S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

18 May, 2023

By Deza Mones

BNP Paribas SA, the biggest fossil fuel financier among European banks in 2022, has toughened its climate policy following investor pressure, but gaps still remain in its strategy, responsible investment group ShareAction said.

The French bank said last week it will reduce its financing of oil exploration and production by 80% by 2030. It will also phase out financing for the development of new oil and gas fields.

ShareAction said BNP Paribas still has more to do to meet the climate standards that investors and the public expect. The bank's corporate financing restrictions do not cover many of its clients and allow for the indirect financing of new oil and gas activities, said the UK-based nonprofit group, the member organizations of which include Amnesty International, Greenpeace and the World Wildlife Fund.

The bank has expanded its assessment of transition plans to cover all oil and gas clients, but it has failed to set a deadline for clients to comply and has not included expansion in its list of assessment criteria, ShareAction said.

BNP Paribas did not respond to requests for comment.

ShareAction previously ranked BNP Paribas as marginally better than other banks when it comes to their environmental policies over various topics, including climate and biodiversity governance, climate risks, climate opportunities, biodiversity strategy, and policy engagement and collaboration with stakeholders. "French bank BNP Paribas performed slightly better than others but with a score of only 63 per cent still has a long way to go," the group said in its December 2022 "In Debt to the Planet" report.

Big fossil fuel lenders

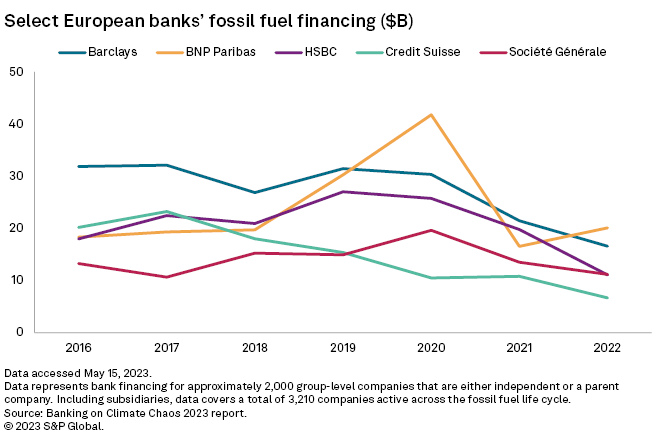

Paris-based BNP Paribas funneled more than $20.08 billion into roughly 2,000 group-level companies active in the industry, data from the latest Banking on Climate Chaos report shows.

Its lending increased by more than a fifth from $16.52 billion in 2021, according to the report, compiled by BankTrack, the Rainforest Action Network and other organizations. The report assessed lending and underwriting by 60 of the world's biggest banks from 2016 to 2022.

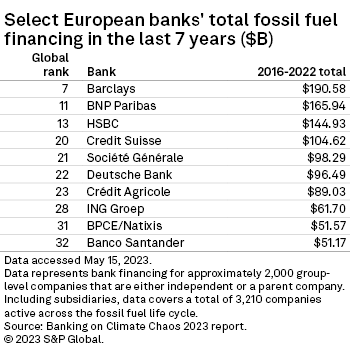

Of the five European banks that extended the most funding to fossil fuel companies over a seven-year period, BNP Paribas stood out as the only lender that increased its lending in 2022, with the amount of financing for the year topping its 2016 level of €18.30 billion. Its highest fossil fuel lending was $41.78 billion, recorded in 2020.

BNP Paribas has faced growing pressure to reduce its support for fossil fuel companies in recent months. In late February, three climate campaigners — Oxfam, Notre Affaire à Tous and Friends of the Earth — sued the group, alleging that its financing of the industry breached France's corporate duty of vigilance law, which requires large companies in the country to ensure their activities do not harm the environment. The case marks the world's first climate-related lawsuit against a commercial bank.

BNP Paribas told Reuters at the time that it could not stop fossil fuel financing immediately, and that it had stopped oil project funding in 2016. The lender was committed to reducing outstanding financing for oil extraction and production by 25% by 2025.

BNP said in its 2022 climate report that it is "more proactively" redirecting its portfolio to finance low-carbon energy production, which amounted to €28.2 billion at the end of September 2022, nearly 20% higher than its financing for fossil fuel production. BNP Paribas has set a target of €40 billion of financing for low-carbon, mainly renewable, energy production by 2023, accounting for 80% of the group's energy production financing.

Additionally, the bank said it has granted €44 billion of loans to support corporate clients' transition plans as of 2022-end and is aiming to reach €200 billion by 2025.

In 2022, the group's green bonds issuance reached $19.5 billion, while for 2023 year-to-date it has issued $9 billion, it noted.

Barclays PLC was Europe's biggest lender to fossil fuel companies over the last seven years, granting $190.58 billion in financing from 2016 to 2022. It ranked 7th globally, with the top three spots occupied by US banks JPMorgan Chase & Co., Citigroup Inc. and Wells Fargo & Co.

UK-based Barclays' lending has been on a downward trend since 2020, when it set out its goal to become a net-zero bank by 2050. Its fossil fuel funding amounted to $16.58 billion in 2022 versus $31.44 billion in 2019, according to the "Banking on Climate Chaos" report.

The British bank also faced calls from investors coordinated by ShareAction to commit to stop directly financing new oil and gas fields.

"Despite taking some important steps forward in the past year, such as cutting oil sands financing, Barclays has failed to fully match its oil and gas policy to its own net-zero goal," ShareAction said in a separate statement.

A spokesperson for Barclays said the bank is working with customers and clients shifting to a low-carbon business model, including "many oil and gas companies that are critical to the transition." It has achieved a 32% reduction in its financed emissions in the energy sector since 2020 and is using its "entire franchise" to support new green technologies and infrastructure projects that will escalate low-carbon capacity, the spokesperson said.

HSBC Holdings PLC

Representatives for Credit Suisse and SocGen declined to comment on the report, while HSBC did not respond to a request for comment.

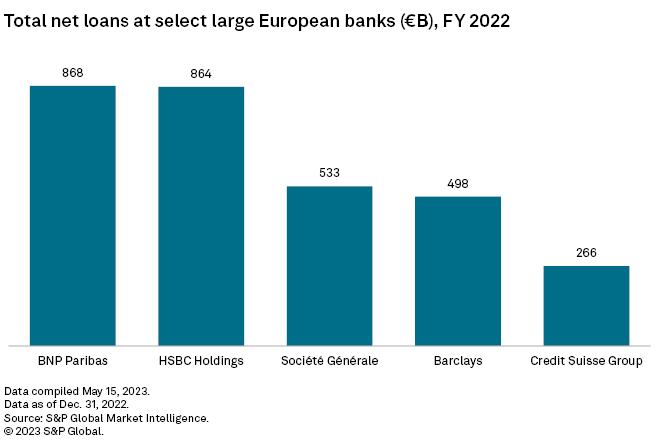

Total loans at BNP Paribas and HSBC exceeded €860 billion in 2022, while those of Société Générale and Barclays were in the region of €500 billion.

Downward trend in 2022

Overall, European banks decreased fossil fuel financing between 2021 and 2022, likely because oil and gas companies received very high levels of financing during the height of the pandemic, a spokesperson for BankTrack told Market Intelligence.

More European banks have also recently adopted policies restricting financing for new upstream oil and gas, and in some cases for midstream projects dedicated to new fields. But most have failed to put in place restrictions to general corporate financing for companies developing such expansion projects.

"This is a big mismatch and highly concerning, as the vast majority of financing is through such general corporate rather than project financing," the BankTrack spokesperson said.