S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Mar, 2023

By Yizhu Wang and Thomas Mason

Buy-now, pay-later platforms are growing their appetite to offer interest-bearing loans, a traditional consumer credit segment they had competed against.

Relying on fees paid by merchants, instead of charging consumers interest, has been one of the few financial features that distinguish buy now, pay later, or BNPL, from other established consumer credit products, such as credit cards and point-of-sale financing. But as rising funding costs bite into the margins of interest-free BNPL products, leading players in the segment are increasingly leaning on interest-bearing loans.

"I think the way that we would characterize buy now, pay later is that their objective is more so a disruption of credit," said Nicholas Lucas, a financial technology equity research associate at Mizuho Securities. "It's interesting that they're changing to being more installment loan originators because those products have existed for a long time."

During the quarter ended Dec. 31, 2022, 67% of loans originated on Affirm Holdings Inc.'s platform were interest-bearing, after a steady expansion through 2022. In June 2022, PayPal Holdings Inc. launched Pay Monthly, an interest-bearing product issued by WebBank, as part of its BNPL portfolio.

BNPL platforms are likely to lean harder on interest-bearing loans than interest-free loans in 2023 as fintech firms and their bank partners try to take advantage of higher rates to drive interest income. Affirm expects to focus on interest-bearing loans more than interest-free loans in 2023, founder and CEO Max Levchin said on a February earnings call.

"The very, very thin lines between BNPL and traditional credit have become even less evident, as the sectors are blurring together," said Ryan Gilbert, founder of fintech-focused venture capital firm Launchpad Capital.

Making interest-bearing loans

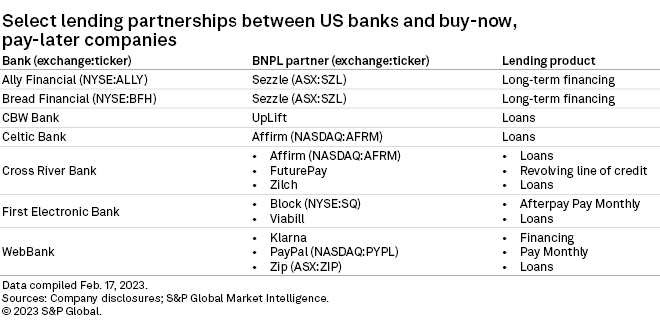

Nearly all leading BNPL players use sponsor banks to originate interest-bearing loans.

Banks involved in the segment include Ally Financial Inc.; Bread Financial Holdings Inc., which owns Comenity Bank; CBW Bank; Celtic Bank Corp.; Cross River Bank; First Electronic Bank and WebBank, according to S&P Global Market Intelligence data.

The interest-bearing segment is where the banks are most focused. Providers of interest-free Pay in 4 loans have faced "almost a perfect storm" of challenges in the current market, including higher loss rates, higher funding costs and greater competition, said Ralph Andretta, CEO of consumer lender Bread Financial. Bread, through its subsidiary Comenity Bank, originates loans for BNPL platform Sezzle Inc.

"If you think about buy now, pay later, it's really two products. You have the Pay in 4 product and you have installment loans," Andretta said at a conference Feb. 15. "The installment loan part of buy now, pay later is what we view as an opportunity to grow."

A larger proportion of interest-bearing loans will put the BNPL platforms under tighter regulatory scrutiny, since there are rules and regulations to cap interest rates and to ensure sufficient disclosures to consumers, said Stephen Biggar, director of financial services research at Argus Research.

"Once you start charging interest, it moves you into a whole new category of oversight," Biggar said in an interview.

Rebalancing funding sources

Rising interest rates and recessionary fears have created a challenging environment for digital lenders, and some BNPL platforms are looking to rebalance their funding sources.

With interest-free products, BNPL platforms draw on their warehouse facilities to fund consumer notes receivables and charge merchants a commission fee of around 6% of the value of goods sold. They also seek funding by selling the receivables as asset-backed securities and taking the loans off the balance sheet by having partner banks originate loans.

The cost of the warehouse facilities funding on-balance-sheet loans has been rising dramatically. According to Sezzle, the weighted average interest on its revolving credit facility was 9.12% as of Sept. 30, 2022, up from 5.25% as of Dec. 31, 2021.

Unloading some loans from the balance sheet to external funding partners could help lower platforms' average funding costs. For the first time, PayPal said it is looking to secure a funding partner to "externalize" a significant proportion of its BNPL loan books in 2023, according to its latest earnings call in February. Affirm is also searching for new bank partners to originate loans, a February filing shows.

BNPL players often use sponsor banks as a source of funding off balance sheet, and the amount and pricing of loans taken over by banks are usually predetermined in an agreement up-front, Mizuho's Lucas said. As a result, fintech firms do not have to carry credit risk, and the funding flow is more stable.

Warehouse facilities tend to have the highest cost compared to other funding sources, while selling the receivables as asset-backed securities is generally cheaper but more volatile and risky, depending on investors' sentiment, Lucas said. Affirm's on-balance sheet books include the capital drawn from its credit facility and loans sold as asset-backed securities, which accounted for 43.87% of its total funding as of Dec. 31, 2022.

"If there's anything that makes investors, including myself, nervous on Affirm, that's the funding sources," said Christopher Brendler, managing director at D.A. Davidson. The conditions around funding sources are sensitive to macroeconomic dynamics and will be a big focus for Affirm in 2023, Brendler said.

Competition remains fierce

Despite the headwinds, the market still appreciates the merits of BNPL, especially the way platforms embed financial services into e-commerce sites. Embedded finance continues to draw interest from banks and technology companies, industry experts said.

Fintech vendor Jifiti.com Inc., which helps banks launch BNPL and point-of-sale financing offerings, added eight bank clients in the past year, with those products weighted slightly toward interest-bearing loans with longer durations, CEO Yaacov Martin said. Banks are also applying the concept of embedded finance into business lending, while the fintech BNPL players mainly focus on consumer lending, the executive noted.

Another new entrant, SoFi Technologies Inc., announced in December that it plans to roll out a BNPL feature, becoming the first bank in the U.S. to launch a product using a BNPL program designed for banks from Mastercard Inc.

Apple Inc. is another "800-pound gorilla in the room," with the technology giant planning to launch Apple Pay Later, said Nelson Chu, founder and CEO at fintech company Percent.

"They are still learning, and they're walking before they run. But I think in general Apple Pay, from an ease of use standpoint, is a fantastic addition," Chu said.