Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Jan, 2022

By Sydney Price and David DiMolfetta

Mobile carriers spent tens of billions of dollars on 5G spectrum over the past two years, but those investments may take a while to pay off, analysts say.

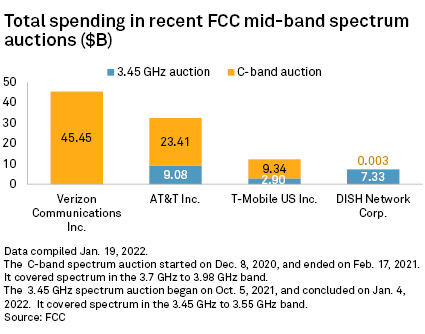

Looking at four of the biggest U.S. wireless companies — AT&T Inc., Verizon Communications Inc., T-Mobile US Inc. and DISH Network Corp. — the companies collectively spent nearly $100 billion in two near back-to-back mid-band spectrum auctions. Mid-band spectrum is considered essential for 5G delivery, balancing speed and range. It provides broader coverage than high-band spectrum and faster speeds than low-band spectrum.

While some analysts note the spending was important for the companies' plans to provide high-speed mobile and home 5G internet offers, others believe the financial outlays will handicap the heaviest spenders long-term, especially as they wrangle with both expected and unexpected delays in access to the spectrum.

Verizon and AT&T, in particular, spent too much in an attempt to keep up with T-Mobile's strong 5G footprint, according to Jeff Moore, principal of Wave7 Research, a wireless research company that covers U.S. postpaid, prepaid, smartphone and fixed wireless competition.

"Both carriers are reacting to the reality that T-Mobile has a superior 5G network," Moore said in an interview.

T-Mobile has been named the top 5G provider by numerous independent research sources, including Ookla and umlaut. The carrier has a rich cache of mid-band spectrum thanks to its 2020 acquisition of Sprint Corp. in a deal valued at $26.50 billion. The gross transaction value, including assumed debt, totaled $81.46 billion.

Spectrum spending

Verizon, meanwhile, spent $45.45 billion in the C-band spectrum auction in 2021 when the Federal Communications Commission auctioned 280 MHz of spectrum in the 3.7 GHz-3.98 GHz band. AT&T dished out $23.41 billion in the C-band auction and then followed that up by shelling out an additional $9.08 billion in the subsequent 3.45 GHz auction, which ended earlier this month. All told, the carrier spent $32.49 billion on mid-band spectrum across the two auctions. After its massive C-band spend, Verizon opted to sit out the 3.45 GHz auction.

T-Mobile spent $12.24 billion combined, and DISH spent $7.33 billion.

Despite the high upfront costs, the spending was necessary for long-term growth, said Lynette Luna, an analyst with Kagan, a media research group within S&P Global Market Intelligence.

"Spectrum is the lifeblood of the wireless carrier business, and carriers need it to stay competitive," Luna said in an interview.

Rising debt loads

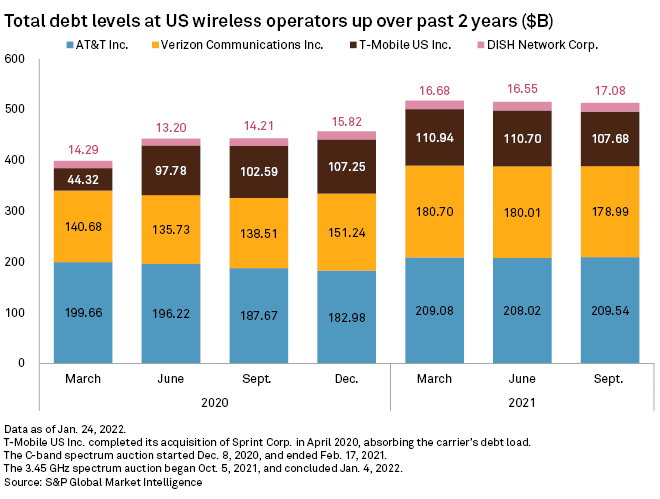

While the spending on M&A and spectrum may have been necessary, it has certainly had an impact on carrier balance sheets over the past two years.

The total debt loads of both AT&T and Verizon spiked significantly in the first quarter of 2021 as the C-band auction wrapped up. AT&T's total debt jumped to $209.08 billion in the March 2021 quarter, up from $182.98 billion at the end of 2020. Verizon's total debt climbed to $180.70 billion from $151.24 billion over the same time frame.

"This large [spectrum] expenditure will reduce the ability of Verizon, and to a lesser extent, AT&T, to innovate in other areas. AT&T is already selling off assets to deal with its debt," Moore said, referring to the company's recent sale of its Warner Media LLC business to Discovery Inc. and its transaction to separate DIRECTV into a new company jointly owned by AT&T and TPG Capital LP.

Putting the spectrum to work

The carriers have been bullish on the spectrum buys, pointing to the services it will support. Verizon rolled out its 5G Ultra Wideband network on Jan. 19, an offering that relies heavily on the C-band spectrum the company purchased.

"On our Jan. 19 C-band deployment, we covered more than 90 million [points-of-presence] and millions of homes in more than 1,700 cities, well ahead of plan on making excellent use of the incremental capital spend to augment and accelerate our business opportunities," Verizon CEO Hans Vestberg said during a Jan. 25 earnings call.

AT&T, meanwhile, has been a bit more opaque with its C-band deployment plans, in part because half of the C-band spectrum the company bought is not set to be cleared or available for use until the end of 2023.

AT&T's lack of detail on its plans is another indicator of the company's poor spending, Moore said.

"It is not yet clear whether AT&T’s investment is intended to enhance the mobile experience or to enable a rollout of internet service to the more than 50% of homes where AT&T is not the incumbent phone company," Moore added.

Ongoing air safety concerns

One unexpected complication around the mid-band spectrum purchase has been the ongoing dispute between wireless providers and the Federal Aviation Administration. The FAA has issued numerous statements expressing concern over C-band equipment's potential interference with flight safety systems. The FAA previously warned that the Jan. 19 5G rollout would ground flights, strand passengers and delay shipments. AT&T and Verizon agreed to temporarily delay turning on a limited number of towers around 50 U.S. airports.

"We are frustrated by the FAA's inability to do what nearly 40 countries have done, which is to safely deploy 5G technology without disrupting aviation services, and we urge it do so in a timely manner," an AT&T spokesperson wrote in a statement.

While the carriers were able to deploy in most planned areas Jan. 19, it is possible Verizon and AT&T will still file a lawsuit alleging the FCC misrepresented the spectrum it was selling, said Recon Analytics analyst Roger Entner, whose research focuses on the wireless experience.

"It is aggravating for AT&T and Verizon, who have spent tens of billions of dollars to get the spectrum and who expected to get it Dec. 23 last year. And we're still dragging on," Entner said. "This is a massive failure of government."

Moore believes the involved parties will work things out. "Concerning the early 2022 avoidance of a rollout of C-band 5G near airports, this is a small, short-term development that will have no meaning in the long run," he said.