Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Jan, 2021

By Chris Rogers

The U.S. industrial recovery continued in December 2020, with capacity utilization across all industries reaching 74.5%, Panjiva's analysis of official data shows, representing the seventh straight increase from a trough of 64.2% in April, though still well below the 77.2% rate achieved a year earlier.

The capacity utilization of the metals industry, which the Trump administration has tried to help by applying duties on imports of steel and aluminum under the section 232 tariffs of 25% and 10%, respectively, reached 68.2% from 72.6% a year earlier and a trough of 49.7%.

The iron and steel sector specifically reached 74.2%, compared to 79.5% a year earlier and a trough of 49.9% in May 2020. Importantly, that is still also well below the 80% threshold defined as necessary for long-term viability by the U.S. Commerce Department, as outlined in Panjiva's research of Dec. 17, 2020.

The Biden administration may look to remove section 232 duties on imports from U.S. allies such as the EU as part of a process of rebuilding relations. However, continued weakness in utilization may fall foul of union pressure, giving a reason to pause before reconsidering the duties.

The incremental cost of removing tariffs on imports from the EU at a high level may be limited. Panjiva's data shows the EU accounted for 15.8% of imports of steel and aluminum covered by section 232 tariffs in the 12 months to Nov. 30, 2020, while shipments from Canada and Mexico represented 42.0% and received exemptions as part of the completion of the United States-Mexico-Canada Agreement trade deal.

Imports have yet to recover to pre-pandemic lows, with total imports down by 28.2% year over year in the three months to Nov. 30, 2020, including those from the EU, which declined 25.5%.

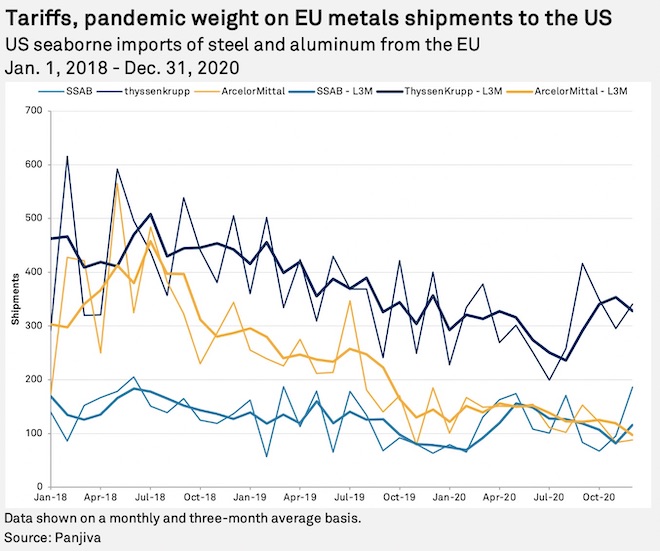

That downturn likely continued in December 2020, with U.S. seaborne imports of steel from the EU having declined by 3.2% year over year in the month. Among the major importers, only SSAB AB (publ) materially increased its shipments, with a 195.2% year over year expansion in December 2020 following growth of 18.8% in the prior month. Increased shipments by thyssenkrupp AG and ArcelorMittal in November 2020 have since reversed with declines of 14.8% and 52.4%, respectively, year over year in December 2020.

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.