One of English fashion designer Katharine Hamnett's recent offerings is a £25 white T-shirt made with organic cotton and blazoned with a stark slogan: Fashion Hates Brexit.

A T-shirt by English fashion designer Katharine Hamnett

|

Those three words capture the angst felt by the nation's clothing industry in the face of the growing risk that Britain could leave the European Union without a formal deal in place. A no-deal Brexit would trigger higher tariffs and therefore lead to higher costs for British companies and consumers. It would also require more red tape for cross-border trade and make it more difficult for Britain's clothing industry to attract skilled workers from the EU.

"It will disrupt the supply chain," said Adam Mansell, CEO of the U.K. Fashion and Textile Association, or UKFT, an umbrella group representing 2,500 British clothing companies, in an interview.

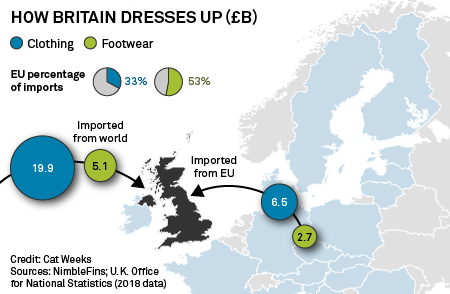

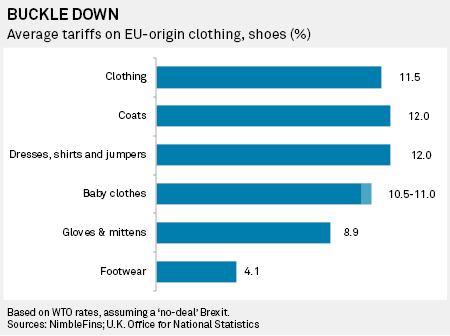

Britain's £30 billion fashion industry employs over 890,000 people and is especially vulnerable to a messy U.K.-EU divorce. Nearly three-quarters of its fashion and textile exports go to the EU, a chunk of trade valued at about £9.6 billion a year, according to UKFT. Without a withdrawal agreement, those exports would be subject to World Trade Organization tariffs of 6%-12% on average.

"We have a significant manufacturing base," said Mansell, noting that 85% of U.K. clothing and textile companies employ fewer than nine people and would be less able to cope with the burdens imposed by a no-deal Brexit. Without a deal, Mansell added, "British exporters will face a tariff bill of £750 million each year."

Bigger companies will not be immune, but they have more firepower to cope. Burberry Group PLC, which imports and exports large amounts of raw materials, samples and finished goods between the U.K. and the EU, has said logistical delays from a no-deal Brexit would hurt its design, product development and customer fulfillment processes.

"Our duty costs would increase materially — in the low tens of millions on an annual basis — which would be a headwind in terms of profits," said Burberry COO and CFO Julie Brown during the company's third quarter earnings announcement in January.

Next PLC, another big British clothing retailer, estimates that about £190 million of its £4 billion annual revenue is dependent on the EU market. In September, the company said it was well-prepared for a no-deal Brexit, "as long as ports and customs procedures are well prepared for the change, and tariff rates are adjusted to ensure no net increase in duty costs to consumers." So far it is unclear how those scenarios will play out, though the U.K. government's worst-case scenario suggests there could be delays of 2.5 days for trucks transporting goods from England to France.

Imports will be affected, too. Under a no-deal departure, clothing imported to the U.K. could be subject to tariffs of 11.5% on average, while shoes could attract a 4.1% tariff, according to data compiled by the U.K.'s Office for National Statistics. The U.K. is also part of the EU's Generalized Scheme of Preferences, or GSP, which allows British companies to pay lower or no duty when importing clothes, shoes and textiles from developing countries such as Bangladesh, Cambodia, India, Sri Lanka and Vietnam. Next, for example, gets more than half its imports from these countries.

The U.K. government said it plans to replicate the EU GSP rates, but time is running out. If the EU rates are not replicated before the end of October, developing countries will lose all preferential access to the U.K. and face much higher WTO tariffs.

There are other complications. For example, the U.K. buys £1.4 billion worth of fashion goods from Turkey and gets duty-free access thanks to a separate EU-Turkey customs deal. Unless the U.K. can forge its own EU-style deal with Turkey, "it will add £180 million in annual costs" to the British fashion industry, said Mansell.

Much of this financial pain will trickle downward — to the British consumer. Analysts say apparel companies are likely to pass on a large amount of Brexit-related costs, leading to higher retail prices at British stores. The 14% decline in the pound relative to the euro since the 2016 Brexit referendum has already dented the purchasing power of Britons who buy clothes when traveling to EU countries. A no-deal outcome will weaken the pound further.

"Brits do like their European clothing and footwear," said Erin Yurday, founder of NimbleFins, a personal finance website for consumers, in an interview. "Clothing will be just one item among others, such as food, that would go up in price."

If onerous U.K.-EU tariffs come into effect, Britain's fashion industry may be forced to look farther afield. For example, the U.K. exports £350 million worth of clothes, shoes and textiles to the U.S. "With a market that size, the figure should be in the billions," said Mansell of UKFT. "If we get a free trade agreement with the U.S., that would be hugely beneficial. But the idea of it happening quickly is perhaps naive."