S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Sep, 2022

Difficult market and regulatory conditions are likely to keep investors waiting into next year for Hong Kong listings from several Big Tech companies in China, including TikTok Inc. parent Beijing ByteDance Telecommunications Co. Ltd. and Alipay operator Ant Group Co. Ltd.

Regulatory crackdowns in both China and the U.S. indefinitely delayed public listing plans for ByteDance and Ant Group. A steep drop in valuation following an initial public offering for AI company SenseTime Group Inc., which moved forward with its Hong Kong listing in December 2021 despite the U.S. government's decision to block American investment in the company, offers a cautionary example for companies that might wish to push forward amid the uncertainty. Additionally, China's tech sector overall saw a sharp correction in valuations in the first half of this year.

"The sentiment that a new listing can produce the desired outcome of letting early investors book profits is not encouraging at the moment," said Kunal Sawhney, CEO of Kalkine Group, an Australia-based equity research firm.

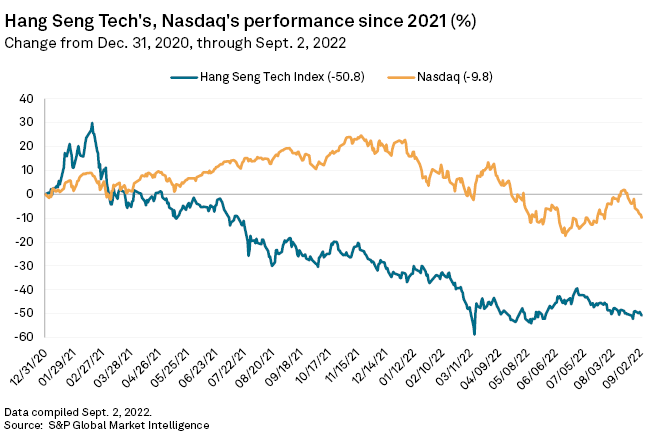

The Hang Seng Tech Index, which represents 30 of the largest technology companies listed in Hong Kong, had fallen 50.8% over the 20 months through Sept. 2. The index includes China's Big Tech companies Tencent Holdings Ltd., Alibaba Group Holding Ltd., Xiaomi Corp., JD.com Inc. and SenseTime Group Inc.

In comparison, the much larger Nasdaq Composite Index, which includes many U.S.-based Big Tech companies, was down 9.8% over the same period.

"Given that the recent rounds of corrections have meant that technology, media and telecommunications stocks no longer trade at a valuation of a growth stock, the market environment looks patchy for new companies looking to list," said Eva Lee, head of Greater China Equities at UBS Global Wealth Management CIO.

Proceeds from Hong Kong's TMT IPOs plunged 97% year over year to $220 million in the first half of 2022, with only two TMT companies going public, according to data from S&P Global Market Intelligence. Weak stock market sentiment and workforce disruptions related to fresh lockdown restrictions following COVID-19 outbreaks in different parts of China contributed to the muted activity.

Investors backing technology companies in Hong Kong or China are no longer chasing high earnings ratios and long paths to profitability, making it challenging to find investors willing to pay the valuation issuers are looking for, said Louis Lau, a partner at KPMG China's capital markets advisory group.

"We are in a different environment in 2022 with geopolitical tensions, inflation and interest rate hikes, and so investors' appetites have changed. Those uncertainties will remain this year — this is evidenced from the first half of 2022 IPOs in Hong Kong," Lau said.

ByteDance, Ant IPO uncertainties

In addition to the broader market headwinds, a potential ByteDance listing faces challenges due to the ongoing U.S.-China tensions and a U.S. government investigation into data management practices at ByteDance-owned social media platform TikTok.

If market conditions improve, there is a chance that ByteDance will go ahead with its IPO early next year, said Ke Yan, head of research at small and mid-cap specialist, DZT Research.

"Even though its valuation is dropping, the company's best bet is to list when there is a good window and get liquidity so financing will be much easier going forward," Yan said.

Chinese financial technology company Ant Group will also be better off waiting for better market conditions before it revives its IPO, analysts said. The company's planned listing was suspended in November 2020 amid a broader regulatory crackdown on Chinese tech groups that included fines for alleged monopolistic practices at Alibaba and the U.S. delisting of ride-hailing app DiDi Global Inc.

Alibaba in recent months began to separate itself from Ant, including by having Ant Group executives step down from roles with Alibaba. The separation is related to easing regulatory concerns in China, according to a July 26 CNBC report.

Dual listings

While Hong Kong may not see fresh TMT listings, market experts say so-called homecoming IPOs will remain popular as a means to hedge any risk of Chinese companies being delisted in the U.S. Homecoming listings refer to U.S.-listed Chinese companies that pursue secondary or dual-primary listings in Hong Kong.

Hong Kong saw a string of such listings in 2020 and 2021, including Weibo Corp., Baidu Inc., JD.com and NetEase Inc.

Chinese e-commerce giant Alibaba is among those that recently applied for a dual-primary listing in Hong Kong. UBS' Lee expects more companies to seek dual-primary listings.

"The rest of the year will be dominated by existing TMT companies seeking dual-primary listings — particularly if they have not done a dual-secondary listing," Lee said.