S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

7 Jan, 2022

By Camille Erickson

|

| Sparks fly as an employee inspects molten steel from an electric arc furnace on the production line of a factory on July 14, 2019, in Kawaguchi, Japan. |

U.S. imports of the type of steel used to make transformers picked up pace in 2021 as manufacturers prepared for a surge in taxpayer-infused infrastructure spending to modernize the nation's power grid.

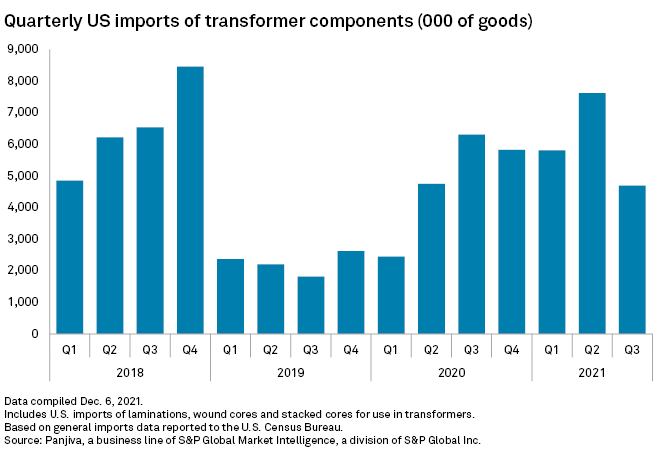

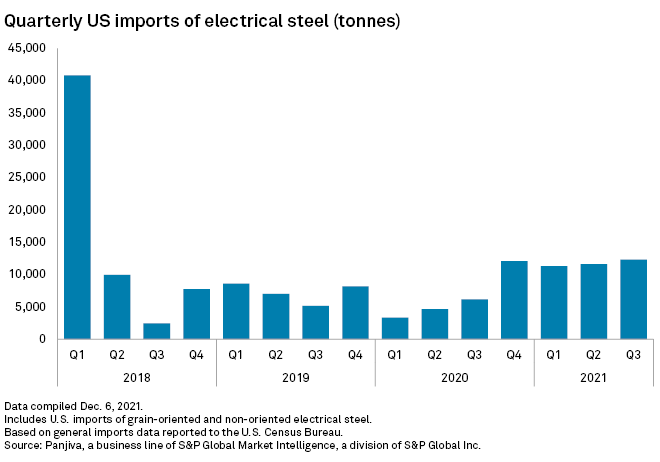

Between January and September, U.S. imports of electrical steel, a critical material used in transformers across the power grid, rose nearly 150% year over year, with 35,171 tonnes of the steel product brought into the country during the nine-month period, according to the latest data analyzed by S&P Global Market Intelligence. Imports of transformer components in 2021 outpaced imports in 2020 too:

Transformer builders are ordering more supplies of the metal in anticipation of spending from the massive U.S. infrastructure package signed into law in November, according to the sole U.S. producer of electrical steel, Cleveland-Cliffs Inc. The law injects $65 billion to develop the nation's power grid and $7.5 billion to build an EV charging network.

"This is a game-changer that will really support the consumption of grain-oriented electrical steel and non-oriented electrical steel for transformers and for engines of electric vehicles," Cleveland-Cliffs Chairman, President and CEO Lourenco Goncalves said of the infrastructure spending in a Jan. 6 interview. "Electrical steel is actually in very, very high demand right now because these companies that produce transformers, they are preparing for the work that will come in the next several months. They are looking ahead."

Ohio-headquartered Cleveland-Cliffs is operating at full capacity to meet rising demand, equivalent to about 250,000 tons of electrical steel per year.

"Right now, demand is a lot bigger than what our installed capacity can produce," Goncalves said. "That's a huge change."

Ducking tariffs

Some U.S. companies and lawmakers have deemed electrical steel a critical material for its role in modernizing electrical grid infrastructure and transitioning the country to clean energy.

Yet each year, millions of transformer components — and the electrical steel they contain — are made outside the U.S. and imported at low prices, a trend that has made it difficult at times for U.S. companies to compete, Goncalves said. An investigation by the U.S. Commerce Department completed in October 2020 called the country's reliance on these imports a potential threat to national security. But the Biden administration has yet to take formal action.

Some lawmakers have called on the Biden administration to expand trade restrictions to boost domestic capacity of electrical steel production. Yet downstream companies such as transformer manufacturers have opposed tariffs or other regulatory measures, fearing that higher costs and supply limitations would follow.

"As evidenced by recent natural disasters, including Hurricane Ida, the United States must preserve and bolster its transformer supply chain to avoid dependence on other countries for the maintenance of our electric grid," U.S. Reps. Marcy Kaptur, D-Ohio; Mike Kelly, R-Pa.; Troy Balderson, R-Ohio; and Conor Lamb, D-Pa., stated in a Nov. 1 letter addressed to Secretary of Commerce Gina Raimondo and U.S. Trade Representative Ambassador Katherine Tai.

"Given the significant forthcoming government investments in electric grid modernization and greening, this circumvention problem must be addressed as soon as possible," the members of Congress added.

The federal government has attempted to address this problem before. In 2019, U.S. imports of grain-oriented electrical steel fell dramatically, thanks to a 25% tariff slapped on steel products coming from several countries under Section 232 of the U.S. Trade Expansion Act. But the tariffs didn't work. Domestic production barely budged, nor did demand for grain-oriented electrical steel and other products, according to the Commerce Department's investigation.

Instead, in an attempt to duck the Trump-era steel tariffs in place under Section 232, some companies began importing electrical steel into Mexico and Canada, and modifying the material into transformer components in order to sell it to the U.S. free of tariffs, according to the investigation.

"That's an example of what we always have to be watching out for, which is the circumvention or evasion of trade measures through further processing to change what good is officially coming in," American Iron and Steel Institute President and CEO Kevin Dempsey said in an interview. "We do think that there are legitimate concerns raised by Cleveland-Cliffs about these transformer parts coming in that they are basically made of steel."

Maintain the status quo

Transformer manufacturers and other downstream companies have spoken out against the imposition of tariffs or other import restrictions on products containing electrical steel, citing the risks of higher costs, limited supply or a monopoly in the sector.

The National Electrical Manufacturers Association, or NEMA, represents over two dozen U.S. transformer manufacturing companies and has long lobbied against additional tariffs. A spokesperson for NEMA declined to comment but referred Market Intelligence to earlier statements on the federal investigation into electrical steel and transformer component imports.

"We consistently asserted that continued importation of products within the scope of this investigation would not threaten national security and was in fact necessary to maintain it and protect the existing U.S. transformer manufacturing base," Stacy Tatman, senior manager of government affairs at NEMA said in early 2021.

Ultimately, the volume of grain-oriented electrical steel being imported each year into the U.S. remains relatively small when compared to the entire sector, said Michael Corelli, a senior vice president at Moody's Investors Service.

"Nevertheless, it doesn't mean it's not an important product for those people who use it," Corelli said.

Panjiva is a business line of S&P Global Market Intelligence, a division of S&P Global Inc.

Segment