S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Nov, 2021

By Camille Erickson

|

|

A mothballed uranium mine sits in the middle of the Utah desert Oct. 27, 2017, outside Ticaboo, Utah. North American uranium producers have responded to the spike in uranium spot prices with cautious optimism, hoping longer-term contracts from nuclear power utilities follow. |

Uranium producers say nuclear utilities have begun exploring long-term contracts now that a Canadian uranium fund has slurped up much of the excess supply in the spot market.

Yellowcake prices have been low for over a decade since the Fukushima Daiichi

Sprott's moves, along with a renewed interest in nuclear power by world governments seeking to reduce their emissions, seem to be motivating utilities to knock on the doors of uranium producers for supply.

"We're seeing a lot more interest from utilities right now because they have more competition," said Curtis Moore, vice president of marketing and corporate development at Energy Fuels Inc., the largest uranium producer in the U.S. "I wouldn't say they're running out, willing to sign long-term contracts at any price. I'd say they're still just dipping their toes into it. They're able to withstand some of these market shocks through inventories, but their inventories are sort of finite."

The outlook for nuclear power has been grim for a decade. The U.S. Energy Information Administration forecasts nuclear energy to make up 20% of the country's electricity generation in 2021 and 2022, slipping from 21% in 2020, and it expects a long-term decline in the power source.

However, in the wake of climate talks in Scotland in November, developed nations such as Japan, France and Canada have announced plans to increase their nuclear fleets to produce carbon-free electricity.

"Demand for nuclear is expected to grow globally and uranium is a key feed for that," said Sid Rajeev, vice president and head of research at Fundamental Research Corp. "We are very bullish on uranium."

Sprott gets in the game

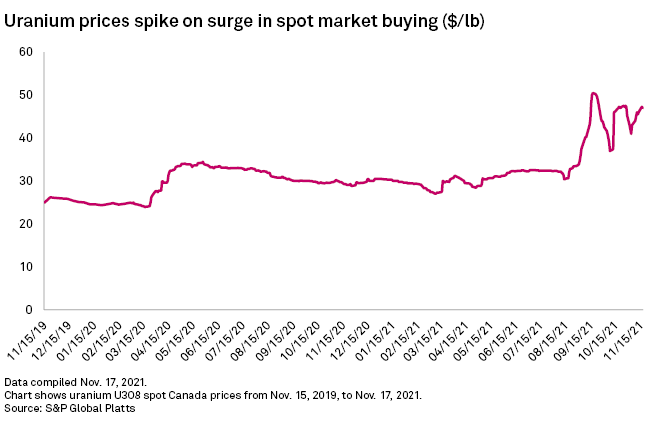

Sprott in July completed its acquisition of the uranium holding company Uranium Participation Corp. and debuted a trust dedicated to buying and holding uranium from the spot market. Uranium prices shook off a monthslong price slump and rallied to this year's peak high of $50/lb in mid-September. Uranium prices have hovered above $44/lb in November, reaching $47/lb at 1 p.m. on Nov. 17, an approximately 60.4% increase year over year, according to S&P Global Platts data.

Sprott did not respond to a request for comment.

As of Nov. 18, Sprott's trust was valued at $1.96 billion and held a massive 39.6 million pounds of U3O8, a form of uranium. That is more than the 2020 attributable production of the world's largest uranium producer, state-owned company JSC National Atomic Co. Kazatomprom in the Republic of Kazakhstan. Meanwhile, demand from financial investors and uranium producers has been gaining momentum amid the tightening market.

Many uranium companies have responded to the bull run with cautious optimism, underscoring the benefits of greater liquidity and meatier prices while hoping more stable demand from nuclear reactors will follow.

"What's happened is it's significantly tightened up the spot market," Energy Fuels' Moore said of Sprott's buying activity. "Traders and utilities have depended on quite a bit of liquidity and availability of physical uranium in the spot market over the last several years. Now they can't depend on it."

A rising tide

Executives from Canadian uranium miner Cameco Corp. welcomed the new financial entrant, seeing liquidity and higher prices as positives for its business. During an Oct. 29 earnings call, Cameco President and CEO Timothy Gitzel said the recent shifts could set the stage for more utility-driven, long-term contracts, replacing some of the rampant, uncommitted primary supply purchases on the spot market.

"We are beginning to see utility interest in on-market contract activity as their [utilities] shift to securing material for their uncovered requirements, which has resulted in an increase of almost 28% in the long-term price since the end of June as well," Gitzel said.

Cameco reported placing more than 20 million pounds of U3O8 under long-term contracts year-to-date, according to third-quarter financial documents filed on Oct. 29. The company added 12.5 million pounds in the form of long-term contracts to its portfolio in 2020. Cameco did not immediately respond to a request for comment.

David Cates, president and CEO of uranium exploration and development company Denison Mines Corp., also emphasized the growing interest from utilities in need of a more secure supply stream.

"With increased interest in the uranium market and a recent lift in both spot and long-term uranium prices, we are encouraged that future utility customers are returning to the market," Cates said in a Nov. 4 statement.

Nuclear utilities have acknowledged paying close attention to Sprott's activities, but their trade association is not expressing any concern that rising prices will harm their business prospects.

"The recent impact of new market entrants and associated price increases do not pose immediate concerns with access to uranium," said Nima Ashkeboussi, senior director of fuel and radiation safety at the Nuclear Energy Institute, a U.S.-based trade association representing nuclear power utilities. "Utilities are continuing to assess these trends and they may or may not make changes to their procurement strategies based on several factors, including when they need uranium and the inventories on hand."

S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.