S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

6 Jun, 2022

By Sheryl Obejera and Marissa Ramos

South Africa's largest banks are set for higher profits in 2022, even after significant increases in 2021, S&P Global Market Intelligence data shows.

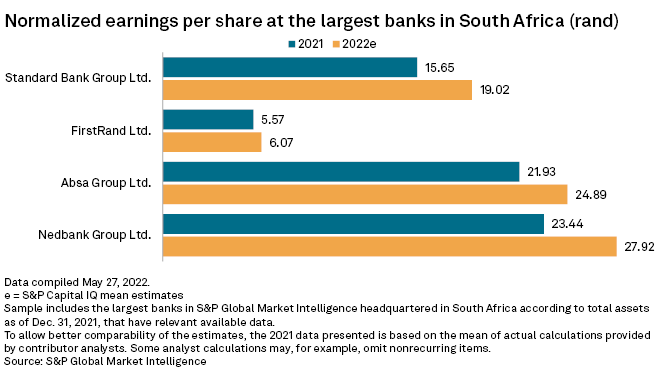

The S&P Capital IQ mean estimates for full-year 2022 normalized EPS at Standard Bank Group Ltd. and FirstRand Ltd. were 19.02 rand and 6.07 rand, respectively, as of May 27, against 15.65 rand and 5.57 rand for full year 2021. The normalized EPS mean estimates for Absa Group Ltd. and Nedbank Group Ltd. for 2022 were also higher than for 2021.

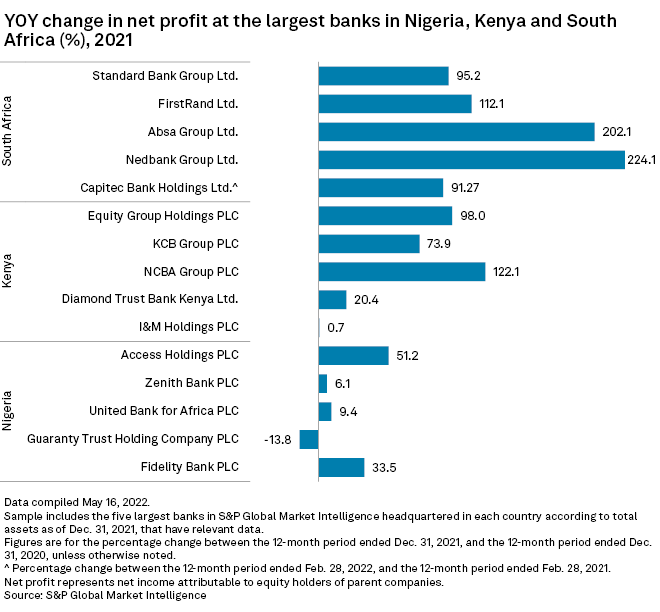

All the banks posted strong results for 2021 on the back of a rebound in economic activity, with net profits increasing between 95% and 224% on a yearly basis. Another large South African lender, Capitec Bank, registered a 91% profit increase for the year ended Feb. 28.

South African banks' performance was connected to the broader, more supportive, economic context, consulting firm PricewaterhouseCoopers wrote in a March report. Some macro-related uncertainty exists over Russia's invasion of Ukraine, PwC said.

The South African banking sector is in a recovery phase, and earnings are expected to recover to pre-pandemic levels in 2022, S&P Global Ratings said in a May 25 report. Lower impairment charges and higher interest rates will support net interest margins, bolstering profits, it said.

Nedbank expects its 2022 return on equity to be higher than in 2021, a spokesperson told Market Intelligence. The key risk for Nedbank is a potential deterioration in the macroeconomic environment beyond its forecasts, while inflation is likely to impact growth. Export volumes will be hit, but higher export prices will somewhat mitigate the effect, the spokesperson said.

Absa expects high single-digit revenue growth for 2022, partly driven by lower COVID-19-related insurance claims, a spokesperson said. Its ROE is expected to be similar to that of 2021.

Standard Bank, FirstRand and Capitec did not respond to requests for comment.

The banks' counterparts in Kenya also reported year-over-year increases in their full-year 2021 earnings. Net profits at Equity Group Holdings PLC and KCB Group PLC rose 98% and 73.9%, respectively. NCBA Group PLC's net profit increased 122.1%, Diamond Trust Bank Kenya Ltd.'s rose 20.4% and I&M Holdings PLC grew 0.7%.

Net profits at Nigeria's Access Holdings PLC and Fidelity Bank PLC rose 51.2% and 33.5%, respectively, while Zenith Bank PLC and United Bank for Africa PLC posted 6.1% and 9.4% upticks in their results. Guaranty Trust Holding Co. PLC was the lone bank in the sample that posted a net profit decline.

Lower provisions

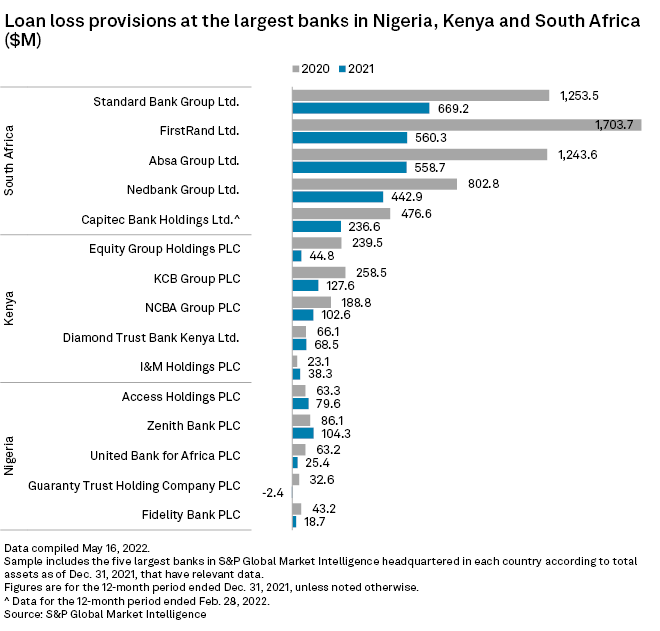

Loan loss provisions at the largest South African banks fell on a yearly basis. Standard Bank booked $669.2 million of loan loss provisions for full year 2021, down from $1.25 billion a year ago. FirstRand's provisions dropped to $560.3 million from $1.70 billion.

Three of the five Kenyan banks in the sample also saw loan loss provisions fall, while Nigeria's Access Holdings and Zenith Bank posted an increase in charges related to credit impairments.

As of June 3, US$1 was equivalent to 15.53 South African rand.