Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Mar, 2023

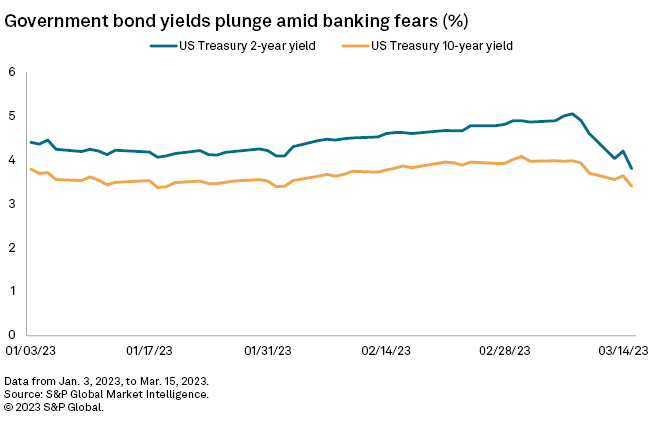

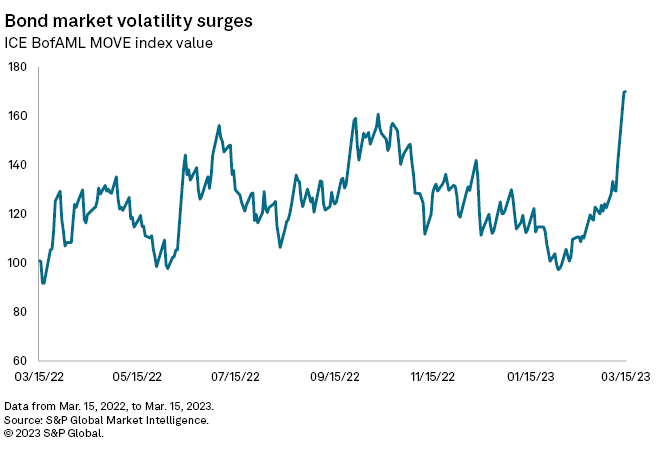

Turmoil in the banking sector and a potential premature pause to the Federal Reserve's rate hike plans have upended the government bond market, causing yields to plummet and volatility to surge to the highest levels in nearly 15 years.

The benchmark 10-year U.S. Treasury yield closed at 3.51% on March 15 from 4.08% on March 2. The 2-year yield, which closely tracks Fed rate expectations, settled at 3.93% on March 15, a 112-basis-point decline in one week. The 2-year yield closed at 5.05% on March 8 after Fed Chairman Jerome Powell indicated that the central bank may accelerate its push to hike rates if inflation and jobs data continued to come in hot.

Meanwhile, the ICE BofAML MOVE Index, which tracks the price movements of options on a basket of Treasurys to measure volatility in the government bond market, was trading at its highest level since November 2008. The index has surged nearly 78% since the beginning of February.

"These are pretty insane moves," said John Luke Tyner, a fixed-income analyst at Aptus Capital Advisors. "Things feel shaky."

Speculation of a more hawkish Fed that would push rates higher evaporated after the collapse of Silicon Valley Bank, questions about the financial health of Credit Suisse and pressure throughout the banking system. While inflation remains persistently high as the Fed pushed up its benchmark federal funds rates by 450 basis points since March 2022, the ongoing banking crisis is deflationary and has sparked concerns about tighter credit conditions and asset price declines, said Kathy Jones, managing director and chief fixed-income strategist with the Schwab Center for Financial Research.

Fed options

Investors have moved into bonds, driving down yields, as part of a "flight to safety," Jones said. Yields are also moving on the growing possibility that the Fed will have to stop its rate hikes in response. The Fed's rate-setting Federal Open Market Committee meets March 21-22.

"The bond market is seeing this [the upheaval in the banking sector] as limiting the Fed's options," Jones said.

How much further government bond yields will move likely depends on contagion from the banking system, said Antoine Bouvet, a senior rates strategist with ING.

"Current levels reflect an unhappy equilibrium between 'business as usual' where the Fed continues to hike into the summer, and a fully fledged financial crisis where it will have to cut rates," Bouvet said.

The odds of the Fed approving a 25-basis-point hike at its meeting next week were at 40% on March 15, according to the CME FedWatch Tool, which measures investor sentiment in the fed funds futures market. Those odds are down from about 80% a month earlier.

The odds that the Fed approves no rate cut next week grew to 60% on March 15. The odds of no rate cut were at zero percent a month earlier.

While a rate hike pause appears likely next week, economic conditions seem to be shifting by the hour, Derek Halpenny, head of research with MUFG, wrote in a March 15 note. Even if a pause occurs, more increases at future meetings remain likely.

"If the Fed does pause to assess the situation we do not view this as the definitive end of the hiking cycle given that it's not clear that inflation is on track toward their 2% target," Halpenny wrote. "If conditions stabilize they can hike again in May."

While the developments in the banking industry in the past seem likely to cause a "quick pivot" from the Fed, rate cuts in the near term remain unlikely, said Tyner with Aptus.

"I think instead we continue to see the Fed and government selectively save one-off incidents … with balance sheet measures that don't rock the system too much," Tyner said. "I'd expect more of these to follow."