S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

20 Dec, 2021

By Jon Rees and Cheska Lozano

BNP Paribas SA will have significant excess capital following the sale of its Bank of the West unit in the U.S., even after a €4 billion share buyback program.

The French bank agreed to sell San Francisco-based Bank of the West to Canada's Bank of Montreal for $16.3 billion. Following share buybacks to compensate for the expected dilution in earnings per share, BNP Paribas will use the proceeds to accelerate organic growth, particularly in Europe, to invest in technologies and to make bolt-on acquisitions, it said. The deal will give BNP Paribas a one-off capital gain of €2.9 billion and, net of the buybacks, boost its common equity Tier 1 capital ratio by 110 basis points.

"We think that means BNP will be running with a CET1 ratio of just over 14% by the end of this year, assuming completion, compared with their 12% target," Credit Suisse analyst Jon Peace told S&P Global Market Intelligence. "So it leaves them with quite substantial excess capital, and I think they feel that 12% is absolutely the right capital target for themselves."

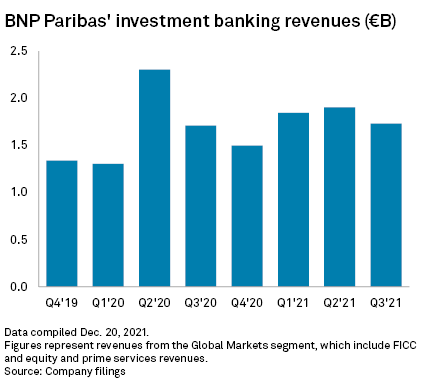

BNP Paribas will exit its retail and commercial banking activities in the U.S. but will maintain its investment banking operations there. In the past two years, it has taken on equities and prime brokerage businesses from Deutsche Bank AG and Credit Suisse Group AG, although it may cast the net wider when it comes to future investments.

"They certainly have a bit of a war-chest now. They have picked up global market share in equities trading, but I don't think they are necessarily targeting the corporate and institutional bank as the most probable way forward for acquisitions," Peace said. "I think they are looking across the space; I think the reference to technologies represents an interest in payments, for instance."

US exit

BNP Paribas is the fifth large foreign bank to exit the highly competitive U.S. retail banking market in little over a year. U.K.-based HSBC Holdings PLC, Spain's Banco Bilbao Vizcaya Argentaria SA, Japan-based Mitsubishi UFJ Financial Group Inc. and Israel's Bank Leumi le- Israel B.M. have all pulled out, choosing to redeploy resources elsewhere.

The scale of domestic U.S. retail banks meant BNP Paribas saw exiting that market as a sensible option, Peace said.

"BNP Paribas felt that in the U.S., there was increasing consolidation creating larger banks that had economies of scale and better resources to digitalize their businesses, and BNP did not have the scale, the means or desire to scale up sufficiently to compete," Peace said.

The business has long been viewed by the market as a poor fit for BNP Paribas' overall business model with no geographic synergy — it operates across 19 states in the U.S. West and Midwest — and possesses limited excess deposits to fund other North American operations, Barclays analyst Omar Fall said in a note to investors published Dec. 8, before news of the deal was announced.

BNP Paribas did not respond to a request for comment.

In 2020, Bank of the West contributed 7.36% of BNP Paribas' overall net income, according to S&P Global Market Intelligence data.

The bank will provide an update to its strategic review Feb. 8 when it unveils full-year results.

A higher G-SIB category

BNP Paribas has also moved into a higher category under the global framework that determines how much capital large globally active banks should hold.

It increased in size and cross-border in 2020 more than any other bank in the Financial Stability Board's list of global systemically important banks and must increase its capital buffers and meet a higher leverage ratio. As of January 2023, its required minimum leverage ratio would move from 3.75% to 4%. At the third quarter, it stood at 3.9%, below the 5.7% average of its peers, according to Barclays.

"This is not an insurmountable issue but leverage is a constraint to large-scale capital return," Barclays said.