Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Aug, 2022

By David Feliba

Brazilian lender Banco Bradesco SA reported an increase in default rates in the second quarter of 2022, an upward trend that left analysts surprised during an Aug. 5 conference call.

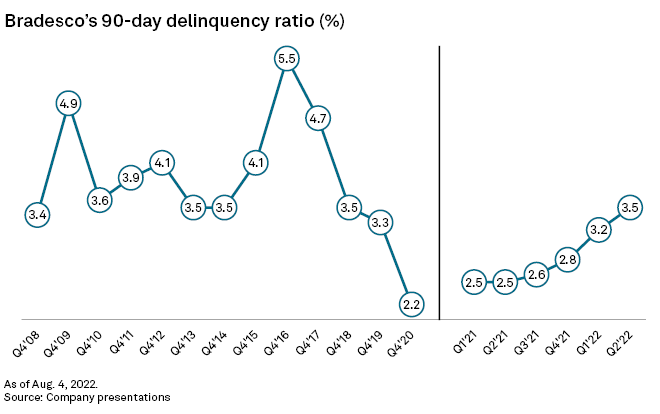

Bradesco, the second-largest private bank in Latin America, reported a 30-basis-point increase in its average 90-day nonperforming loan ratio. Delinquency in the broad portfolio went up to 3.5% compared to 3.2% in the first quarter and 2.5% in the year-ago period.

Officials said the bank could see further deterioration of its loan book as it pivots to higher-yielding loans and as inflation continues to erode the repayment capacity of its borrowers.

"The scenario remained challenging in the second quarter, with persistently high inflation," said CEO Octavio de Lázari. "The hiking cycle in Brazil is pretty much underway and that leads us to a less optimistic expectation for 2023 when GDP expansion could be close to 0%."

The bank booked north of 10 billion Brazilian reais in provisions during the first half of the year and signaled that allowances for loan losses for the entire year would be around 21 billion reais, at the upper end of its 2022 guidance range.

The rising trend in delinquencies was particularly visible for both individuals and small and medium-sized enterprise loans, which rose 40 and 30 basis points to 4.8% and 3.5%, respectively.

"We still expect delinquency to rise in the next few quarters depending on the job market and income," Lázari said. However, the CEO argued that the rise in NPLs was not necessarily a bad thing for Bradesco, as it also reflects the results of its strategy to pivot to higher-yielding loan segments such as credit card and consumer loans.

"It is a trade-off: more delinquency but greater margin," the CEO said. "We are working with more profitable operations that have a higher delinquency than mortgage loans."

The bank reported 17.7% loan growth in the first half of 2022, above its yearlong range of 10% to 14% for loan book expansion.

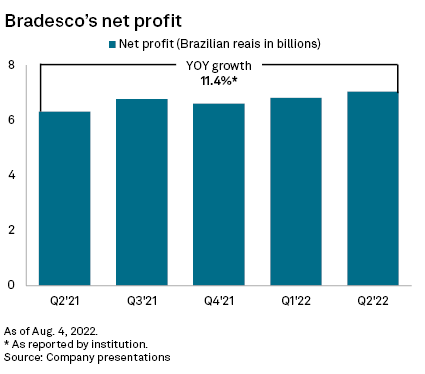

Bradesco on Aug. 4 reported that its second-quarter net income rose 11.4% to 7.04 billion reais. Bradesco's allowances for loan losses jumped 52.4% in the period to 5.31 billion reais, reflecting a more challenging scenario for the local economy.

As of Aug. 5, US$1 was equivalent to 5.21 Brazilian reais.