Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Jan, 2021

By Chris Rogers

U.S. President Joe Biden has signed 15 Executive Orders and two administrative actions among his first day actions. Unsurprisingly, the details of trade policy have not been a focus, though an integrated plan is expected in the coming weeks. Two actions are relevant for supply chains and fit with the president's prior commitments to the environment and bolstering the U.S. economy.

Rejoining the Paris Agreement on climate change will help smooth the way in future dealings with the EU, as discussed in Panjiva's 2021 Outlook.

There is also a chance to make membership permanent by including a requirement to be part of the Paris Agreement within the United States-Mexico-Canada Agreement trade deal, Inside Trade reports. Rejoining Paris will also likely underpin a wider renewable energy policy and in due course the potential removal of tariffs on solar panel imports.

On medical supplies, there are two orders. In the first, Biden's Executive Order calls for "coordinating the Federal Government's efforts to produce, supply, and distribute personal protective equipment, vaccines, tests, and other supplies for the Nation’s COVID-19 response, including through the use of the Defense Production Act."

The second order, which provides for a detailed implantation, calls for a report within 100 days including a "strategy to design, build, and sustain a long-term capability in the United States to manufacture supplies for future pandemics and biological threats," including how to address the role of foreign supply chains.

While triggering the DPA is not a guarantee of new supplies — incentives for manufacturers may be needed — it could help address the downturn in imports of supplies experienced in the past few months.

Panjiva's analysis shows that U.S. imports of medical supplies needed to treat the pandemic, based on U.S. International Trade Commission definitions, dropped by 24.7% in November 2020 versus their peak in June 2020. That was led by a 55.1% slide in personal protective equipment, including a slump in rubber glove imports that may be difficult to onshore given the limited geographic availability of rubber.

The rate of decline likely continued in December 2020 with seaborne imports of face masks having dropped by 63.5% compared to their August 2020 peak, Panjiva's data shows, which almost entirely represents a slide in shipments from China. New rules for the wearing of face masks issued by the Biden administration may stretch supplies that are already available either from domestic manufacturing or imports.

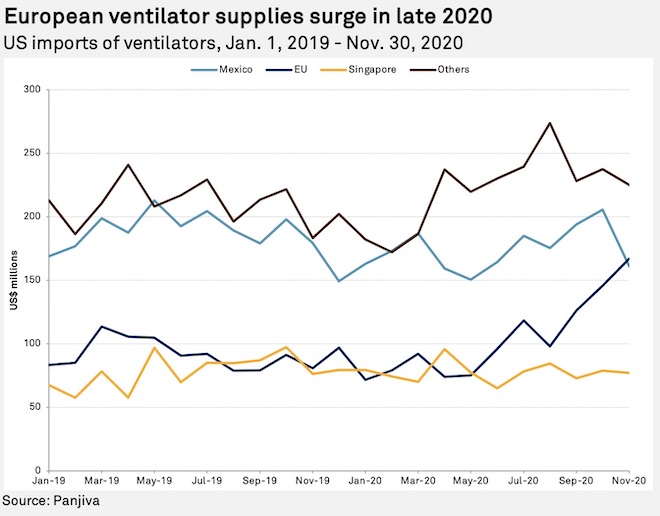

By contrast to consumables like personal protective equipment, there has been an increase in imports of oxygen therapy equipment (ventilators) and pulse oximeters. Panjiva's data shows that total U.S. imports increased 13.0% in November 2020 versus July 2020 and were in line with their five-month average of $625 million.

There has been a shift in supplies in recent months, however, with supplies from the EU having increased to 22.9% of the total in the three months to Nov. 30, 2020, compared to 17.3% in the prior three-month period, including an increase in imports linked to Medtronic PLC (Covidian) and Drägerwerk AG & Co. KGaA. Imports from Mexico accounted for 29.1% in both periods including shipments linked to Fisher & Paykel Healthcare Corp. Ltd. and Becton Dickinson and Co., while shipments from Singapore, the third-largest supplier nation, and the rest of the world have declined.

The high proportion of shipments from ally nations should reduce the need to onshore manufacturing, allowing government efforts and funding to focus on more problematic areas like masks and gloves, as noted above.

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.