Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Jun, 2023

| A wind farm in Norway. Rich in cheap hydro and wind power, the country is among Europe's last crypto hubs. Source: dmathies/iStock via Getty Images |

Owners of datacenters and crypto-mining operations are claiming that their businesses, far from being a drag on electric systems, can help integrate renewables and balance grids.

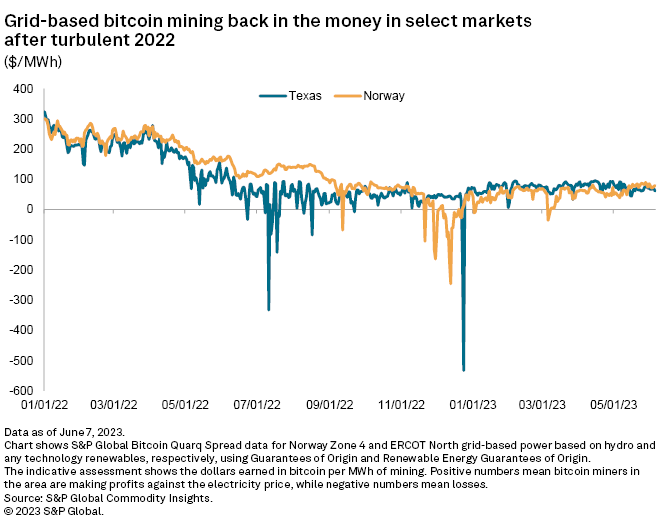

With its Renewable Bitcoin Quarq Spread Index, S&P Global Commodity Insights tracks the profitability of mining bitcoin, accounting for the costs of renewable certificates using Platts Renewable Energy Certificate (REC) and Platts Guarantee of Origin (GOs) data.

While mining is in the money in key markets, according to the index, during times of low crypto prices and high electricity prices, miners have profited from opting out of consumption from the grid, sometimes earning more than from the mining activities themselves.

Some sector pioneers now point to crypto mining's ability to capture energy from renewables that otherwise would have been curtailed, improving project economics and enabling more development in low-price regions.

Part of this trend is a pivot to smaller-scale behind-the-meter installations, according to the founders of a US mining startup.

"Our view isn't that you should throw up a bunch of generation assets so that you can mine bitcoin," said Andrew Webber, founder and CEO of Digital Power Optimization Inc. (DPO), an energy services startup developing behind-the-meter computing solutions for renewables assets.

"When you really pencil out that math, it's very hard to make that work," Webber said. "It can't be the only thing that you're doing with that energy asset."

Instead, Webber and business partner Alex Stoewer, COO of DPO, see co-located mining behind the meter as an optimization tool that reduces curtailment or sales into a low power price environment, as well as an enabler for fresh renewables in regions where power is cheap.

DPO has also been able to fund maintenance for an old hydroelectric plant in central Wisconsin after acquiring it and adding computing capacity on-site. Built in 1908, the 6.8-MW Hatfield Hydro Project would have otherwise eventually been decommissioned, Stoewer said.

Norwegian official: Mining seizes valuable resources

Similar concepts could work in unlocking more development in regions in Africa that anticipate population growth, the startup founders say. Meanwhile, Europe "has better uses for [its] power," said Stoewer.

Indeed, the energy crisis only reinforced European lawmakers' attention on energy efficiency and potential drains on supply, and regulatory winds are changing for bitcoin miners as a result.

One of Europe's more active mining markets is Norway, which offers affordable and clean power due to large hydroelectric and wind reserves. About 250 MW of capacity is estimated to be powering mining in the country, mostly in the northernmost price zones where electricity remains comparatively affordable.

"We see the energy situation as demanding and that crypto mining is seizing valuable power resources," Norway's state secretary, Elisabeth Sæther of the Labour Party, said in an email to S&P Global Commodity Insights.

While grid operators are obligated to connect new power end users to the grid — as well as to award increased capacity to existing end users — on a nondiscriminatory basis, queues for grid connection have lengthened in Norway due to rising demand from various sectors, Sæther said.

To tackle this, the government laid out an action plan earlier in spring that proposes introducing new prioritization criteria for grid connections based on the maturity of projects that request grid connections.

These criteria also include financing and plans for load usage, and the minister stressed that this filter will not discriminate against any particular sector.

However, in an upcoming revision of the Norwegian Act on Electronic Communications, the government is expected to propose new obligations for all datacenter operators, including crypto miners. The bill is set for a vote in mid-June. The government is also revising its national Data Centre Strategy, Sæther said.

Neighbor Sweden, also a hub for mining in Europe, has also indicated that it is prioritizing resources for other ventures such as hydrogen-based steel or chemicals production.

Bitcoin passes baton to artificial intelligence

While major miners may be relegated to the back of the queue, Sweden remains a hub for flexible datacenters joined with renewables projects, Hungarian startup founder Daniel Jogg said.

His flexible datacenter startup, Enerhash Technologies, has developed projects across Europe and beyond, advising asset owners like E.ON SE subsidiary E.ON Hungária Zrt. or Sweden's Vattenfall AB on leveraging flexible datacenters for balancing volatility.

Europe has not experienced negative wholesale power prices for the past few years, but with an increase in solar installed capacity and weaker demand, negative power prices have reemerged — a trend datacenter developers say bolsters their business case.

When two reactors at the Forsmarks kärnkraftverk nuclear plant in Sweden went down in April, Jogg said 200 MW of flexible computing was able to ramp down as a high-frequency demand response mechanism to balance the grid.

Enerhash also works with oil and gas field owners in the Middle East who are looking for better uses for flared gas by powering datacenters, as well as US oil and gas developer Allied Energy Corp.

Meanwhile, datacenter demand is set to triple in the next decade thanks to AI computing power, making datacenters a promising part of the flexibility puzzle, Jogg said.

The energy companies Jogg works with are rarely interested in mining bitcoin for profit, he said. "They are solving their problems. They are entering this business because they have the best synergies with datacenters. 95% of the time, they say, 'Do what you want with the bitcoin stuff, we need the datacenter.'"

Stigmatized cryptocurrencies

Integrated behind-the meter applications do not face the long grid connection queues that standalone miners would, DPO's Webber said.

Dozens of utilities and independent power producers in the US are keen to invest in such capabilities, Webber said, but refrain from disclosing early pilots and investments because of the "stigma" attached to cryptocurrencies.

|

| The 6-MW Hatfield hydro plant in Wisconsin, restored by DPO and partner Wiconi Hydro. Source: Cascade Digital Power |

"It's an interesting proposition, but it's just such a risky market," said Jonathan Schroth, a research analyst on the datacenter infrastructure and services team for 451 Research, part of S&P Global Market Intelligence.

Part of the challenge is the price of devices used to mine bitcoin via proof of work technology, which had peaked between $13,000 and $15,000 per unit, Schroth said. A pivot away from proof of work mining is possible, but Schroth said it bears a risk of stranded assets.

Investors who are uncomfortable with cryptocurrencies are eyeing other segments such as AI computing, which also requires large amounts of electricity, Webber said.

Texas remains attractive as crypto bill fails to pass

Much of the mining activity behind bitcoin is based in the US, where conditions for mining remain more favorable.

About 38% of bitcoin's global hashrate, the computational power used by the blockchain network, is generated in the US, according to December 2021 data — the most recent available — from the University of Cambridge's Bitcoin Electricity Consumption Index. Within the US, the state of Georgia had by far the largest share of activity, at nearly 31%, according to the index.

The majority of US-based crypto mining relies on fossil fuel-derived electricity, said David Shargel, a partner at law firm Bracewell in New York, adding that miners are increasingly hunting for new ways to tap into renewables. "They recognize they may not be welcome within the traditional grid," Shargel said.

"What we mostly see are folks artificially elongating the lifespan of a fossil fuel-powered plant," said Schroth, pointing to the example of beleaguered miner Greenidge Generation Holdings Inc., which made headlines for using a coal plant in New York later converted to run on natural gas to power its activities.

In January, New York became the first state to ban crypto mining derived from fossil fuels, and even some Texas lawmakers have recently tried to chip away at the state's mining cohort.

"For a couple of years now, Texas has been extremely attractive. Part of the incentive was providing a monetary reward for crypto mining operations that were able to shed load, stop their operations when load was at peak," Shargel said.

To limit this, Texas state Sen. Lois Kolkhorst, a Republican, told a state Senate committee hearing in March that Texas' booming digital mining industry is planning to add 37 GW of additional load to the state and no longer needs state incentives to thrive.

S.B. 1751, a bill sponsored by Kolkhorst, proposed that miners should only earn credits for demand response services if they comprise less than 10% of services procured by the Electric Reliability Council of Texas Inc.

The bill progressed through the Texas Senate amid strong pushback from the industry but ultimately did not pass after being halted by the House of Representatives in late May.

Shargel does not expect interventions to reduce mining activity in the US. "The mining industry will be here to stay for at least some time. The miners are going to continue to find the optimal locations and sources of power," Shargel said.

S&P Global Commodity Insights reporter Maxim Grama produces content for distribution on Platts Dimensions Pro. S&P Global Commodity Insights is owned by S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.