S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

26 May, 2022

Bonus pay is expected to drop at most major European and U.S. investment banks in 2022 as they balance costs against weaker revenues in a tough macro environment.

Russia's invasion of Ukraine, along with interest rate hikes, has ended a revenue boom in equity underwriting and M&A advisory, which drove banker bonuses to record levels in 2021. Rising inflation and slowing economic growth will further constrain the banks' ability to earn big and pay big in 2022.

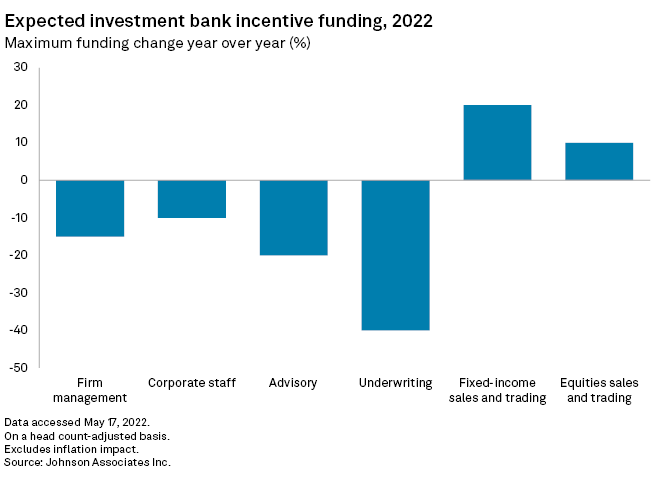

Based on first-quarter revenue and cost trends, incentive funding at major investment and commercial banks is expected to fall by 5% to 10% in 2022, with investment bank underwriting desks seeing declines of up to 40%, Johnson Associates has estimated. Lower revenues will be the main driver of direct decreases in incentive pay, but inflation will make the situation worse, the financial services compensation consulting firm said in its latest sector report.

Following "an unbelievably good year," underwriting revenues "dropped off a cliff" amid a slowdown in advisory in the first few months of 2022, Alan M. Johnson, managing director of Johnson Associates, said in an interview.

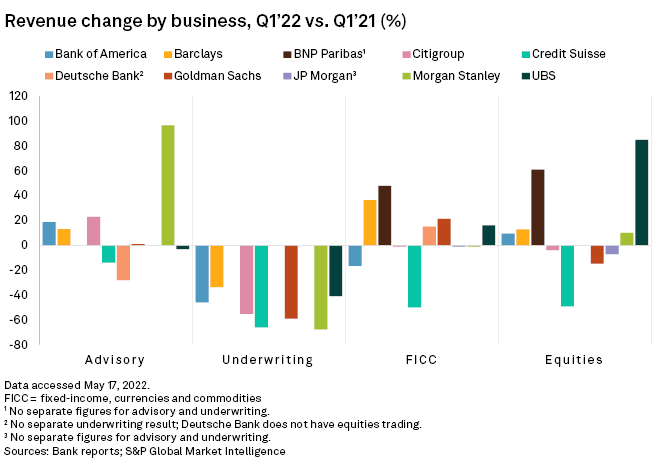

The war in Ukraine hit equity underwriting revenues in particular, with fees falling by as much as 80% year over year in the first quarter from record growth rates in 2021, according to data by financial market intelligence company Tricumen. The IPO market ground to a halt, with no new listings at the New York Stock Exchange for the first time since 2008, Tricumen said.

First-quarter underwriting revenues at most of the largest investment banks globally were notably lower than a year ago. The banks sampled included Bank of America Corp., Citigroup Inc., The Goldman Sachs Group Inc., JPMorgan Chase & Co., Morgan Stanley, Barclays PLC, BNP Paribas SA, Credit Suisse Group AG, Deutsche Bank AG and UBS Group AG. Advisory and trading delivered a mixed picture at the firms.

Trading revenues have held up well in the early part of 2022 thanks to greater market volatility, which will be reflected in the changes of incentive pay, Johnson said. While the general trend in 2022 is downward, there will be divergences between banks based on business mix, Johnson said.

Johnson Associates expects 2022 incentive funding to drop by 35% to 40%, or perhaps more, at investment banks' underwriting desks. Funding could decline by up to 20% in advisory. Fixed-income and equities trading desks, on the other hand, are expected to book increases of up to 20% and up to 10%, respectively, due to more client activity amid the market volatility experienced this year, according to Johnson Associates.

While there are differences in the design and calculation of bonus pay accruals at U.S. and European investment banks, all of them have been good at matching expenses to revenues over the past few years, Tricumen partner Darko Kapor said in an interview. This implies that banks would aim to drive down costs, including compensation and benefits expenses, as revenues weaken this year.

In the first quarter, "most banks — even those that typically front-load compensation and bonus accruals to the first half of the year — maintained strong cost control," Tricumen said in its sector report for the period.

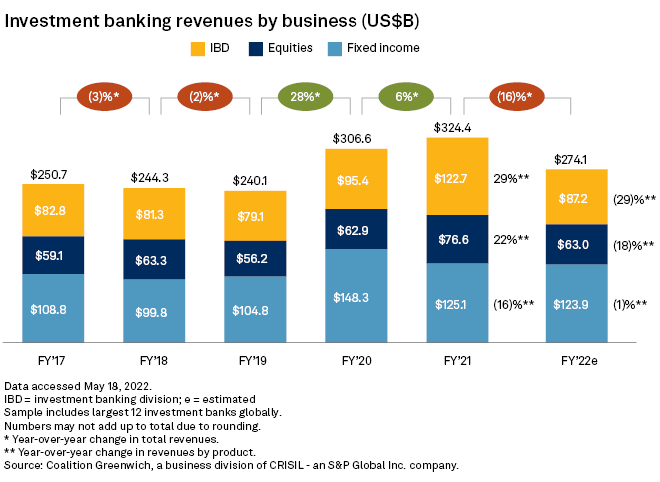

The 2022 revenue outlook is bleak, with the war in Ukraine and tightening central bank policy weighing on underwriting and advisory revenues. Revenues from equity and fixed income, currencies and commodities trading will also be affected, research company Coalition Greenwich said in a second-quarter report. The company, which is owned by S&P Global Inc., projects a 16% drop in total revenues for the 12 leading global investment banks. This sample includes the banks mentioned above as well as HSBC Holdings PLC and Société Générale SA.

All big U.S. banks except JPMorgan cut compensation and benefit costs in the first quarter. Goldman Sachs booked the largest cut at 32% year over year. JPMorgan's first-quarter cost increase of 2% was a fraction of the 19% hike made in the first quarter of 2021. JPMorgan and Bank of America declined to comment on 2022 bonus pay plans. Goldman Sachs, Citigroup and Morgan Stanley were not immediately available for comment.

Deutsche Bank, which raised investment bank compensation costs in the first quarter due to high competition for talent in the sector, plans to keep full-year adjusted costs flat on 2021, a spokesperson told S&P Global Market Intelligence.

Compensation costs at Credit Suisse were higher in the first quarter due to a change in its bonus pay formula, but the bank does not forecast a change in the economic value of the awards, CFO David Mathers said during a first-quarter earnings presentation April 27. The bank cut cash bonuses and increased the amount of deferred variable pay on the heels of the Archegos and Greensill scandals in 2021. This year, the bank returned the deferred and cash components of the bonus payments back to normal, Mathers said. A Credit Suisse spokesman declined to comment on bonus pay plans beyond the CFO's statements.

BNP Paribas, Barclays and UBS declined to comment on 2022 bonuses.