S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

2 Nov, 2022

The broad U.S. stock market climbed in October after months of declines.

While inflation remained high, stocks began to rally in October in the hope that the Federal Reserve would start to pivot away from aggressive interest-rate hiking in December.

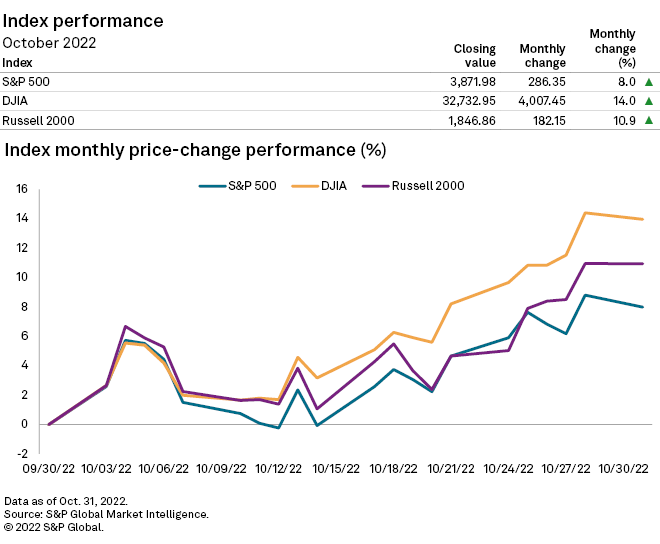

The S&P 500 finished the month up 8.0%, while the Dow Jones Industrial Average rose 14.0%. Similarly, the smaller-cap-focused Russell 2000 closed the month up 10.9%.

Sector performance

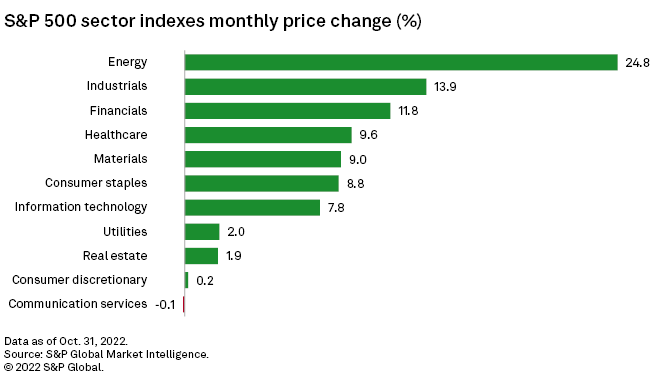

All but one of the S&P 500 sector indexes logged an increase in share prices in October.

The energy sector index recorded the largest increase, up 24.8%, while the industrials and financials sectors followed next, up 13.9% and 11.8%, respectively.

On the other end, the communication services sector index was the sole index to finish the month in the red, down a very slight 0.1%.

Largest gains, drops

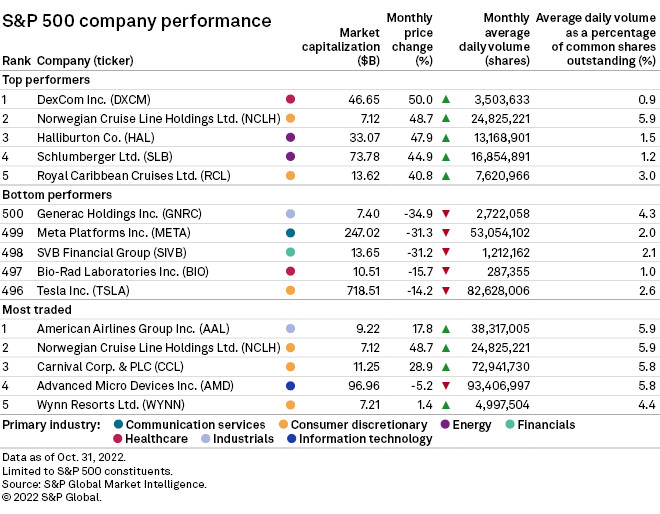

Among the S&P 500 constituents, DexCom Inc. recorded the largest share-price increase in October, up 50.0%. The medical device company's share price spiked Oct. 28 after reporting that third-quarter revenue and earnings beat expectations and that it increased its revenue guidance for the 2022 fiscal year.

Cruise line company Norwegian Cruise Line Holdings Ltd. placed second, up 48.7% in October, while energy-focused Halliburton Co. ranked third, up 47.9%

* Click here to set email alerts for future Data Dispatch articles.

* For further global market analysis, try the Market View Excel template.

Conversely, Generac Holdings Inc., a company focused on power generation equipment and energy storage systems, logged the largest drop in its share price in October, down 34.9%.

Meta Platforms Inc. and SVB Financial Group followed next, with share-price drops of 31.3% and 31.2%, respectively.

American Airlines Group Inc. was the most-traded stock in the S&P 500 in October, with an average daily volume of more than 38 million, or roughly 5.9% of its shares outstanding.