S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Apr, 2021

By Molly Christian, Bill Holland, and Ellie Potter

|

President Joe Biden discussed the American Jobs Plan, the first of his two-part infrastructure package, on April 7 in Washington, D.C. |

President Joe Biden's recently unveiled tax plan to accompany his $2 trillion infrastructure proposal takes direct aim at fossil fuel subsidies in favor of clean energy incentives.

The U. S. Department of the Treasury on April 7 released "The Made in America Tax Plan" — a 19-page proposal that, among other things, would raise the corporate income tax rate from 21% to 28% and replace fossil fuel subsidies with clean energy incentives. The plan outlines several clean energy tax credits, including for carbon capture and sequestration technologies, but does not specify which fossil fuel subsidies could face the chopping block.

"Today the tax code contributes to climate change by providing significant tax preferences and subsidies for the oil and gas industry," according to the plan. "The president's tax plan would remove subsidies for fossil fuel companies, while providing incentives to reposition the United States as a global leader in clean energy and to ensure that our infrastructure is resilient to storms, floods, fires, and rising sea levels."

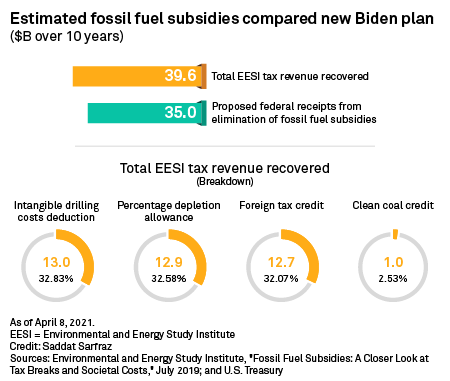

The Biden administration has said that eliminating these subsidies would yield more than $35 billion in federal tax receipts over the coming decade, cutting into oil and gas companies' profits but having "little impact" on energy prices.

Fossil subsidies

Congress has the ultimate power to amend the tax code, so Biden's proposals could be tempered by Republicans and moderate Democrats in the narrowly divided chambers over the coming months, according to Sasha Mackler, director of the Energy Project at the Bipartisan Policy Center. He also questioned the administration's focus on eliminating fossil fuel subsidies given the difficult year the oil industry just weathered and the industry's role in reducing emissions.

"I'm not sure why we'd be focusing on fossil fuel subsidies when many of these industries right now are actually changing their positions and really starting to think about how they can be constructive participants in the journey towards a net-zero economy," Mackler said. "I think really we want to be supporting those industries as they engage on these issues."

Former President Barack Obama also proposed ending fossil fuel subsidies and gained little traction, noted William Yeatman, a research fellow at the libertarian-leaning Cato Institute, adding that "upsetting the tax code gets K Street in high gear and tends to engender even bipartisan opposition." However, ending such subsidies would not be an enormous blow to the industry, Yeatman said.

"The numbers we're talking about, and I think it's in particular the depletion allowance, are not the sorts of sums that present some sort of existential threat to the fossil fuel industry," Yeatman said.

Oil, gas impact

Three major deductions or credits used by U.S. oil and gas producers to lighten their tax load are clear potential targets: foreign tax credits, deductions for intangible drilling costs and the percentage depletion allowance, a basket of an estimated $38.6 billion in potential revenue, according to Capitol Hill think tank the Environmental and Energy Study Institute using data from the 2017 Congressional Joint Committee on Taxation.

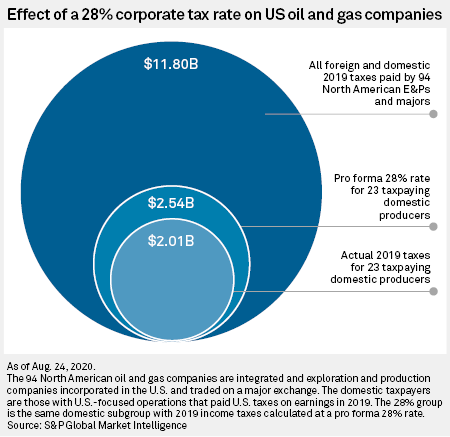

Whichever deductions are selected for elimination, there is little juice to be squeezed from the sector fruit at the moment. Taxes are paid with profits — and profits have been sorely lacking over the past decade. Producers spent freely to chase the shale revolution, increasing production volumes but collapsing the value of each additional barrel of crude or cubic foot of natural gas.

In 2020, as demand for oil cratered with the worldwide COVID-19 pandemic, U.S. supermajors and independent exploration and production companies, or E&Ps, recorded more than $129 billion in losses before taxes, according to S&P Global Market Intelligence data. The producer that paid the most taxes in the sector was Appalachian shale gas driller Cabot Oil & Gas Corp., which ponied up $41 million in tax payments on $241 million in earnings before taxes. Supermajor Exxon Mobil Corp. paid no U.S. taxes in 2020 while booking nearly $29 billion in losses before taxes, according to the data.

An August 2020 analysis by S&P Global Market Intelligence of oil and gas profits since 2015 showed companies booking taxable profits in only three of the five years, with the supermajors accounting for the bulk of those profits. All those losses become an offset to tax liability companies can use.

Oil and gas trade groups have often focused on preserving the deduction for intangible drilling costs, as it allows all producers to deduct most of the costs of a well — including labor-related costs — except the drilling rig itself.

The remaining two credits are of interest to two widely separated groups of oil and gas drillers, setting up a possible intra-industry conflict if lobbying groups find themselves needing to choose which to prioritize defending. The foreign tax credit is primarily a tool of the supermajors and big independents, allowing them a credit against their U.S. taxes for taxes paid to foreign countries. The percentage depletion allowance is of concern for smaller E&Ps and royalty owners.

"Treasury costed unspecified fossil energy provisions at $35 billion over 10 years, which roughly comports with Biden's $40 billion over 10 years," analysts at energy policy analysis firm ClearView Energy Partners LLC said after Biden introduced the Made in America Tax Plan.

"Both numbers suggest an effort to eliminate direct incentives such as intangible drilling cost expensing and percentage depletion," while leaving alone indirect provisions such as changes in accounting methods, ClearView said. "Democrats could have difficulty garnering party-line support to eliminate all fossil energy tax provisions, but we reiterate that direct and indirect provisions that primarily affect international supermajors remain at risk."

Oil and gas investors reacted negatively to Biden's tax plan, according to investment bank Raymond James, which sees the elimination of subsidies as unlikely.

"Investor concern grew over the possibility of eliminating some fossil fuel subsidies (namely intangible drilling costs)," Raymond James oil and gas analyst John Freeman said. "We see this as extremely unlikely to pass with swing-vote Senator Joe Manchin (Chair of Senate Energy Committee) stating yesterday [April 8] his aversion to using a second budget reconciliation to pass the infrastructure bill and given his pro-energy stance."

Clean energy incentives

The oil and gas industries' pain could be clean energy's gain under the Treasury's tax outline, which seeks to support Biden's goal for the U.S. to achieve net-zero emissions economywide by 2050.

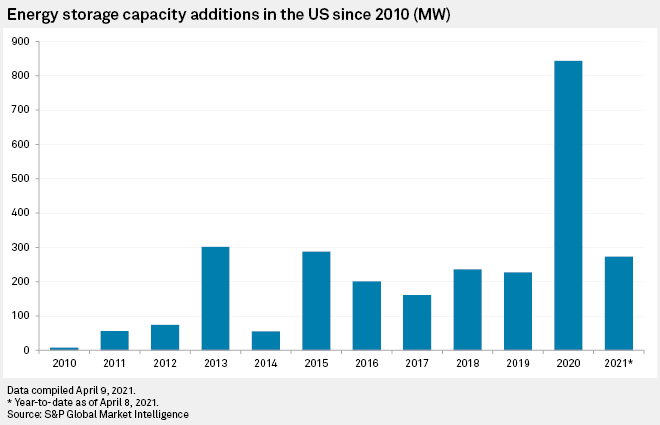

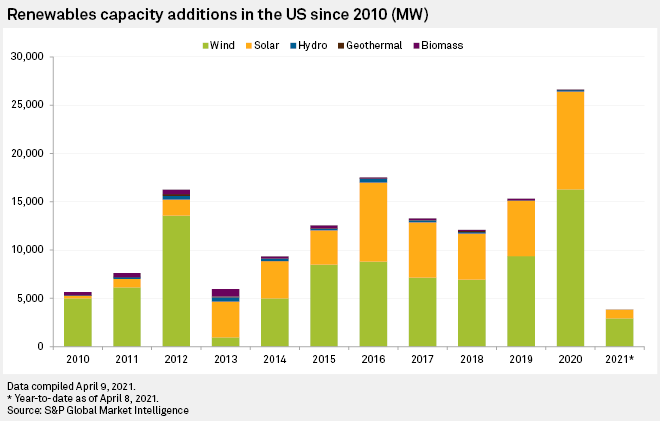

Biden has called for a 10-year extension to production and investment tax credits for clean energy and storage projects, offering the industry a reprieve from frequent lapses in those incentives. In 2015, Congress approved multi-year extensions to federal wind and solar energy tax credits. But renewable energy proponents have said more is needed to fulfill state and national climate goals, prompting Congress to pass several shorter-term extensions in recent years.

"Extending tax credits 10 years provides long-term legislative stability for the renewable industry typically accustomed to boom-and-bust cycles as a result of short-term tax credits expiring and then being reinstated," said Adam Wilson, a renewable energy analyst for S&P Global Market Intelligence.

Although renewable capacity is on the rise, a 10-year extension to clean energy credits is "like a burst of wind behind the sails of a boat that is already moving forward but will now take on greater speed," said Keith Martin, a tax and project finance lawyer with Norton Rose Fulbright. "We've just lost too much ground on climate change. We need to use every tool we have available."

Biden has also proposed making clean energy and carbon capture credits available through a direct pay option so more entities can benefit from the incentives, including electric cooperatives and public utilities that do not pay taxes. The direct pay option will have big implications, according to Wilson.

"It makes tax credits more efficiently obtainable and allows developers, should they choose, to avoid tax equity investors and receive the tax benefits directly," he said. "Tax equity financing is costly and cumbersome for developers to navigate so a direct pay plan opens up more options for developers looking to take advantage of tax credits."

The White House's infrastructure and tax plans would also create a new incentive for long-distance transmission projects, with some studies estimating the U.S. will need to double or even triple its transmission capacity to fulfill Biden's goal of decarbonizing the power sector by 2035. That incentive could ease cost allocation issues for new transmission lines, which some experts say is the biggest hurdle facing the industry.

"It's very hard, but you can get transmission lines sited and permitted," said Rob Gramlich, executive director of Americans for a Clean Energy Grid. "The problem is any time any of the regional planners start talking about them, all of the stakeholders and [grid operators]… argue about who is going to have to pay for it."

If Congress approves a 30% investment tax credit for transmission projects, as some lawmakers have proposed, that "makes the cost allocation challenge 30% easier," Gramlich said.

Many aspects of Biden's infrastructure and tax plans are likely to encounter political opposition. But beefed-up clean energy credits could garner bipartisan support, sources said, with Republican and Democratic states alike able to accommodate new renewable facilities.

"I think the tax credit extensions will not have much trouble given they've been in place for years already," Wilson said. "I would think that's digestible for most legislators."