S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Apr, 2023

By Karin Rives

| New York State Comptroller Thomas DiNapoli has been outspoken in his support for ESG-related investment criteria. The state's public pension fund will be carbon-free by 2040, DiNapoli says. Source: Office of the New York State Comptroller |

Like his Republican counterpart in Texas, New York State Comptroller Thomas DiNapoli has a list of companies in which he will no longer invest pension fund money due to their fossil fuel policies. The similarity between these lists, however, ends there.

Texas made headlines in August 2022 when it banned 10 banks and hundreds of investment firms over their alleged "boycott" of fossil fuel-heavy industries. At the same time, New York is continuing to forge ahead with an opposite strategy.

The $242 billion New York State Common Retirement Fund in 2019 became the first public pension system to announce a climate action plan. The following year, DiNapoli set a 2040 target deadline for fully decarbonizing the fund's portfolio.

Since then, the Democratic comptroller's office has reviewed its coal, oil sands, shale oil and natural gas investments and has begun to assess integrated oil and gas holdings. So far, 55 companies have been either restricted or removed from the pension fund because they were unwilling to meet energy transition goals aligned with the Paris Agreement on climate change, DiNapoli said in an interview.

"We have a lot of confidence in our approach," the comptroller said. "We think it's thoughtful and it's based on careful analysis to minimize risk and take advantage of new opportunities."

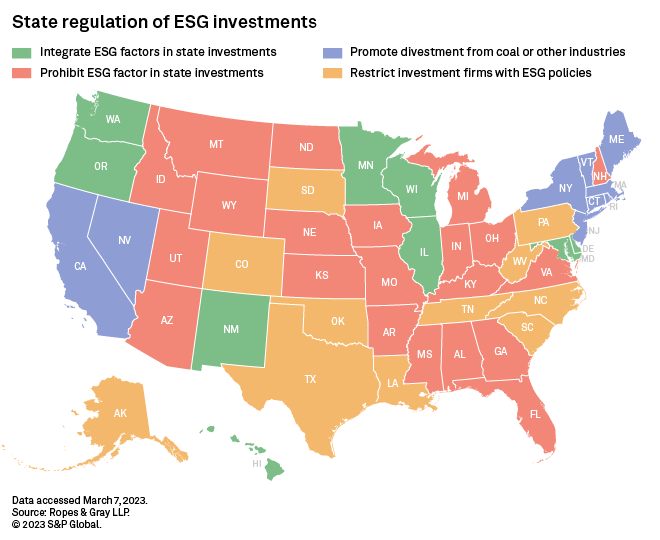

The New York pension chief's approach is not an aberration in today's America. As Texas and several other red states continue to restrict some investment firms over their environmental, social and governance policies, legislatures in 13 blue states this year have introduced bills that take the opposite stance, according to a tally maintained by the law firm Ropes & Gray.

State lawmakers in Colorado, Hawaii, Illinois and Massachusetts were among those that either proposed to divest public assets from fossil fuel holdings or to expand ESG criteria in state investments.

Blue states have also weighed in on the heated ESG policy debate, albeit with less frequency and vigor than that of their red state peers.

In September 2022, 13 Democratic state treasurers and New York City Comptroller Brad Lander signed an open letter hitting back at the rapidly growing anti-ESG movement in Republican-run states.

"States that focus solely on the short term will fail to compete over the longer time horizon that is necessary for them and their pension funds to succeed," they wrote. "They will miss potential growth because their focus is on preserving the status quo. And they will suffer from possible suits or challenges that longer-term players will avoid due to more rigorous oversight."

'Our fiduciary duty'

Oregon State Treasurer Tobias Read, who signed the letter, said that as the state's chief investment officer, he is responsible for developing a plan to transition the state's pension away from fossil fuel holdings by 2050.

"I'm under no illusions — this will be hard work," Read said in announcing his plan in November 2022. "But it's what we have to do because by taking our obligations to our beneficiaries seriously, we'll serve Oregon's public servants better, and by doing that we'll contribute to a better Oregon."

Colleen Davis, Delaware's state treasurer, said she decided to speak up after being surprised by the speed at which the anti-ESG narrative spread. Davis told a recent Ceres sustainability conference that the push to limit fund managers' risk assessments "flies in the face of our fiduciary duty."

Blue states are "more along the lines of, 'let's keep all of our all sources of data, and all sources of economic risk at hand and available to us,'" Joshua Lichtenstein, a Ropes & Gray partner, said in an interview. "Then they can make what they think are the best decisions based on the totality of the data, and the totality of the factors."

That approach does not satisfy some blue state residents who think their treasurers are not going far enough. In Oregon, for example, a bill to move up Read's divestment plan to 2035 narrowly failed in March after the treasurer warned lawmakers that it would "almost certainly" lead to lower investment returns.

Antitrust concerns

Treasurers and attorneys general from Republican-led states counter that many fund managers today invest according to a political agenda, such as phasing down fossil fuel holdings or using their proxy voting power to help diversify corporate boards.

On March 30, attorneys general from 21 Republican-led states sent a letter to 53 leading asset managers warning about "potential unlawful coordination" from their participation in initiatives such as the Net Zero Asset Managers Initiative.

The coalition of firms that joined the group promised to decarbonize their portfolios such that assets under management have net-zero emissions by 2050 in accordance with the Paris climate accord. ESG critics allege that such agreements may violate antitrust laws.

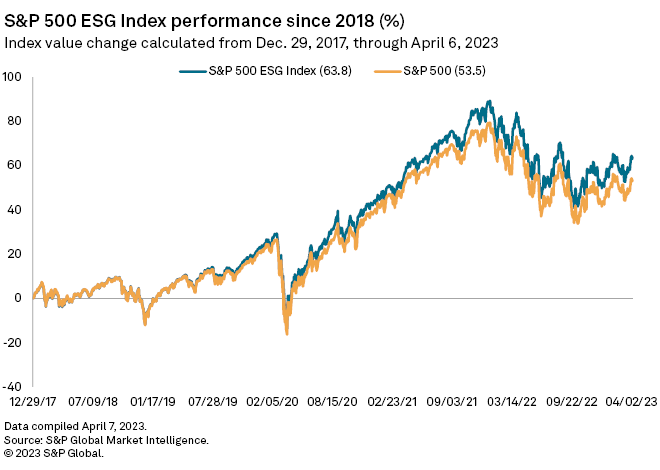

But their most persistent argument is that ESG investment policies hurt returns, despite a lack of conclusive evidence that this is the case. The S&P 500 ESG index, for example, continues to slightly outperform the standard stock market index.

9.5% returns

Blue state public pension officials say they must consider ESG risks and opportunities since they manage their retirement systems for the long term and must take future societal and environmental change into account. The three largest US state pension systems are in California and New York.

"For us, it's been well over a decade of integrating these considerations into our investment strategy," DeNapoli said. "We feel it's worked well for us."

The New York system for state and local employees that the NY Common Retirement Fund serves reported 9.5% returns for fiscal 2022, higher than any other state pension fund, according to data compiled by the conservative nonprofit Reason Foundation.

The strong results were due in part to the fact that New York's fiscal year ended in March 2022 — before the largest market losses occurred that year. But as the market took a toll in the months that followed, the New York pension fund still eked out a 4.5% return for the quarter that ended Dec. 31, 2022.

On March 31, DiNapoli's office announced that it would commit another $1.3 billion to its sustainable investment program "to capitalize on climate solution opportunities ... and protect the fund's long-term strength."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.