S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Jun, 2021

By Etain Lavelle

The British like to boast about their home-grown biotechs, although they are less keen to discuss why many of those companies skip London exchanges and engage in IPOs in the U.S.

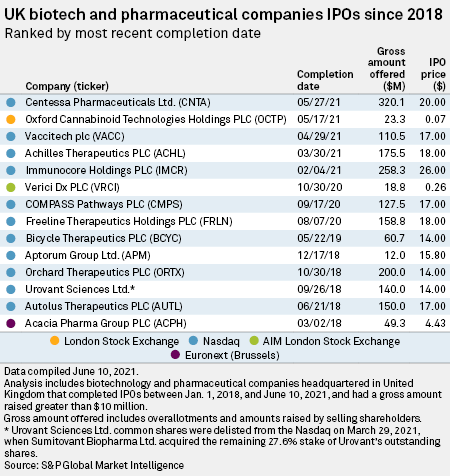

For example, Vaccitech PLC, which sprang up from an Oxford University lab, chose Nasdaq when the company was ready to tap public markets for the first time. The company, which played a key role in developing one of the COVID-19 vaccines, joined a string of its peers, including Autolus Therapeutics PLC, on the U.S. exchange in April. Centessa Pharmaceuticals Ltd. soon followed.

Many British companies are opting to list in the U.S. to skirt the U.K.'s onerous listing requirements and tap into the U.S. market's welter of specialist healthcare investment funds, according to industry specialists. They made another key observation: U.K. investors are more risk-averse than their U.S. counterparts and lack the expertise to gauge the potential pitfalls involved in drug development.

For Vaccitech — trading up almost 10% year-to-date at $15.45 — the $110 million IPO marked the culmination of two decades of research into coronaviruses by Oxford University professors Sarah Gilbert and Adrian Hill. They co-founded the company, which is best known for developing the AstraZeneca PLC COVID-19 vaccine. Gilbert and Hill were both recognized by Queen Elizabeth II on June 11 in her annual birthday honors for their scientific achievements, highlighting their contribution to keeping the country at the forefront of innovation after Brexit.

When it came to choosing Nasdaq, Vaccitech CFO Georgy Egorov said the company wanted to be on an exchange with many other biotechs and liked the fact that American investors understand the company's platform better.

"At the end of the day, while the U.K. is absolutely phenomenal in the very deep capital markets, the U.S. unfortunately still has a slightly higher number of biotech specialists [investors]," Egorov said in an interview.

|

U.K. biotechs listing on Nasdaq benefit from a pool of analysts and investors well versed in the high costs of clinical trials required for the approval of any experimental molecule, many of which fail in the early stages of drug development. Even though plenty of science-based companies are keen to remain a U.K. or a European story, the potential to raise such large amounts of capital on the Nasdaq is too great a draw when compared with AIM — the London Stock Exchange's Alternative Investment Market.

Since 2018, 22 European biotech and pharmaceutical companies have opted for Nasdaq or the New York Stock Exchange, compared with 13 on European exchanges. In 2021, more than three dozen U.S. companies in these two sectors have IPO'd, compared with five U.K. companies.

While there is U.K. interest in biotech at the venture capital stage, many companies still turn to U.S. markets when it is time to go public. The Bio Industry Association highlighted that 2020 was on course to surpass 2018 as the strongest year on record for overall sector financing in the U.K., with a total of £744 million of new venture capital funding secured. At the same time, British biotech IPOs on North American exchanges raised £119 million in 2020.

Experimental biotechs need major funding to perform critical research. In oncology, for example, more than $100 million is required just to be able to finance two or more phase 2a studies, said Stefan Luzi, a partner at venture capital group Gilde Healthcare Partners BV.

"It's just challenging to raise that amount of capital on a European stock exchange. It's not impossible, but I think it's more difficult. Hence, for many platform companies still, I think the logical next step will be a Nasdaq listing," Luzi said in an interview.

Many in the financial community consider the U.K.'s listing requirements to be onerous by international standards, such as rules around liquidity and share structures, as well as a longer timetable for the listing process. But the U.K. government has commissioned a review and recently recommended overhauling these regulations to make London more attractive to growth-stage companies, spurring some optimism from industry figures including Clive Dix, CEO of AIM-listed C4X Discovery Holdings PLC and former chairman of the Bio Industry Association.

"I think the next the next year will tell whether the markets really react in the right way in the U.K.," Dix said in an interview.

One long-term U.K.-based healthcare investor who spoke on condition of anonymity said British investor appetite in biotechs is also a factor.

"The depth of risk appetite [in the U.K. is] orders of magnitude off from where things are in the States — and the level of knowledge and expertise, there's no comparison," he said.

|

AIM still playing a role

The London Stock Exchange, which can trace its history back to the coffeehouses of the 17th century, is one of the oldest exchanges in the world, with more than 1,000 companies listed. In contrast, the AIM market was launched in 1995 to attract innovative growth companies.

While the junior market has lost out to Nasdaq when it comes to enticing the big players in experimental science, it has served a useful role as a stepping stone to a U.S. IPO for some, including Verona Pharma PLC and GW Pharma Ltd. It has also appealed to nonbiotech life sciences companies with proven technology or established revenue streams, including Oxford Cannabinoid Technologies Ltd. and Arecor Therapeutics PLC, a revenue-generating biotherapeutic company that spun out from Unilever PLC in 2007 and raised £20 million in its recent AIM IPO.

"We believe that AIM is actually working well at the moment for good-quality healthcare and biotech companies. I think we're seeing institutional investors' appetite for Arecor-type companies increasing," said Arecor CEO Sarah Howell in an interview.

"Arecor is a value proposition. Again, that works well for AIM. We have a de-risked portfolio of products, we don't have that high-risk profile of a novel medicine, novel drug play — we're generating revenues, we have partnerships with blue-chip pharma companies," said the CEO, formerly of BTG PLC and GlaxoSmithKline PLC.

A brighter future

Engendering confidence in London's ability to attract high-quality pharmaceutical, biotech and life sciences companies is Oxford Nanopore Technologies Ltd., which may attract a valuation of at least £4 billion, according to Berenberg analysts. Still, the company, which specializes in DNA sequencing technology, is considered by many to be a platform company, not a biotech.

Oxford Nanopore said it could not be more specific on when to expect its IPO on the London Stock Exchange in the second half of this year. The company has deep roots in the U.K.: It was founded as a spinout from Oxford University in 2005, and one of its investors, private equity and venture capital firm IP Group PLC, is publicly traded on the LSE under the ticker IPO.

With a cluster of companies from various sectors seeking to IPO on the London Stock Exchange imminently, it is all the more striking to see those that best reflect the strong history of British scientific research and innovation still opting for the U.S. The hoped-for relaxation of listing rules might be just the tonic the U.K. needs to keep its science anchored onshore.

"I personally would love to keep this company growing in the U.K. on the U.K. markets, but we can only do that if we get the right investments, and we get the belief in the science behind it," Dix said of his company, C4X. "How many times have we got to prove that with our technologies before we have to leave?"