S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Dec, 2021

By Deza Mones and Francis Garrido

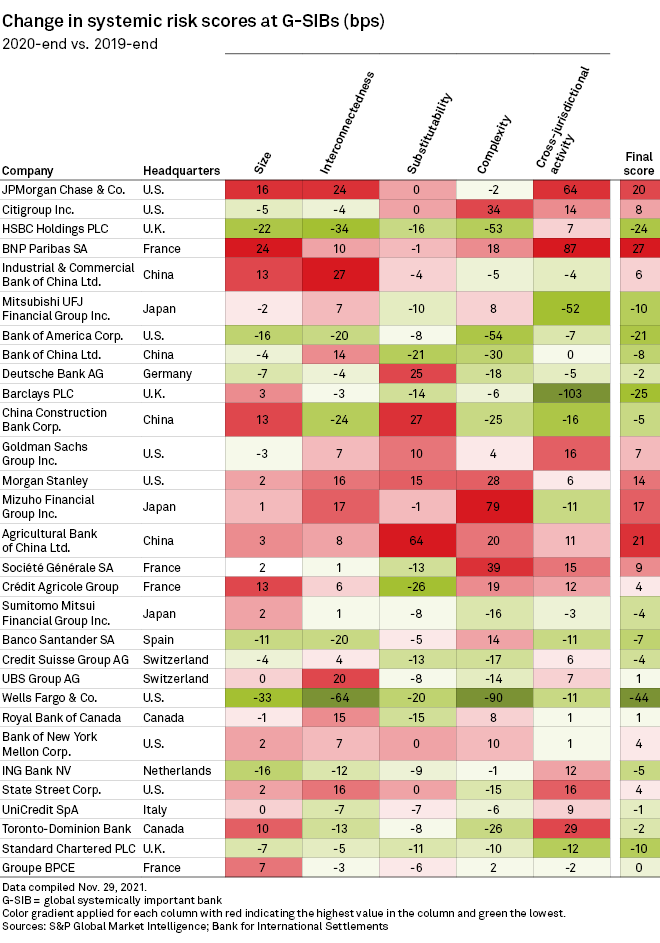

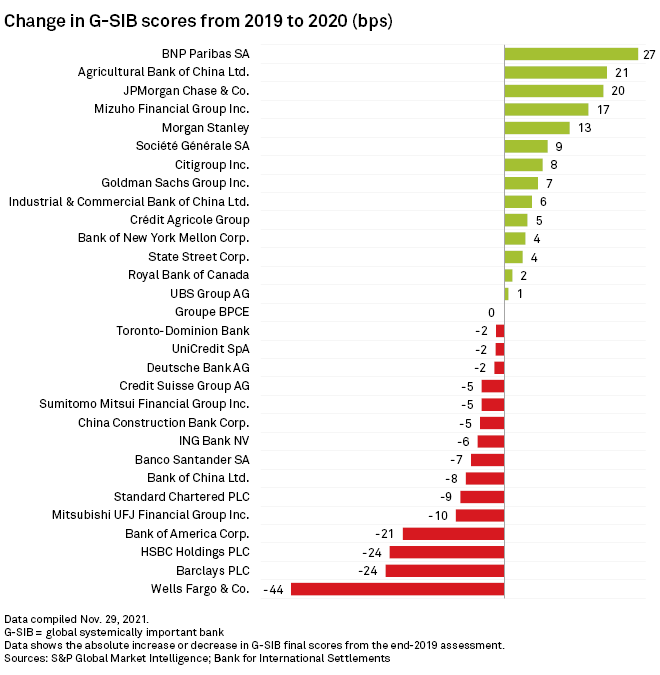

France's BNP Paribas SA increased in size and cross-border claims more than any other large global bank in 2020.

The lender logged the highest increases in overall size and cross-jurisdictional activity among global systemically important banks, or G-SIBs, at the end of 2020, as well as the highest overall risk score, as it moved up to a higher category, which means it must hold more capital.

The list of G-SIBs is published by the Financial Stability Board, which assesses top banks' systemic importance using five equal-weighting categories that include interconnectedness, substitutability and complexity. Final scores, measured in basis points, are then mapped in "buckets" that determine their minimum capital ratio requirements.

The French banking group's overall G-SIB score for 2020 rose by 27 basis points from a year earlier, giving it a final score of 333 basis points to join U.S. peer Citigroup Inc.

In the size category, which is based on banks' total exposures as defined by the Basel III leverage ratio, BNP's score rose by 24 basis points. Its reported total exposures increased to €2.267 trillion at 2020-end from €1.972 trillion a year earlier. BNP ranked as Europe's biggest bank by assets in S&P Global Market Intelligence's recent annual global bank ranking.

As for cross-jurisdictional activity, which takes into account a bank's claims and liabilities outside its home market, BNP's score rose by 87 basis points to 623 basis points, the second-highest score in the category among the banks in the list.

The lender's scores on interconnectedness, a measurement of lending to and borrowing from other financial institutions, and complexity — a measurement of over-the-counter derivatives, trading securities and "level 3 assets," which are defined as illiquid and difficult to value — rose over the period by 10 basis points and 18 basis points, respectively.

Under substitutability, which measures payments activity, assets under custody and underwriting activity, BNP's score dipped by 1 basis point to 281 basis points.

Other banks that rose to a higher bucket are U.S.-based JPMorgan Chase & Co.