S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

19 Apr, 2021

By Brian Scheid

U.S. stock market investors are increasing their short bets against biotechnology companies, pulling the most-targeted stocks into steep declines from earlier surges as major equity indexes continue to climb to new highs, according to the latest S&P Global Market Intelligence data.

Analysts say markets are viewing publicly traded biotech companies as ever more likely to fail as the Biden administration boosts its scrutiny in all corners of the healthcare sector, from pharmaceutical company mergers to prescription drug prices.

"Healthcare was overvalued coming out of 2020 when everyone was throwing money at the sector given the visibility that COVID gave it," said Brad Loncar, CEO of Loncar Investments, an index provider for two biotech stock-focused exchange-traded funds. "This year with the new administration, drug pricing legislation and other headlines have caused a bit of a headwind."

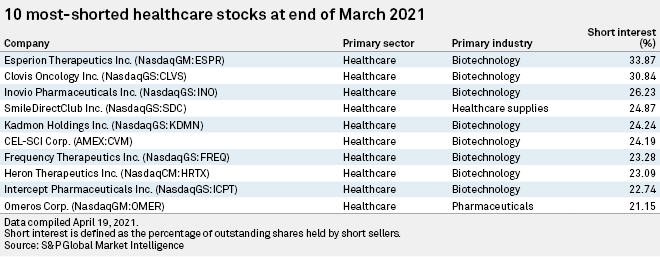

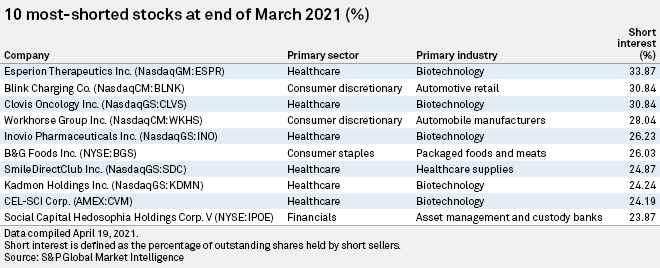

Six of the 10 most-shorted stocks across all U.S. exchanges at the end of March were healthcare stocks, and the sector accounted for 12 of the top 20 most-shorted stocks. Nearly all of those healthcare companies are in the biotechnology industry.

Short-sellers borrow stock and sell it in anticipation that they can replace it later at a lower cost if the share price falls. If their plays are successful, short-sellers profit from the difference between the price at which they sell the stock and the price at which they repurchase.

"My guess is that short sellers believe the money will cycle out of healthcare into reopening stocks and therefore feel this is a safer area to keep short positions at work," Loncar said in an interview.

As of April 16, the S&P 500's healthcare sector was up about 6.9% on the year, compared to an 11.4% increase in the overall S&P 500.

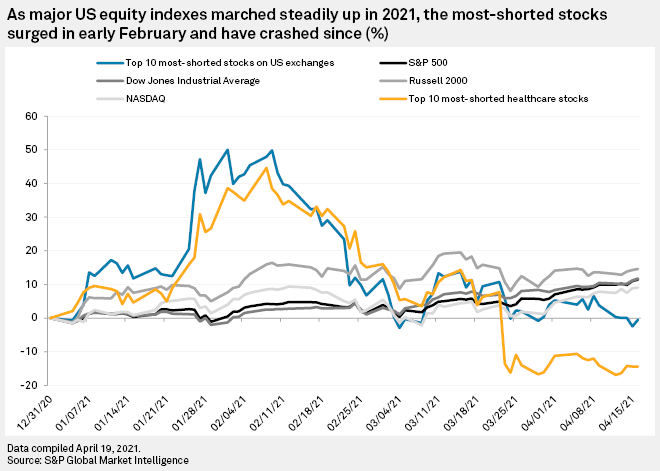

But the healthcare stocks targeted by market shorts have seen a steep decline. The 10 most-shorted healthcare stocks, for example, climbed by nearly 45% from the start of 2021 to early February, but have since fallen more than 14% on the year.

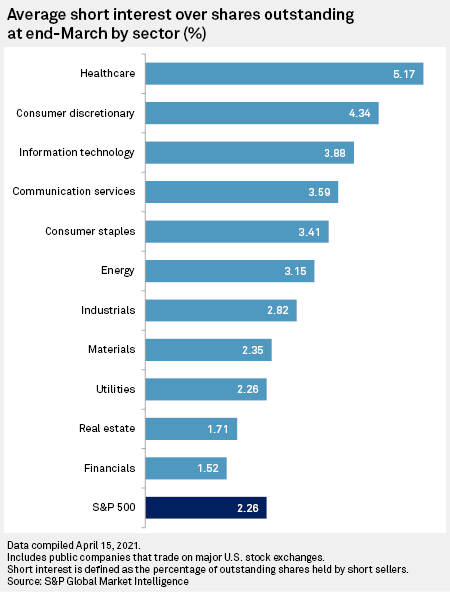

Average short interest in healthcare stocks hit 5.17% at the end of March, up 31 basis points from mid-March and up 53 basis points from mid-February.

"A much better-than-expected COVID vaccine rollout in the US and a slow resumption of more profitable procedures has Wall Street completely abandoning typical defensive plays, such as healthcare stocks," said Edward Moya, a senior market analyst with OANDA. "The US economic boom is here and many traders feel that healthcare's lagging profits will continue to struggle with the reopening trades."

Fawad Razaqzada, a market analyst with TF Global Markets, said the climbing short interest in healthcare stocks may be due to the sector's defensive status "which is likely to underperform during times of bullish exuberance."

Short interest in the stock market has dipped since a Reddit-fueled band of retail traders caused GameStop stock to rise steeply in response to the heavy speculative betting on the retail game company's pending demise.

Short selling of the S&P 500 averaged 2.26% at the end of March, down 87 basis points in roughly a year.