, the European bank with the largest exposure to Russia, has lost more than half of its value, declining 59.9% in the first six months. The Austrian bank is at risk of losing a third of its profits if it sells its Russian business.

Other banks with significant Russian exposures include Hungary's OTP Bank Nyrt., Italy's UniCredit SpA

* Access financial highlights for CaixaBank on the CapIQPro platform.

* Access indexes including regional bank indexes on the CapIQPro platform.

OTP Bank was driven to a first-quarter loss by a 149% jump in total risk costs on provisions booked for its Russian and Ukrainian operations. Adding to the bank's headache is the planned windfall tax on banks in Hungary, which the lender said would cost it 78.3 billion forints in 2022 alone.

SocGen recently closed the sale of its Russian unit at a loss of roughly €3.1 billion, while UniCredit has "limited opportunities" to reduce its Russian exposure but continues to look at potential options "at the right conditions," CFO Stefano Porro recently told Reuters.

In Poland, the government's new mortgage borrowers support scheme has weighed on the country's lenders. PKO Bank Polski SA and Bank Polska Kasa Opieki SA registered share price declines of 38.7% and 34.6%, respectively, in a reversal of the gains recorded in 2021.

US banks suffer

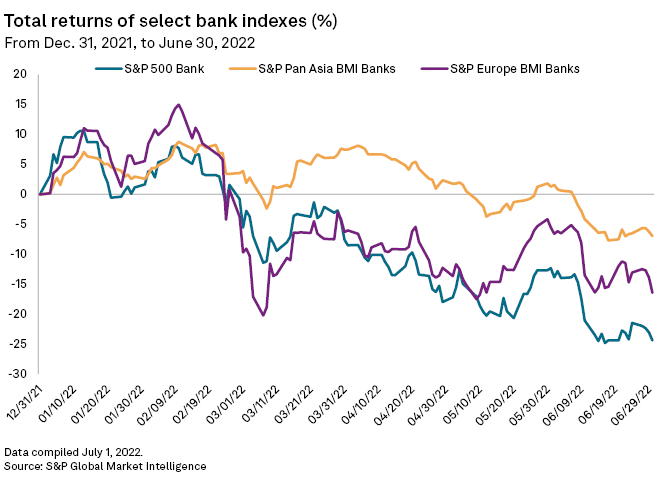

Overall, European bank stocks are yet to rebound to their pre-Ukraine war levels but have still outperformed their U.S. counterparts. The S&P Europe BMI Banks index fell 16.4%, compared to 24.4% for the U.S.-based S&P 500 Bank index. Stocks of Asian banks generated a negative return of 7.0%.

The trend is consistent with movements in broader indexes. The S&P 500 has fallen 20.3% year-to-date, compared to a 3.5% drop in the FTSE 100, 16.4% in the Eurostoxx 600 and 6.2% in the Hang Seng Index.