S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

29 Sep, 2021

By Camilla Naschert

|

| A study about the emissions profile of blue hydrogen has led to debate over its role as a solution in the path to net-zero. Source: Vithun Khamsong/Moment via Getty Images |

Touted as a key lever in global decarbonization, so-called blue hydrogen has sparked a debate in recent weeks among scientists and energy experts, calling into question the supposedly low-carbon fuel's green credentials.

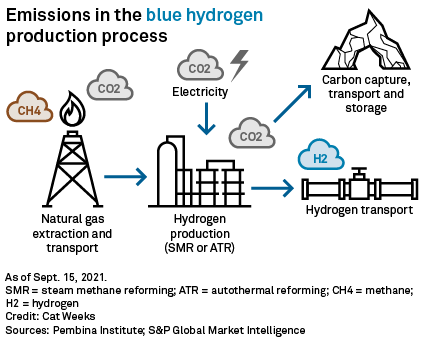

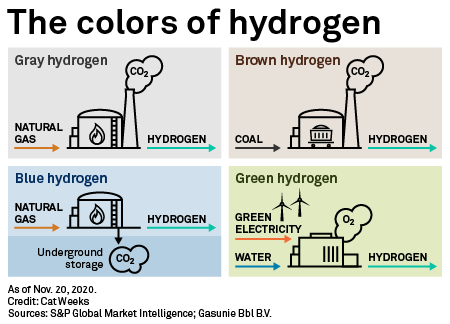

Viewed as a more sustainable alternative to traditional emissions-intensive "gray" hydrogen, made from natural gas, blue hydrogen uses carbon-capture technology to curb greenhouse gas emissions. Oil and gas giants BP PLC and Equinor ASA and power producer Uniper SE are among those pursuing blue hydrogen production projects, while gas-heavy industrial powerhouses like the U.K. and the Netherlands have placed strong emphasis on the fuel in their decarbonization plans.

But a recent scientific study pouring cold water on the climate benefits of blue hydrogen has sparked a sprawling debate about the merits of a technology often regarded as a transitionary solution in the journey to a "green" hydrogen economy, powered by renewables.

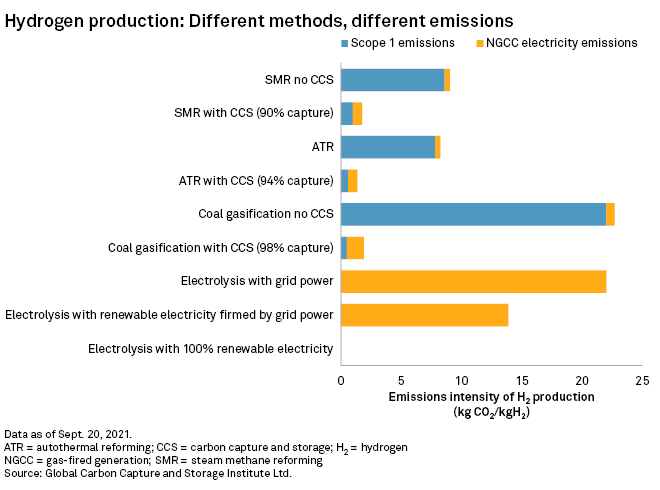

Researchers in the U.S. found that blue hydrogen produces 20% more carbon emissions in heat generation than using natural gas. This is partly because additional electricity is needed to run carbon-capture equipment, which, if derived from natural gas, leads to greater methane leakages and increased carbon emissions.

A few weeks after the study's release, co-author Robert Howarth, professor of ecology and environmental biology at Cornell University, told S&P Global Market Intelligence that he is yet to see a compelling rebuttal of his argument. "We scientists change our minds when we're wrong [but] no-one's pointing us to papers we have missed," he said Sept. 3, adding that pushback is coming from those invested in the oil and gas industry or those with an "emotional or intellectual entanglement" with blue hydrogen.

"I view [the criticism] as people who have bought into this blue hydrogen story," Howarth said.

Transition fuel or technology lock-in?

Howarth's study triggered a more fundamental debate about the concept of blue hydrogen as a transition fuel. Martin Tengler, a hydrogen analyst at research firm BloombergNEF, said the typical lifetime of blue hydrogen facilities will be at least 30 years, and many facilities proposed in the EU, which has a net-zero target for 2050, will be commissioned in the second half of this decade.

"If your lifetime is 30 years, you've got 10 years after 2050 when your facility is usable but you need to buy offsets to be net-zero," Tengler said in an interview. "But what if everybody does that? We cannot plant another planet full of trees."

Meanwhile, green hydrogen made from renewables and electrolysis is expected to be cost-competitive with blue hydrogen as early as 2030, he said.

The debate around the pursuit of blue and green hydrogen, and the roles the two fuels might play, has caused a division in the energy sector.

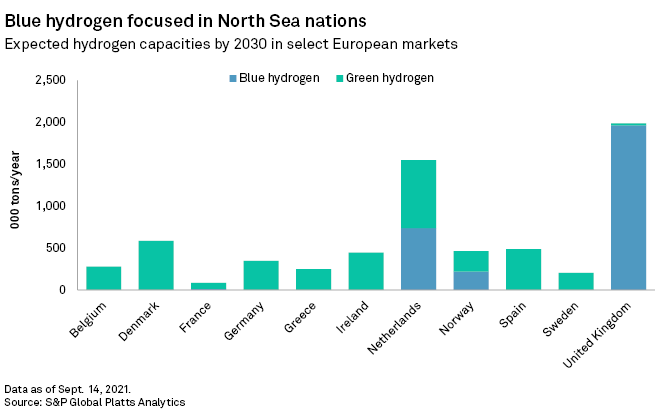

Electric utilities across Europe are already focusing much of their efforts on green hydrogen, and hydrogen strategies from nations such as Germany and France prioritize electrolysis. "In the long run, green hydrogen is the only sustainable solution," a spokesperson for Germany's RWE AG said in an email. "We see blue hydrogen as a supporting factor for the build-up of the market in some countries."

|

Scottish Power Ltd. CEO Keith Anderson also stressed the Iberdrola SA-owned utility's focus on green hydrogen, targeting users in hard-to-electrify industries like industrial processes and heavy transport. "We believe zero means zero," he said in an email.

In contrast, governments in the U.K. and the Netherlands include blue hydrogen in their national strategies. Dutch gas company Gasunie Bbl BV said its gas infrastructure will be "colorblind" and that intermediate solutions may be needed to complete the energy transition. "Ultimately, we believe the future is a green hydrogen future," a company spokesperson said in an email.

The chair of the U.K.'s hydrogen lobby group even went as far as resigning from his post over the organization's support for blue hydrogen.

"You are obligated to be neutral [as chair] and the honest answer is I'm not neutral on it," Chris Jackson, who stepped down from the U.K. Hydrogen and Fuel Cell Association in August, said in an interview. "I don't see there being a significant opportunity in blue hydrogen."

Jackson, who is CEO of green hydrogen developer Protium Green Solutions Ltd., sees blue hydrogen as an uneconomic option in light of rising gas prices, which he said will make green hydrogen cheaper by the end of this decade anyway.

Celia Greaves, CEO of the U.K. hydrogen association, said supporting blue hydrogen now would pave the way for the ramp-up of green hydrogen production. "All blue hydrogen projects currently underway in the U.K. are setting a high bar in terms of carbon capture with over 95% CO2 removal from the process considered a minimum," Greaves said in an email.

'Making peace' with blue hydrogen

Proponents argue that blue hydrogen is a pragmatic solution in light of burgeoning demand to address decarbonization in a variety of sectors considered difficult to electrify.

"This is why I have made my peace with blue hydrogen. I simply cannot see sufficient quantities of green hydrogen being produced fast enough and with low enough environmental impacts to meet demand," said Michael Liebreich, founder of BloombergNEF and chairman and CEO of energy advisory firm Liebreich Associates, in a Sept. 13 post on LinkedIn.

Bringing the technology in line with net-zero will require higher carbon capture rates well over 90% and very low fugitive methane emissions, he added.

In their study, Howarth and co-author Mark Jacobson, professor of civil and environmental engineering at Stanford University, assume a 3.5% methane leakage rate for the gas and up to 90% carbon-capture potential, figures they describe as conservative, or generous to the blue hydrogen cause.

|

A green hydrogen electrolyzer at an RWE site in Germany. |

Criticisms of the study have focused on Howarth and Jacobson’s assumptions on methane leakage, which they estimate at between 1.5% and 4.3%, and carbon-capture rates.

Norwegian think-tank SINTEF said that the study overstated methane leakage rates, noting that emissions in European gas production are as low as 0.23%, citing the Oil and Gas Climate Initiative.

And a spokesperson for Norway's Equinor said that Howarth and Jacobson based their carbon-capture levels on "outdated and inefficient" steam methane reforming, or SMR, technology with an overall CO2 capture rate of 76%. More modern SMR technology, as well as autothermal reforming, or ATR, can achieve rates of 95% or above, the spokesperson said in an email to S&P Global Platts.

Howarth called the methane leakage rate "a universal finding," adding that science on methane is much more advanced in the U.S. than in Europe. "Europeans shouldn't think they can do a better job. You just haven't looked as hard," he said.

BloombergNEF's Tengler said that his team's assumptions on capture rates for blue hydrogen plants are 60% to 90%. "Even if it's 90% as the study assumes, that's still not enough for net-zero," he said.

ATR, which uses oxygen to drive a reaction, rather than burning methane in SMR, is described as a more carbon-efficient hydrogen production process. But Jacobson, the Stanford researcher, noted that ATR requires substantially more equipment and electricity to produce the same volumes as SMR. "The bottom line is there's no free lunch here," he said during a Sept. 7 webinar organized by the Green Energy Group.

According to the study, there are only two blue hydrogen plants operating globally, run by Royal Dutch Shell PLC in Canada and Air Products & Chemicals Inc. in Texas. Carbon-capture technology remains relatively expensive and lacks a track record of commercial-scale projects.

"If it can't be done, then it's no to blue hydrogen," Liebreich wrote. "But then I'm really not sure ... how we get to net-zero on any time frame compatible with the Paris Agreement [on climate change], while preserving human progress."

'We're late'

More fundamentally, Howarth argues that the world's need for hydrogen is overstated. "Globally we use twice as much nitrogen fertilizer as we should. Instead of going for blue hydrogen there, why not find other ways?" he said. Even in emissions-intensive steel-making, he sees scope for more direct electrification using renewable power. "I'm not convinced hydrogen is all that critical."

Tengler said policymakers should first "consider whether you need hydrogen in the first place. Many sectors are better electrified."

Across Europe and beyond, policymakers have already decided to back hydrogen, with national strategies covering many gigawatts of capacity already agreed. The European Commission's hydrogen strategy targets 40 GW of electrolyzer capacity by the end of this decade, but has also left scope for "low-carbon" systems including blue hydrogen in the interim. East Asian nations like Japan and Korea also plan to import large amounts of blue hydrogen in the coming decades, and the technology is gaining traction in the U.S. as well.

Driven by an uptick in hydrogen-powered commercial vehicles, demand for the fuel in Europe's key markets will grow by 30% by 2030, according to Platts Analytics. At that point, blue hydrogen will make up 7% of the supply, with 27% green and 63% gray, Platts Analytics estimates.

So, has the study out of Cornell and Stanford missed the zeitgeist? "Yes, we're late," Howarth said. "Sometimes science influences policy and sometimes it doesn't. ... I wish our study would have come out sooner, but policymakers should have been asking more questions."

James Burgess, a reporter with S&P Global Platts, contributed to this story. S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.