Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Oct, 2022

By Anser Haider

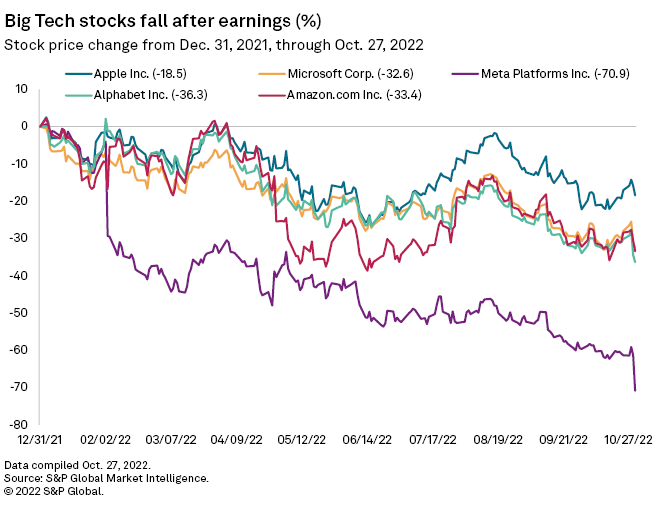

Big Tech stocks experienced a brutal week as investors sold shares after a series of disappointing earnings reports that reflected economic headwinds in the third quarter.

Microsoft Corp., Alphabet Inc. and Meta Platforms Inc. each lost billions in market value after posting weak earnings and dour guidance. Amazon.com Inc. also saw its stock plunge in after-market trading Oct. 27 after reporting disappointing results for the September quarter.

With the turbulent economic environment likely to continue through the rest of this year, analysts said technology companies must ramp up efforts to placate spooked investors.

"In this softer macro and a recession likely on the doorstep, Big Tech management teams need to quickly adjust to a much different backdrop or risk losing its luster for investors that have bet on these tech thoroughbreds for the past decade," said Wedbush analyst Dan Ives.

Advertising woes

A slump in online advertising weighed heavily on both Meta and Alphabet's third-quarter earnings.

Meta, which was already struggling to adapt to changes to Apple's mobile ad-tracking policies, saw its advertising revenue fall about 4% year over year in the September quarter. Meta is in the process of pivoting its core focus from social media towards the future metaverse, which is also not sitting well with investors.

"Meta's results were an absolute train wreck that speaks to pervasive digital advertising doldrums ahead for Zuckerberg & Co. as they make the risky and head scratching bet on the metaverse," Ives said. Meta is attempting to transform its business model at the worst possible time, given all the economic headwinds, the analyst added.

Meta's shares plummeted nearly 25% following the earnings results, closing at $97.94 on Oct. 27, its lowest price since 2016. Year-to-date, Meta's stock had lost almost 71% as of market close Oct. 27, underperforming its Big Tech peers.

Meanwhile, Alphabet reported its worst quarterly performance since the COVID-19 pandemic, as third-quarter revenue growth slowed to 6% year over year due to a decline in digital ad spending.

"Google is an ad business first and digital ads is no longer a safe place to hide" from economic disruption, wrote Bernstein analysts Mark Shmulik and James McNeill in a research note. They also cut their price target on Alphabet's stock to $120 from $130 per share.

Cloud growth slows

Economic uncertainties have also started weighing on the growth of cloud-computing platforms.

Cloud market leader Amazon Web Services Inc. saw revenue grow 27.5% year over year in the September quarter, down from growth of 39% a year earlier and below analysts' expectations.

"We are seeing signs all around that, again, people's budgets are tight, inflation is still high, energy costs are an additional layer on top of that caused by other issues," Amazon CFO Brian Olsavsky said during the company's Oct. 27 earnings call. "We are preparing for what could be a slower growth period, like most companies."

Amazon's shares tumbled about 20% in after-market trading on Oct. 27 following its earnings results.

Microsoft's Azure cloud-computing platform also saw growth decline in the September quarter to 42% on a constant-currency basis, a point below the company's guidance. Microsoft expects cloud growth to slow further in the December quarter, to 37%.

Although Microsoft's stock took a post-earnings hit like its tech peers, analysts were more optimistic about the company's long-term growth prospects.

"We think Microsoft can continue to leverage top-tier competitive positions and customer relationships in some of the largest markets in software to continue to drive outsized returns vs. megacap tech/S&P 500 peers," Citi analyst Tyler Radke wrote in an analyst note.

Amazon and Microsoft's cloud businesses combined accounted for more than half of the total public cloud infrastructure market in 2021, according to a September report by 451 Research.

Apple endures

Apple Inc. was the outlier in Big Tech earnings for the week, reporting revenue and earnings per share above analysts' expectations.

The company's shares were up about 3.5% in early-morning trading on Oct. 28, despite misses on estimates for iPhone sales in the September quarter.

"In a horror show week for Big Tech earnings, Apple was the one bright spot as iPhone demand was relatively strong despite the macro with a heavy iPhone 14 Pro mix seen in the quarter," said Wedbush's Ives.

Moreover, revenue for Apple's Mac computers was up 25% year over year, powering through a significant decline in the overall market for PCs and laptops.

"Apple is likely to remain a relative safe haven for many as the macroenvironment remains highly uncertain and choppy," said Credit Suisse analyst Shannon Cross.

451 Research is part of S&P Global Market Intelligence.