S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

19 Jul, 2022

By Siri Hedreen

|

A fracking drill rig used to extract natural gas — a hydrogen feedstock — and crude oil. |

The energy industry is far from a consensus on whether blue hydrogen derived from natural gas can be considered "clean." Its cost-competitiveness is now being called into question, with a proxy advisory firm warning that policy and market forces could turn blue hydrogen into a stranded asset.

"All things considered, there is a significant risk that blue hydrogen assets become white elephants," ISS ESG, Institutional Shareholder Services Inc.'s responsible investment arm, said in a July 12 analysis.

The colors of hydrogen

Renewable electricity-powered hydrogen, or green hydrogen, has a zero-carbon footprint, but this comes at a price. As of 2021, the fuel costs about $5 per kilogram in the U.S., according to the U.S. Energy Department, compared to $1.50/kg for gray hydrogen, which is produced without carbon capture.

Blue hydrogen is derived from natural gas but with carbon capture technology to offset emissions. As such, the fuel has been favored by some natural gas companies, while others tout blue hydrogen as a lower-cost compromise between gray hydrogen and green hydrogen.

A study in the journal Energy Conversion and Management, published just before the Russian invasion of Ukraine, estimated the cost of blue hydrogen at between $1.69/kg and $2.55/kg.

But whether blue hydrogen meets the threshold of "clean" is a point of contention, depending largely on the ability of carbon capture to make a meaningful difference in greenhouse gas emissions.

The nascent technology has been demonstrated to capture up to 90% of carbon dioxide emissions, ISS said. "The simple and crucial fact, however, is that such a rate has never been achieved at commercial scale," the analysis said. "Moreover, without empirical evidence, it cannot be guaranteed that greenhouse gases stored underground will in fact remain sequestered indefinitely, presenting the risk of leakage."

Natural gas-derived hydrogen comes with other emissions streams. When it comes to the methane emissions associated with natural gas extraction, blue hydrogen is no better than gray, ISS said.

Policy levers, market challenges

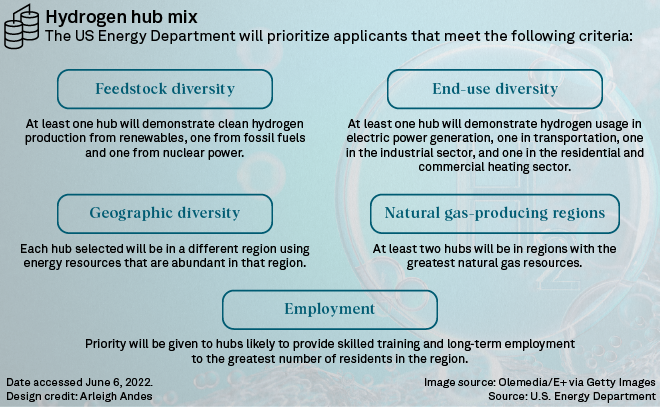

In the U.S., the Biden administration has yet to pick a side with funding pledges for both blue and green hydrogen. In June, the DOE made available $8 billion to develop at least four regional hydrogen hubs. The program, funded by the bipartisan infrastructure law, requires the DOE to support at least one hub powered by fossil fuels and one powered by renewable energy.

But the DOE has also sought to lower the cost of green hydrogen. The same law committed $1 billion to improve the process of electrolysis, or the splitting of hydrogen and oxygen in a water molecule, to produce hydrogen gas.

The European Commission set its sights on green hydrogen in 2020, aiming to deploy 6 GW of electrolyzers by 2024.

Sanctions on Russia and skyrocketing natural gas prices mean "blue hydrogen is no longer a low-cost solution" for Europe, according to the Institute for Energy Economics and Financial Analysis. The think tank estimated in May that the cost of blue hydrogen in the U.K. is up 36% from the previous year.

The ISS analysis concluded by advising investors to approach hydrogen "cautiously and with careful consideration of the specifics of each project."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.