S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

30 Dec, 2022

By Alex Graf and Zuhaib Gull

Banks' mortgage-related fee income will remain challenged in 2023 as the lending segment continues to face headwinds, but the challenging environment also presents M&A and talent acquisition opportunities for banks to bulk up ahead of the next up-cycle, according to industry experts.

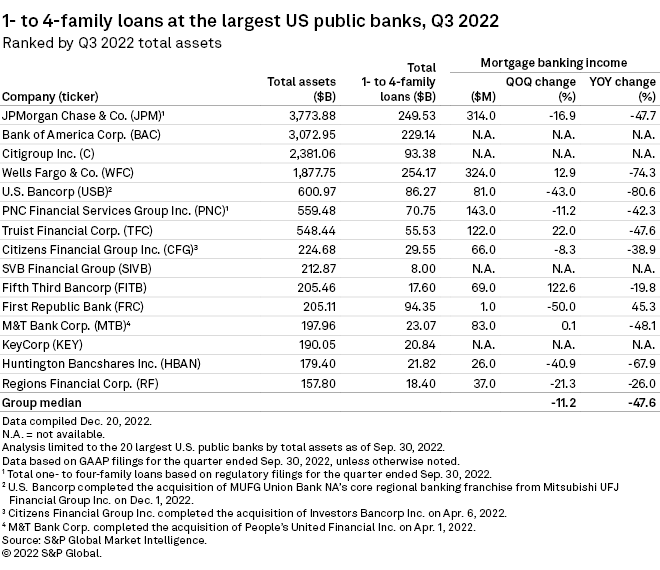

Of the 15 largest public banks by total assets as of Sept. 30, seven reported quarter-over-quarter declines in mortgage banking income from one- to-four family loans in the third quarter and 10 saw a year-over-year decline, according to S&P Global Market Intelligence data. The group saw a median decline of 11.2% quarter over quarter and 47.6% year over year.

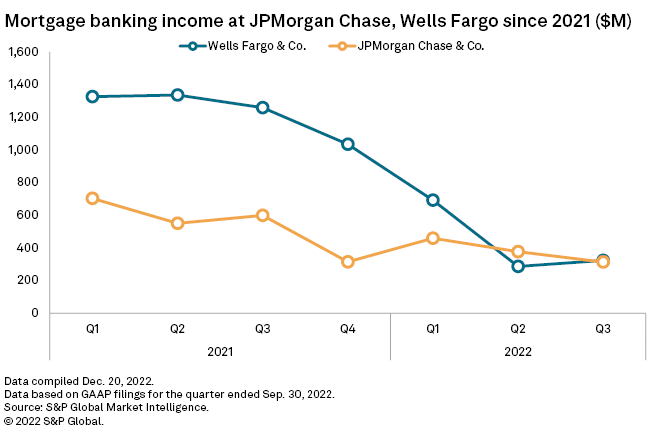

Some of the largest drops in mortgage fee income came from Wells Fargo & Co. and JPMorgan Chase & Co. Wells Fargo reported mortgage banking income of $324 million in the third quarter, down from $1.3 billion in the first quarter of 2021, while JPMorgan reported $314 million in the third quarter, down from $704 million in the first quarter of 2021.

With very little refinance and homebuying activity due to high home prices and mortgage rates, the current mortgage market is very difficult, Jeff Davis, managing director of Mercer Capital, said in an interview.

"Call it somewhere between very tough and brutal," Davis said. "I t's just such a cyclical business. And when it's good, it's really good. And when it's bad, it's really awful."

Other business lines, low delinquencies a silver lining for banks

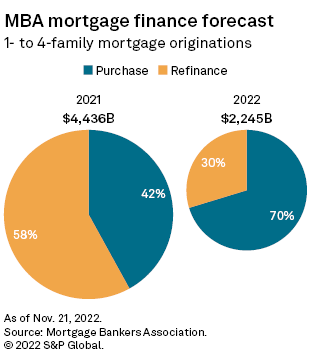

Overall mortgage originations will total around $2.245 trillion by the end of 2022, down from $4.436 trillion in 2021, according to the Mortgage Bankers Association, or MBA, mortgage finance forecast.

The association expects the environment to be even more challenged in 2023, predicting just $1.899 trillion in total mortgage originations for the whole year.

Housing affordability and inventory issues are compounding with rising rates to create a "perfect storm" that has discouraged many borrowers from buying homes, Marina Walsh, the MBA's vice president of industry analysis, said in an interview. But there is some silver lining for banks with mortgage exposure, industry experts said.

Luckily for banks, they have other sources of income, unlike independent mortgage companies which are more "one-trick" ponies, Davis said.

"[Banks] have other sources of revenue. They have their deposits, they have their credit cards, other lines of business, other consumer loans so there's a little bit more flexibility. So whereas they may be unprofitable in mortgage, they may have the option to make up for some of that loss in other areas of the business," Walsh said. "That is not the case with independent mortgage companies."

Another bright spot for banks is the current historic-low level of delinquencies. T he MBA's mortgage delinquency survey, which it has conducted since 1979, hit a new low of 3.45% in the third quarter, Walsh said.

The low level of delinquencies benefits banks by keeping the costly work of managing loan modifications and foreclosures at a minimum. However, if a widely expected recession hits, delinquencies are unlikely to stay low, Walsh said.

"T hat could mean unemployment is going to go up a little bit and we could potentially see increases in delinquencies," Walsh said.

Still, Walsh emphasized that a potential recession in 2023 will not come near the delinquency or unemployment levels of the Great Depression given that many homeowners have plenty of equity and a low mortgage rate if they did not buy within the last year.

Mortgage M&A opportunities

Because of the volatility of the mortgage market, Davis does not expect most banks to be especially interested in acquiring mortgage-focused businesses, especially if mortgage rates hold steady.

But the current low valuations for nonbank mortgage originators present an M&A opportunity for banks willing to take on the risk, Performance Trust Capital Partners managing director Will Brackett said in an interview.

"F ee income is extremely valuable to banks," Brackett said. " T he diversification of the earnings stream, the diversification of credit, et cetera, makes the business line also very valuable to a lot of banks."

New York Community Bancorp Inc. announced its acquisition of the mortgage-heavy Flagstar Bancorp Inc. in April 2021 while the mortgage cycle was still hot, and despite regulatory delays that pushed closing to December 2022 and into a vastly different mortgage market, the companies maintained the strategic and financial advantages of the transaction.

The combined company is prepared "to take full advantage of the next refinancing market, which will come," Flagstar's former President and CEO Alessandro DiNello said in October on New York Community's third-quarter earnings call.

Another area of the mortgaging industry that may be attractive to potential buyers is servicing rights.

Servicing rights, which entitle mortgage companies to monthly fees based on principal balance in exchange for collecting mortgage payments, bookkeeping and interacting with borrowers, becomes increasingly attractive and scarce in the secondary market when mortgage rates go up and acquiring those companies becomes more competitive as a result, said Bill Jones, the senior vice president of Community Capital Advisors, in an interview.

PNC Financial Services Group Inc. struck such a deal with its purchase of SecurityNational Mortgage Co.'s mortgage servicing rights in October.

Talent acquisition opportunities

To adjust for rate cycles, banks and mortgage lenders flex the size of their mortgage business up and down to take advantage in times of prosperity and avoid cost center drags when volumes are low, Brackett said.

Layoffs are one way that banks and mortgage companies are flexing down in the current downturn, and the MBA estimates the industry will need to significantly reduce employment in order to right size following the drop-off in originations, Walsh said.

"Our estimate is a 25% to 30% decrease in mortgage employment from peak to trough and we haven't nearly squeezed out all the capacity that we need to," Walsh said.

This period of layoffs could present an opportunity for banks, Brackett said.

"W hen you get some displacement, it becomes a good opportunity for banks to begin to build mortgage groups or restructure mortgage groups for sort of the next cycle of higher volume," Brackett said.